Courtesy of Lee Adler of the Wall Street Examiner

The Labor Department reported that seasonally adjusted (SA) first time claims for unemployment fell by 3,000 to 382,000 from a revised 385,000 in the advance report for the week ended September 15. The consensus estimate of 375,000 was too low this week, so the market saw it as a “miss” and sold off. As usual the seasonally adjusted data misstated the real performance of this measure.

Here’s the language used by the Department of Labor (DOL) in its press release with regard to not seasonally adjusted data. ”The advance number of actual initial claims under state programs, unadjusted, totaled 327,797 in the week ending September 15, an increase of 28,068 from the previous week. There were 353,820 initial claims in the comparable week in 2011.” The added emphasis is mine. Note that the DOL specifically warns that this is an advance number and states that not seasonally adjusted numbers are the actual number of claimants from summed state claims data. The advance number is virtually always adjusted upward the following week because interstate claims from many states are not included in the advance number. The final number is usually 2,000 to 4,000 higher than the advance estimate. I adjust for this in analyzing the data. Lately the increase has been around 2,000, so that the adjusted number that I used in the data calculations would be 330,000, rounded.

Also important is the fact that the DOL shows the comparison with last year. Using the adjusted figure of 330,000, this year shows a year to year decline of approximately 24,000, an improvement of 6.7% versus the corresponding week last year.

This was the lowest number of initial claims for this week since September 2007. The current week was also better than the average of the last 10 years’ claims for this week of 337,000.

On a week to week basis, claims rose by approximately 30,000. This week of September has always had an increase over the past 10 years. Last year the increase was 25,000, and in 2010, 41,000. The average increase for the corresponding week over the past 10 years has been 25,000.

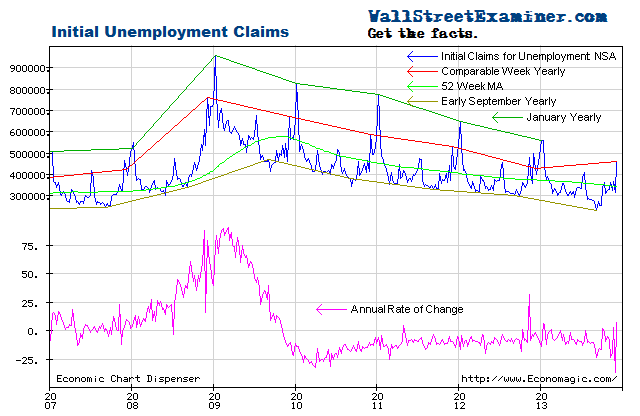

To avoid the confusion inherent in the fictitious SA data, I analyze the actual numbers of claims (NSA). It is a simple matter to extract the trend from the actual data and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. It’s easy to see graphically whether the trend is accelerating, decelerating, or about the same. This week’s data continues to be consistent with the improving trend of the past two years. It is well within the range of weekly fluctuations in the rate of change from -3% to -20% that have occurred since mid 2010. Since mid 2011, in most weeks the annual rate of change has been within a couple of percent of -10%. The trend has been remarkably consistent.

The consistency is clear in the annual rate of change graph. The rate of decrease in new claims continues to fluctuate around the -10% axis. The current year to year decline of 6.7% remains near the middle of the range of the rate of change over the past 2 years.

Given this steady improvement the Fed had no reason for additional QE other than its own state of panic in the face of the constant pundit clamor for it. But Bernanke stated that the purpose of QE now is to goose the markets and housing and hopefully cause economic growth to accelerate. He said that he would not remove the program hastily even if the economy showed signs of improvement. He all but said that the Fed will now err on the side of recklessness.

As the number of workers eligible for unemployment compensation has trended up since 2009, the percentage of workers filing first time claims has continued to decline. Comparing the yearly line for the current week to the 52 week moving average, the trend of improvement continues to track at a steady rate. The current level is near the level of 2003-04, the last non-bubble, “normal” year. By this standard, the current level of claims is “normal.” [The surge during this period of 2005 was due to Hurricane Katrina.]

Lately, economists have been arguing about the “natural” unemployment rate. I think we’re at it now. If we recognize that the bubble period with its millions of fake jobs was abnormal, then the low level of claims during those years was also abnormal. Where we are today is probably normal and the expectation that the US will ever get back to 6% unemployment is a false hope.

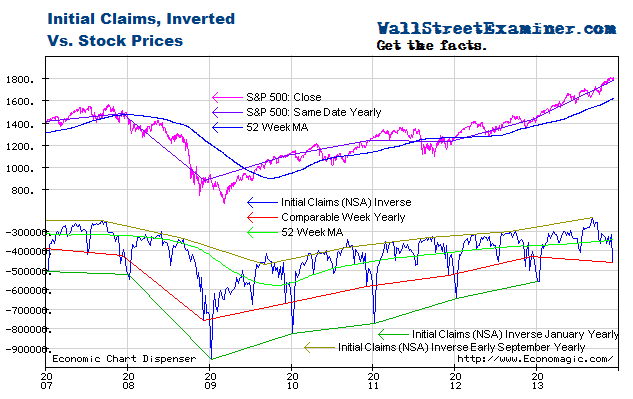

Plotted on an inverse scale, the correlation of the trend of claims with the trend of stock prices over the longer term is strong, while allowing for wide intermediate term swings in stock prices. Both trends are largely driven by the Fed’s operations with Primary Dealers (covered weekly in the Professional Edition Fed Report; See also The Conomy Game, a free report). This chart suggests that as long as this trend in claims is intact, the S&P would be overbought at approximately 1450, and oversold at roughly 1200. That means that as of September 14, it became overbought on this basis. Previously I have said that “barring a much stronger improvement in the claims data which would suggest accelerating growth, the market will be at greater risk of a correction in the next few months.” But the Fed may have just changed the rules by adding more cash to the markets every month. [I cover the technical side of the market in the Professional Edition Daily Market Updates.]

The chart below gives a longer term perspective on claims. The trend has been improving while remaining above the bubble years with their 10 million fake jobs taking orders for new and unneeded condos and houses, building them, permitting and inspecting them, and taking and processing mortgage applications.

The punditry consensus estimate missed again this week, as usual. How is it that conomists can be surprised so often? Easy. They are looking at bad data–the SA data. Seasonal adjustment factors for this week have varied over the last 10 years from 1.179 to 1.236 (chart below). Based on that range, and the seasonally adjusted number could have been anywhere from 387,000 to 405,000. This week’s factor was below the bottom of the historical range at 1.165 resulting in a SA reading of 382,000.

It’s all pure nonsense, but the SA numbers must get realigned with the trend eventually. Perhaps this was the beginning of that process. In that case the SA numbers would begin to overstate the rate of improvement for several months, which would be just as misleading as understating the improvement over the past 6 months. . (False Claims and Absurdities of Mainstream Media Reports On Initial Unemployment Claims).

The following chart is a picture of reality versus the the Impressionist art of seasonal adjustments. Sometimes the SA data represents reality to some degree, and sometimes it doesn’t. If you are following only The SA data, at any given time you have no way of knowing which it is. One thing is certain– it is not photo-realism.

There are ways to measure trends using actual data. One way is to show the year to year line as of the current and corresponding date, as shown on the chart below, as well as the first four charts above. Another is to view the annual rate of change as shown in the first chart above.

The arbitrary seasonal adjustment process has often raised false alarms.There were big counter trend pops early in the second half of 2010 and in the second quarter last year. In the July 7 week it gave a false positive reading, which conomists furiously tried to explain away with some nonsense about auto plant shutdown timing, when the explanation was far more mundane. The SA data was just wrong.

The trend of the SA data often goes off track for months at a time, giving a false picture. That has been the case for most of this year. The trend of the SA data has been flat from February through September 15 , implying that the trend is not improving, while the actual trend has continued trending down (improving). First time claims are actually doing better than the impression given by the trend of the SA data, which is why conomists have been constantly confused.

Even though the actual data did not warrant more Fed Quantitative Easing, i.e. money printing, as conomists and Wall Street become increasingly confused by the bad data, the drumbeat for it grew louder and more persistent. Bernanke heard the sound of those drums and sang his song to them but more QE was not not needed and not justified. While the economic numbers will probably accelerate, I expect to see the effects of the negative unintended consequences in inflation data in the months ahead. The Fed may be willing to tolerate a little more inflation, but will it get more than it bargained for?

For long term charts and other measures of initial claims and other employment measures visit the permanent Employment Charts page, updated whenever new data becomes available. Be sure to check out the section on real time Federal withholding taxes.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.