Courtesy of Mish.

With all the focus (mine included) on the US elections it was easy to overlook some quite a lot of extremely poor economic reports in the Eurozone.

By the way, many people are attributing the stock market decline to the election of Obama. I was up at 3:00AM and the futures were still green. Futures turned red following comments by ECB president Mario Draghi regarding economic weakness in Germany.

Here are some dreadful Eurozone news stories you may have missed.

Sharpest Fall in French Service Sector in a Year

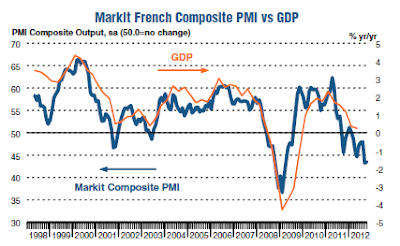

The Markit France Services PMI® shows the sharpest fall in French service sector business activity for a year.

Key Points:

- Final Markit France Services Activity Index at 44.6 (45.0 in September), 12-month low.

- Final Markit France Composite Output Index at 43.5 (43.2 in September), 2-month high.

Summary:

Business activity in the French service sector decreased at a substantial rate in October. This primarily reflected a further drop in incoming new business, as weak economic conditions weighed on demand. The rate of job losses accelerated as service providers responded to excess capacity. Output prices continued to be cut at a sharp rate, despite a further (albeit weaker) rise in input costs. Future expectations deteriorated again, slipping to the lowest level since January 2009.

Across the French private sector as a whole, new business fell sharply, albeit at a slightly slower rate than in the previous month.

Employment in the French service sector continued to fall in the latest survey period. The rate of job cutting quickened to the fastest since December 2009, as a number of companies pursued restructuring strategies and chose not to replace voluntary leavers.

…