Courtesy of Mish.

In Germany Rebounds but … I noted a recovery “of sorts” in Germany, a contraction in France at the steepest rate in four years, and a record decrease in services employment in Italy.

Thus, it should be no surprise to see the Markit Eurozone Composite PMI® shows national divergence hits record high.

Yet, in aggregate, the eurozone contraction decelerated with the eurozone composite PMI rising from 47.2 to 48.6.

So, what’s it all mean?

Chris Williamson, Chief Economist at Markit offered this interpretation: “The eurozone is showing clear signs of healing, with the downturn easing sharply in January and the region moving closer to stabilisation in the first quarter. ….”

No Signs of Healing

I disagree with Williamson. Those divergences show the eurozone is getting sicker, not healing.

If there was any healing, and certainly if there was any rebalancing, manufacturing and export growth would be picking up in Spain, in Italy, and in France at the expense of Germany.

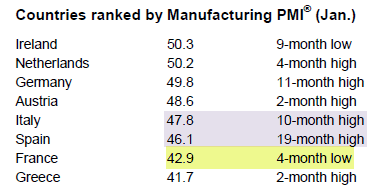

A quick check of the Markit Eurozone Manufacturing PMI will show that is not what’s happening.

There are certainly a lot of highs. However, Italy and Spain are still in deep contraction and France is a certified zombie.

…