Karl Denninger wrote the post below before the Fed's announcement. It's embarking on QE3, and as Karl notes, this is scary – August showed a 10% rise in energy costs at the crude level and a 6.4% rise in costs at the finished level. This does not go well with more "credit cheapening" (QE3, money printing). The consequences are predictable.

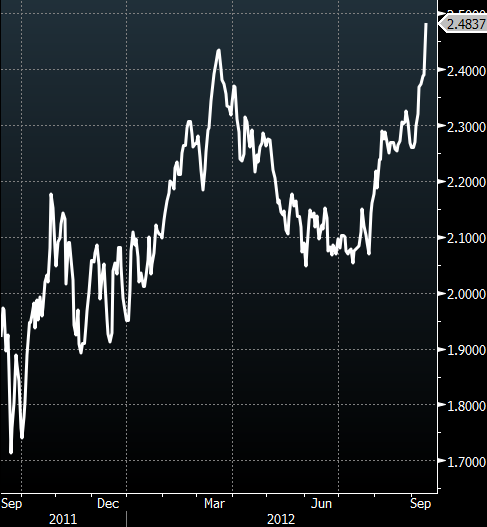

Here's a chart on inflation expectations from Soberlook: "QE3 purchases will not directly impact longer duration bonds (at least not as much as the 5yr notes). The longer term part of the curve will therefore be driven by inflation expectations. And longer term inflation expectations, as implied by the TIPS yields, rose sharply today."

The Producer Price Index for finished goods rose 1.7 percent in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This increase followed advances of 0.3 percent in July and 0.1 percent in June, and marks the largest monthly rise since a 1.9-percent increase in June 2009.

At the earlier stages of processing, prices received by manufacturers of intermediate goods moved up 1.1 percent in August, and the crude goods index rose 5.8 percent. On an unadjusted basis, prices for finished goods climbed 2.0 percent for the 12 months ended August 2012, the largest advance since a 2.8-percent increase for the 12 months ended March 2012. (See table A.)

Well now.

But the big table — where's it coming from? Food and Energy.

The bad news however doesn't end there — it also extends to crude goods where the escalation went all the way down the scale and did not stop with food and energy.

Coming into the announcement on "expected" QE this could be rather interesting…… this much is certain — a nearly 10% rise in energy costs at the crude level, and at 6.4% at the finished level, isn't the sort of thing you want to see if there is more credit cheapening coming from The Fed.