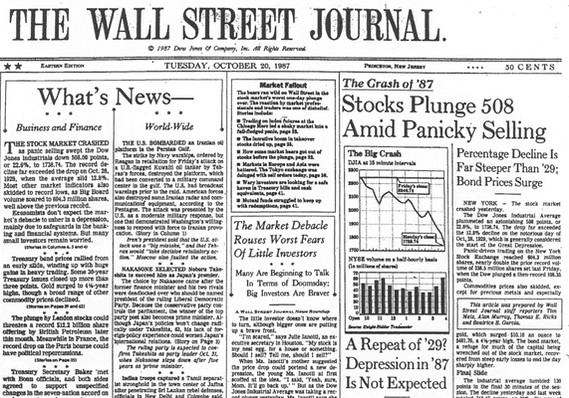

25 years ago today, the market fell 22%.

25 years ago today, the market fell 22%.

You never know what's going to panic the markets – since then we've had many other sudden corrections like Black Friday just 2 years later and Black Wednesday in September 1992, we've had the dot.com collapse and 9/11 and whatever you call 2008 and recently we had Dubai and Greece leading to sudden crashes and the ubiquitous flash crash and whatever happened last August (Europe again).

So stock markets are dangerous places to keep your money, on the whole. That's why TZA (ultra-short Russell) is our primary hedge in the Income Portfolio and, as I mentioned in last Wednesday's post, should the S&P fail to hold 1,440, then the Dow has little support all the way down to 13,295 as well. Just this Tuesday, I reiterated a TZA spread Members could use for general portfolio coverage:

Ultra hedges/Bdon – You just can't beat TZA at $15. The Jan $12/15 bull call spread is $1.50 so 100% upside if TZA simply doesn't go any lower. If they do go lower, you can sell the April $11 puts, now .50 for $1 (the Apr $12 puts are .92) before your $1.50 is even out of the money and then you'd be in the Jan $12s at net .50 and worst case is you get assigned at net $11.50 in April but, of course, you can roll or simply accept the assignment and cover and then you have more long-term protection.

We like to buy our protection when the market is going up – it's cheaper that way! TZA was at $14.75 at yesterday's close and the Jan spread was still about the same $1.50 but it's $2.75 in the money – all we need is for TZA to not go down (Russsell not to go up) and we make a tidy profit. That's a good way to hedge because the only way that hedge loses money is if the market breaks higher.

We like to buy our protection when the market is going up – it's cheaper that way! TZA was at $14.75 at yesterday's close and the Jan spread was still about the same $1.50 but it's $2.75 in the money – all we need is for TZA to not go down (Russsell not to go up) and we make a tidy profit. That's a good way to hedge because the only way that hedge loses money is if the market breaks higher.

We're not turning bearish yet but, as we're seeing some pretty serious misses (GOOG and CMG yesterday, for example) and some pretty strong reactions to those misses – it is a good time to make sure people do remember the value of hedging. If nothing else, it's a piece of mind that lets us ride out these dips without worry. Also, of course, it's good to have wagers on both sides of the field. In our $25,000 Portfolio, for example, we are playing AAPL bullish and AMZN bearish and yesterday they both went down. We were able to sell a few APPL calls and AMZN puts to cover and now we're collecting premium on both ends while we wait for earnings.

The Dollar continues to push higher as the EU predictably inspires no additional confidence in their meeting (as we expected yesterday) and now Moody's is raising warning signals on the German Banking System, saying the country is over-banked, pushing down profits and making it less likely they'll have the reserves to deal with major losses. Spain is still dithering about accepting a bailout, the anti-austerity party is winning in Greece, Hollande is on the ropes in France and Merkel's opposition is growing – not exactly confidence-inspiring and the Euro has dropped back to the $1.30 line this morning while the Pound fell right through $1.61, back to $1.603 – that's not good and a rising Dollar puts additional pressure on the markets.

The Dollar continues to push higher as the EU predictably inspires no additional confidence in their meeting (as we expected yesterday) and now Moody's is raising warning signals on the German Banking System, saying the country is over-banked, pushing down profits and making it less likely they'll have the reserves to deal with major losses. Spain is still dithering about accepting a bailout, the anti-austerity party is winning in Greece, Hollande is on the ropes in France and Merkel's opposition is growing – not exactly confidence-inspiring and the Euro has dropped back to the $1.30 line this morning while the Pound fell right through $1.61, back to $1.603 – that's not good and a rising Dollar puts additional pressure on the markets.

We bet the Dollar long by going short on oil at the $93 line – in both the Futures (/CL) and USO, using the next weekly $35.40 puts, which we picked up at .66 (now .78) in our virtual $25,000 Portfolios yesterday as we still expect one more big plunge as the last of the November contracts have to be cleared between now and Monday. The Dollar is already over $79.50 this morning and, if we get a real market crash, we can see USO re-test $32.50, which would make those puts worth $3 each though we'll probably be thrilled to take a double off the table.

It was a wild day in the markets yesterday as GOOG accidentally released earnings at 12:15 and boy – were they disappointing. Fortunately, we had discussed Google's prospects extensively yesterday morning in Member Chat and my conclusion in the subject was:

It was a wild day in the markets yesterday as GOOG accidentally released earnings at 12:15 and boy – were they disappointing. Fortunately, we had discussed Google's prospects extensively yesterday morning in Member Chat and my conclusion in the subject was:

Unless GOOG has a significant upside surprise (and their biggest all year was 11%), they are only expected to earn $10.65 vs. $9.72 last year and last year Oct earnings were the 11% surprise and it took them from $525 to $670 into Jan, when they missed by 10% and fell right back to $565.

So, if you assume they are going to be 10% stronger than the earnings that took them to $670, then we can add $67 and we get $737 and GOOG has already priced this in with a run from $575 in July, where they posted $10.04 in-line earnings – all the way to $774 at the end of Sept and now back to $755. So, barring any big positives, I don't think GOOG has much chance of going higher and the 200 dma is way down at $633 and the 50 dma is $720 so not much preventing a drop. I wouldn't short them but it's just a very dangerous-looking play on either side.

Unfortunately, the early release caught us by surprise and we hadn't even gotten around to discussing possible short plays on GOOG or the Nas but thank goodness we weren't long. The only long trade idea I liked was the 2014 $700/800 bull call spread at $48.50, selling the Oct $775 calls for $10.20 as a spread and, of course, the $775 calls will expire worthless today but the spread is still $37.60 so not even a $1 loss on a 10% drop – that's why we love those kind of plays.

Now, if you want to stick with GOOG (see Dave Fry's chart) on that spread, or even set up a new one, you can drop the $800 caller ($46) down to the $740 caller ($66) for $20 and sell the Nov $720 call for $8.50 so now you have $28.50 and you spend $18.90 to roll your $700 calls ($83.60) down to the $660 calls ($102.50) and that lowers your basis on the spread from $48.50 to $38.90 but now you are in the $660/740 bull call spread, which is $40 in the money and, each month, you can sell more calls and use some of the money to widen your spread and some to reduce your basis until you have a free spread that will be all profits at the close. It's a little boring but VERY profitable!

Now, if you want to stick with GOOG (see Dave Fry's chart) on that spread, or even set up a new one, you can drop the $800 caller ($46) down to the $740 caller ($66) for $20 and sell the Nov $720 call for $8.50 so now you have $28.50 and you spend $18.90 to roll your $700 calls ($83.60) down to the $660 calls ($102.50) and that lowers your basis on the spread from $48.50 to $38.90 but now you are in the $660/740 bull call spread, which is $40 in the money and, each month, you can sell more calls and use some of the money to widen your spread and some to reduce your basis until you have a free spread that will be all profits at the close. It's a little boring but VERY profitable!

We have been painfully sticking with AAPL as they have dropped 10% in a month and yesterday they dropped $12 more dollars to close at $632.64 after testing $630 again. While GOOG's problems with ad revenues have nothing to do with AAPL's business model, we still felt it prudent to partially cover our long AAPL positions – just in case. AAPL and AMZN both report next Thursday in what's sure to be another interesting day in the market.

Meanwhile, MSFT disappointed and MCD missed this morning and GE was unimpressive AND guided down – while Q3 was probably a trough, it won't take much to get investors nervous. As we expected, the more international exposure a company has, the poorer their performance but CMG had a very disappointing report and they are all US so it's possible we're over-estimating our local market as well.

So caution is the word of the day and we'll have to keep ourselves well-hedged and wait another week for another few hundred earnings reports to get a better picture. 24 companies missed earnings estimates Wednesday (close to half) and 8 of them guided down, yesterday was much better with just 16 misses out of 50 but GOOG was one of them and another 8 guided down and this morning 10 out of 21 companies are reporting misses and 3 of them are guiding even lower – we expected a poor earnings season but is it even worse than expected?

Let's be careful out there.