The Futures have given back all of yesterday's last-minute gains and then some.

The Futures have given back all of yesterday's last-minute gains and then some.

After hours last night, Moody's downgraded 5 Spanish regions "driven by the deterioration in their liquidity positions, as evidenced by their very limited cash reserves … and their significant reliance on short-term credit lines."

While Asia shrugged it off and finished more or less flat, Europe is freaking out – about that and the continued terrible earnings reports that are hammering the point home that the economy is certainly worse than it was last year. Why then, are the markets up over 10% from last year – well, since there's no easy answer to that – down they go!

The Euro fell down to the $1.30 line (where we went long in early morning Member Chat) and oil futures fell to $87.28 (and make a good buy over $87.50 on /CL) and gold took a pounding to $1,710 while gasoline fell below the $2.60 line, where it's also a good long play on /RB as it's unlikely the Euro fails $1.30 for very long or the Yen goes above (weaker) 80 to the Dollar (now at $79.85) and it's also not likely the Dollar breaks 80 today (now 79.93) – so, overall, this is a nice spot to go long in the Futures.

The Euro fell down to the $1.30 line (where we went long in early morning Member Chat) and oil futures fell to $87.28 (and make a good buy over $87.50 on /CL) and gold took a pounding to $1,710 while gasoline fell below the $2.60 line, where it's also a good long play on /RB as it's unlikely the Euro fails $1.30 for very long or the Yen goes above (weaker) 80 to the Dollar (now at $79.85) and it's also not likely the Dollar breaks 80 today (now 79.93) – so, overall, this is a nice spot to go long in the Futures.

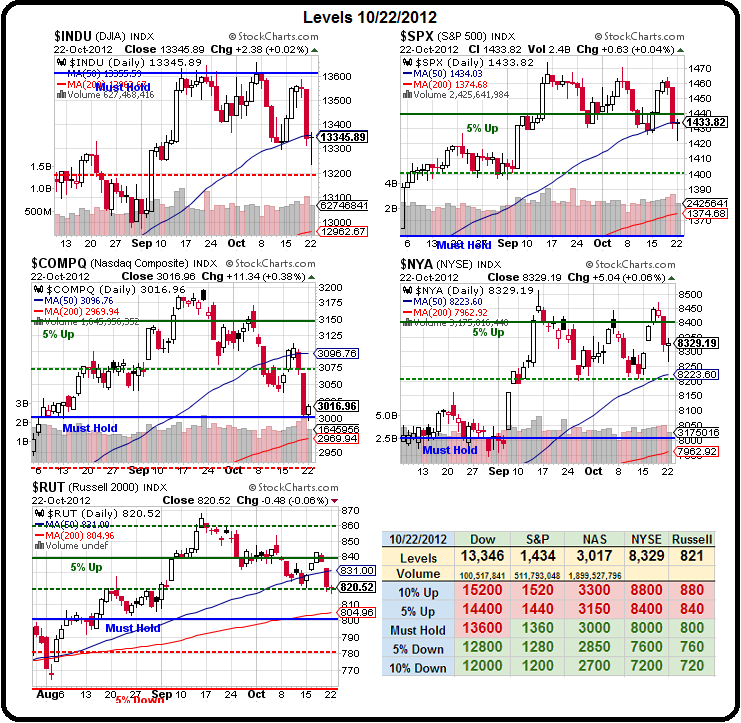

It's over an hour to the open but let's call it Dow 13,200, S&P 1,416, Nasdaq 2,980, NYSE 8,250 and Russell 810 and, as you can see from our Big Chart – we're barely holding our Must Hold levels with the Nasdaq crashing us below and we can't even blame AAPL today, which is holding up pretty well so far at $630 – after putting up a $15 gain yesterday (2%).

As we expected yesterday morning, the Nasdaq held 3,000 like a champ and rallied 20 points off that line into the close before dropping back a few but today will be harder with the Nas gapping well below 3K – painting a terrible technical picture before most people have a chance to make their first trade.

Has anything changed since yesterday? Not really – we knew Spain was a mess, we knew Q3 earnings would suck but, apparently, seeing the actual numbers is really spooking investors. In reality, only 10 of 40 companies missed yesterday but 5 of those guided down and only two companies (HSTM and LII) guided up all day. As CNBC put it: "Earnings conference calls are beginning to resemble crisis hotlines as corporate executives slash profit forecasts because of fears of higher taxes, a recession in Europe and slowing economy in China."

Has anything changed since yesterday? Not really – we knew Spain was a mess, we knew Q3 earnings would suck but, apparently, seeing the actual numbers is really spooking investors. In reality, only 10 of 40 companies missed yesterday but 5 of those guided down and only two companies (HSTM and LII) guided up all day. As CNBC put it: "Earnings conference calls are beginning to resemble crisis hotlines as corporate executives slash profit forecasts because of fears of higher taxes, a recession in Europe and slowing economy in China."

This morning is worse with 13 out of 52 reporting companies missing earnings (not all in yet) and a whopping 11 giving negative guidance (ARG, CPLA, CNC, DD, GNTX, IIVI, ITW, LRY, ST, XRS, MMM and TECH).

Guiding up were PLD, R and WHR. This is not encouraging – it means that, for the average person owning stocks and listening to conference calls – there's an 11:3 chance they are hearing bad news with a bad outlook.

This is the backdrop for today's Fed meeting, which goes on tomorrow as well and ends in a statement to be released at 2:15. Even as I write this – the Euro failed to hold $1.30 and the Dollar punched over 80 and oil failed to hold $87 and gasoline is dropping to $2.58 so no fun in the Futures this morning. Europe is finally together, dropping 1.6% across the board – just as our futures are down 1.2% across the board now as the Euro tests $1.296 and the Dollar hits 80.10, which is up from 79.50 yesterday, accounting for 0.75 of the drop (2/3).

We don't like to react too quickly to currency-based market moves as they have a tendency to snap back fast. It it, however a good time to review the suggested Disaster Hedges from the weekend (5 Plays that Make 500% if the Market Falls) or our DIA hedge from yesterday's post.

We don't like to react too quickly to currency-based market moves as they have a tendency to snap back fast. It it, however a good time to review the suggested Disaster Hedges from the weekend (5 Plays that Make 500% if the Market Falls) or our DIA hedge from yesterday's post.

We're still looking at the sell-off as a buying opportunity until/unless we fail those Must Hold lines and I will point out that UPS's domestic package business is up 1.2%, which offset most of the decline in Europe – underlining what we expect this earnings season – that the companies that do International business are hurting across the board and, unfortunately, these are the guys who tend to report early.

Not to worry though, as the rich continue to get richer. COH reports an 8% jump in US sales but that's nothing compared to International, which is up 15% and led by China. Going the other way is ordinary electronics at RSH, which is down 15% on release of their earnings and XRX underscores the weakness in the office spaces with a 12% decline in net profit that is sending their stock down another 5%. back to the year's low's around $6.50.

Before we get too bearish today, we'll have to wait for a possible decision from the EU Court of Justice, where they are hearing a suit today brought by a member of the Irish Parliament on whether or not the ESM is constitutionally valid. Silly as it seems, could be a nice relief rally if the court hands down a quick decision in the ESM's favor. We hear from the Richmond Fed at 10am but the best chance for a market save today rests with AAPL, who roll out the IPad Mini at 1pm – we need to see AAPL pop over $640 to get the Nasdaq back on track and we'll be watching that 3,000 line closely.