Spain is fixed again.

Spain is fixed again.

In a report that surprised no one, Spanish banks passed their stress tests with flying colors on Friday but Europe was closed at the time so they weren't able to rally until this morning and the markets over there are up over 1% (7:30 – not reflected in Dave's chart). Sure the banks are short about $76Bn in capital but that doesn't even seem like a big number these days and sure the tests assume GDP growth of 0.7% next year and 1.2% in 2014 and sure their most adverse scenario only has the market down 5% in 2013 and then flat in 2014 but – hey – they passed!

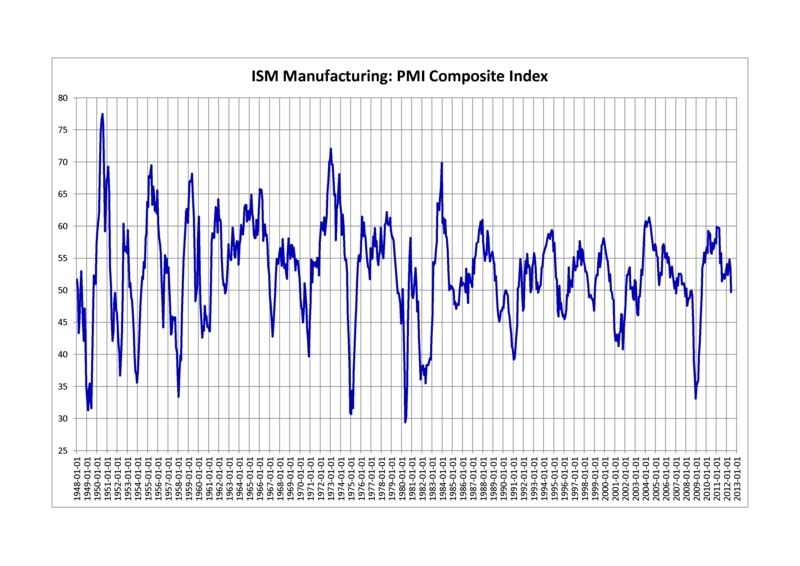

Even better for this morning, Global PMI Reports are coming in and, other than a few stragglers (notably France at a disastrous 42.7 and Australia at 44.1), we have improvements across the board or, at least, a flattening of the downturn. We were discussing over the weekend how the drought was probably giving us a bad string of numbers as greatly reduced crop production has been a factor in taking down the Transports, bringing down inventory levels and lowering orders for Durables – notably farm equipment.

Keep in mind that all the PMI does is ask Purchasing Managers whether conditions are worse, the same or better than previous months and the percentage of managers who report "better" (with some weightings) is the PMI number, this is why it's a highly cyclical indicator – good times give tough comps, bad times give easy comps – so it's the trends that matter and improvement in the PMI (not there yet) is a great early indicator of some economic recovery.

Deutsche Bank thinks things are good enough to package several Commercial Mortgage Bonds that are rated BBB- (the lowest investment-grade ranking) together and rate the bundle at "A" for resale. Isn't that BRILLIANT? The bank plans to offer investors 4% debt for this A-rated paper and, before you say "Hey, isn't that what destroyed the economy in 2008?" – I will remind you that it's now 2012 and this time it's sure to be different.

The fact that this is even still legal is appalling. The logic behind it is that, by spreading your risk across several bad loans, you have less risk than if you just make a single bad loan. Richard Hill, a debt strategist at Royal Bank of Scotland Group Plc said in an e-mail. “This methodology wasn’t particularly successful in older vintage CDOs as the performance of bonds proved to be highly correlated despite the perceived diversity.” Uh – ya think?!?

Of course, with the Fed driving Treasury rates below inflation – investors have little choice but to seek out risky investments (or malinvestments as Hyek would say) following the script laid out by Ludwid von Mises in the 40s:

"The popularity of inflation and credit expansion, the ultimate source of the repeated attempts to render people prosperous by credit expansion, and thus the cause of the cyclical fluctuations of business, manifests itself clearly in the customary terminology. The boom is called good business, prosperity, and upswing. Its unavoidable aftermath, the readjustment of conditions to the real data of the market, is called crisis, slump, bad business, depression. People rebel against the insight that the disturbing element is to be seen in the malinvestment and the overconsumption of the boom period and that such an artificially induced boom is doomed. They are looking for the philosophers' stone to make it last."

See, this is not complicated folks – we've been making these mistakes for centuries now…

The best part about a Federally funded mistake is we can enjoy them while we can. What Mises and Hyek are saying is not that adrenaline doesn't work – just that it's not a cure. The Fed, the ECB, the PBOC, the BOE and the BOJ have all recently given the Global economy a fix of monetary stimulus and it will be enough to do SOMETHING but I certainly wouldn't use the word "boom" to describe it – more like a mid-bust correction, more likely.

The best part about a Federally funded mistake is we can enjoy them while we can. What Mises and Hyek are saying is not that adrenaline doesn't work – just that it's not a cure. The Fed, the ECB, the PBOC, the BOE and the BOJ have all recently given the Global economy a fix of monetary stimulus and it will be enough to do SOMETHING but I certainly wouldn't use the word "boom" to describe it – more like a mid-bust correction, more likely.

A lot of what happens next depends on whether or not we can throw the "Conservatives" out of Global Government so they can stop wasting our resources on the top 1% and get back to economic reality of using Government to improve the base (the bottom 99%) in order to put the economy on solid ground.

People need to work – that should be pretty obvious. Jobs must be created, whether by mythical "job creators" or actual jobs sponsored by the Government and the jobs that produce assets that ALL of the people can benefit from – like infrastructure – are the best jobs of all. Inflation is a fine solution for Global Debt but only if the inflation is bottom up – coming from wage increases that allow the lower and middle classes to pay their bills and look forward to a better future – not this top-down foolishness we have now that constantly erodes consumer spending power and confidence.

People need to work – that should be pretty obvious. Jobs must be created, whether by mythical "job creators" or actual jobs sponsored by the Government and the jobs that produce assets that ALL of the people can benefit from – like infrastructure – are the best jobs of all. Inflation is a fine solution for Global Debt but only if the inflation is bottom up – coming from wage increases that allow the lower and middle classes to pay their bills and look forward to a better future – not this top-down foolishness we have now that constantly erodes consumer spending power and confidence.

So, while we will be enjoying this rally, we will read our boarding cards very carefully and always be aware of the location of the nearest emergency exit and, of course, we will always have our Stock Market Parachutes ready to deploy – just in case things are not as fixed as we think…

China is closed this week so it's all about Europe and the US and we get our own PMI report at 10 am along with Construction Spending. The Fed's Williams (dove) speaks at noon followed by his boss, Big Ben, at 12:30, who will address Butler University on monetary policy. Williams is teeing off the Value Investing Congress, which I'm skipping this year because we can still just buy AAPL for under $700 or CHK for $18.87 or BTU for $22.29 or X for $19.36 – but picks from the likes of Bill Ackman, Whitney Tilson and others will move the markets all day.

Tomorrow we get Auto Sales and probable easing from the Aussie Central Bank along with New York's ISM report and another day of the Value Investing Congress. Wednesday is ADP and non-manufacturing PMI from around the World that will hopefully confirm today's improvements and, later that day, should be the last time anyone seriously believes Mitt Romney can win this election as he has to spend 90 minutes discussing Domestic Policy without pissing off over half the people who actually live here.

Tomorrow we get Auto Sales and probable easing from the Aussie Central Bank along with New York's ISM report and another day of the Value Investing Congress. Wednesday is ADP and non-manufacturing PMI from around the World that will hopefully confirm today's improvements and, later that day, should be the last time anyone seriously believes Mitt Romney can win this election as he has to spend 90 minutes discussing Domestic Policy without pissing off over half the people who actually live here.

Thursday we get rate decisions from the BOE and the ECB but it's the press conferences that will move the markets early morning and then we have bond auctions for France and Spain – probably the most exciting day of the week, capped off by a speech from the Fed's Bullard (hawk). Friday is the Big Kahuna – Non-Farm Payrolls and it would be truly horrible for Romney if we get a good number. Obama will know what that number is on Wednesday – Romney will not. At 3pm we also get a look at Consumer Credit and, this close to the holidays – that's a very important number.

It's going to be an interesting week. Things can turn ugly after Wednesday as Romney is sure to come out telling us how bad things are and this is not an economy that will stand up to a lot of questioning. ADP on Thursday and NFP on Friday can really panic people if we get bad numbers but the upward revision in employment (+386,000 jobs created) announced last week still hasn't been digested yet and may ripple through some other data.

On top of all that, we have the beginnings of earnings season – let the games begin!