Courtesy of Lee Adler of the Wall Street Examiner

The financial news media ballyhooed the Consumer Confidence release today, as the index hit a 4 year high and beat economists’ consensus expectations.

Consumer confidence rose in November to the highest level in more than four years, a sign U.S. household spending will keep growing.

The Conference Board’s confidence index climbed to 73.7, the highest since February 2008, from a revised 73.1 reading the prior month, figures from the New York-based private research group showed today. The median forecast of 75 economists surveyed by Bloomberg projected a reading of 73.

via Consumer Confidence in U.S. Increases to Four-Year High – Bloomberg.

But there’s a catch.

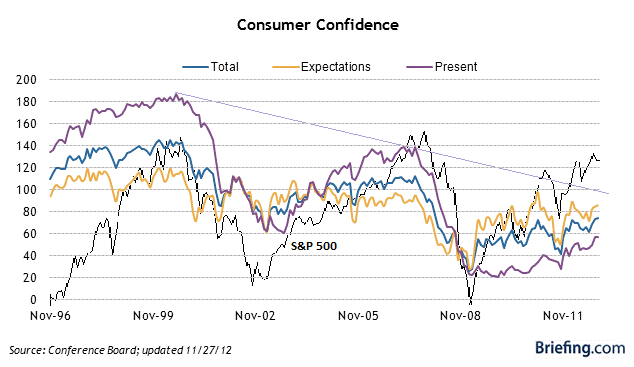

Briefing.com publishes a nice chart of the index along with its two primary components. I’ve added a few embellishments, including an overlay of the S&P 500 and a trendline connecting the peaks in the present condition component. That chart shows that there’s less to the 4 year high than meets the ear. It sounds great, but the fact is that this “high” is below the low of 2002-03 and way below the upper limit of the 13 year downtrend in confidence. While there’s been some recovery, consumers can hardly be seen as ebullient or even resilient. In fact, they remain downright depressed. The Present component of the index is still at less than half the level it was in 2006 and 2007.

It is about 4 years from the last low in the present conditions index. Yet it remains well below the trendline established by the last two peaks, in 2000 and 2007, in the present condition component. In the 4 years from the 2003 low to the 2007 peak, the index rose 80 points. In the 4 years since November 2008, the index has risen by less than half the amount it rose in the 2003-2007 period.

The other thing we notice is that consumer confidence tends to follow stocks. The biggest exception was in 2007, when consumer confidence began to collapse as housing prices started down before stocks. The fact that this indicator typically follows the stock market makes it relatively useless as a market indicator.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.