Courtesy of Lee Adler of the Wall Street Examiner

New factory orders, which is a broader measure than durable goods orders because it includes non-durables, increased in August but were down sharply versus the corresponding period last year. The first year to year decline in this measure is often associated with the onset of bear markets in stocks.

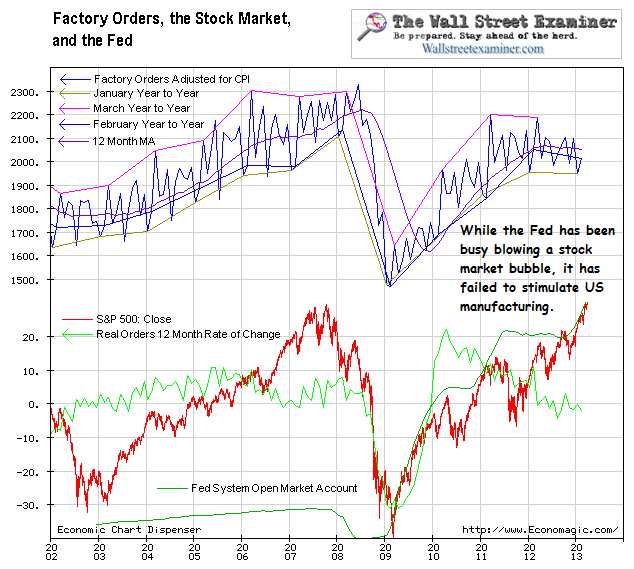

I adjust this measure for inflation and and use the not seasonally adjusted number in order to give as close a representation as possible of the actual unit volume of orders and thus the actual trend. Total new factory orders were down 4.4% year over year, which was a sharp drop from the July year to year gain of 1% and the worst performance since November 2009.

The month to month change was a gain of 2.5%. August is always an up month and the gains are typically much stronger than than they were this August. August 2011 and 2010 were up by 8.3% and 6.8%. The average August reading for the previous 10 years which was a gain of 8.5%.

A possible mitigating factor was that July’s performance was the best in the past 11 years, but the chart doesn’t look good. Not only has the year to year line reversed the uptrend, the 12 month moving average has also turned down. That breakdown, and the negative divergence versus stock prices is certainly cause for concern. However, August was soft for many economic indicators, and September has rebounded strongly. This indicator is released with a greater lag than many indicators which have since rebounded in September. Based on the ISM data for September, there’s a good chance that this downturn will reverse.

The shorter term chart below tells an interesting story. It makes clear that not only does the stock market follow the Fed, so do factory orders (and everything else, for that matter). In the past, as long as the Fed was sitting on its hands in terms of expanding its balance sheet, both the stock market and factory orders remained rangebound. But a funny thing happened on the way to QE3. Traders learned from QE1 and 2 and frontran QE3. While the new program was announced on September 13, the settlements of the forward purchases of MBS won’t begin until late October or early November. That’s when the cash will hit the financial system. So while stocks rose in anticipation of the effects of QE, since the cash has not yet actually entered the system, the manufacturing economy remains stalled.

From a timing perspective, the problem with the Factory Orders data is that even though it led the stock market upturn by a month or so in 2009, and may lead the next downturn, the lag time of more than a month between the measurement period and the release of the data for that period is enough time for the market to have already begun to turn in response to Fed action. With the Fed’s new “glasnost” policy in which it openly telegraphs its policy changes in advance, traders frontrun the actual implementation of the policy. That’s not to say that the traders are right and that this apparent sell signal from factory orders is wrong, but when the money actually starts to hit the financial system it’s possible that factory activity may rebound (I know that my colleague Russ Winter disagrees). That seems to be the message from other data already out for the month of September.

It’s also notable that factory orders did not begin to decline until stocks had entered the second leg of the bear market in 2008. Sometimes it leads, and sometimes it lags the trend turn in stocks. So there’s some question as to how reliable this data is as a timing indicator.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.