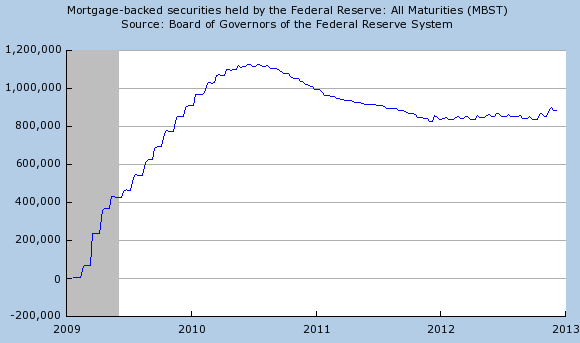

Fed lowers mortgage rates without "printing money"

Courtesy of SoberLook.com

|

| $bn, source: St Louis Fed |

[Note by Lee Adler: Banks “Sitting On Reserves” Is A Fallacy: There were no QE3 settlements before November 14. The Fed’s first MBS purchases were in September. These purchases were and are forward contracts with settlement periods of up to 60 days or more. The first purchases in September began settling on November 14 with more on November 19 and 20. The next settlement period will be December 12-20, with at least $70 billion set to settle.]

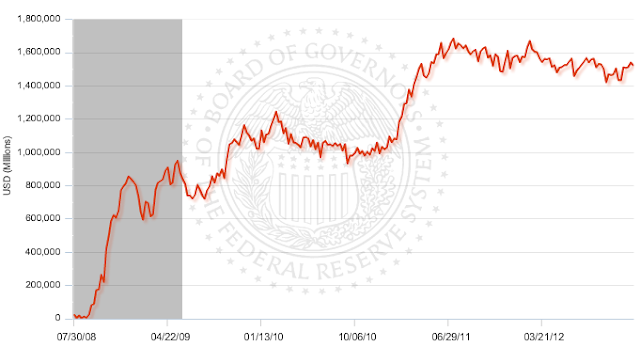

More importantly, bank reserves are basically holding flat…

|

| Reserve balances with Federal Reserve Banks (source FRB) |

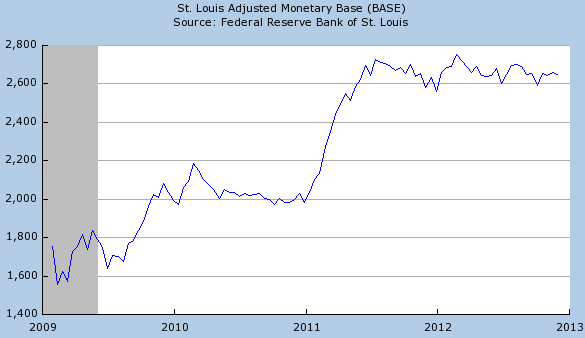

… and so is the overall monetary base (effectively no new base money has been created since the start of the QE3 program).

|

| $bn, source: St Louis Fed |

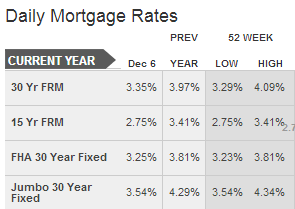

Just the "threat" of open-ended MBS purchases by the Fed has created demand for agency MBS (see discussion), pushing MBS yields to new lows. That in return has sent mortgage rates to record lows as well.

|

| Source: Bankrate |

In fact today even as the 30y fixed rate hovers above absolute lows, the 15y fixed and the 30y jumbo both hit records.

.png) |

| Source: MortgageNewsDaily.com |

If lowering mortgage rates was what the Fed intended to accomplish with the latest monetary expansion, the central bank has succeeded. And so far they have done it without a significant change in bank reserves. Whether this will translate into improved economic activity and job growth remains to be seen (see discussion).