What have you done for us lately?

What have you done for us lately?

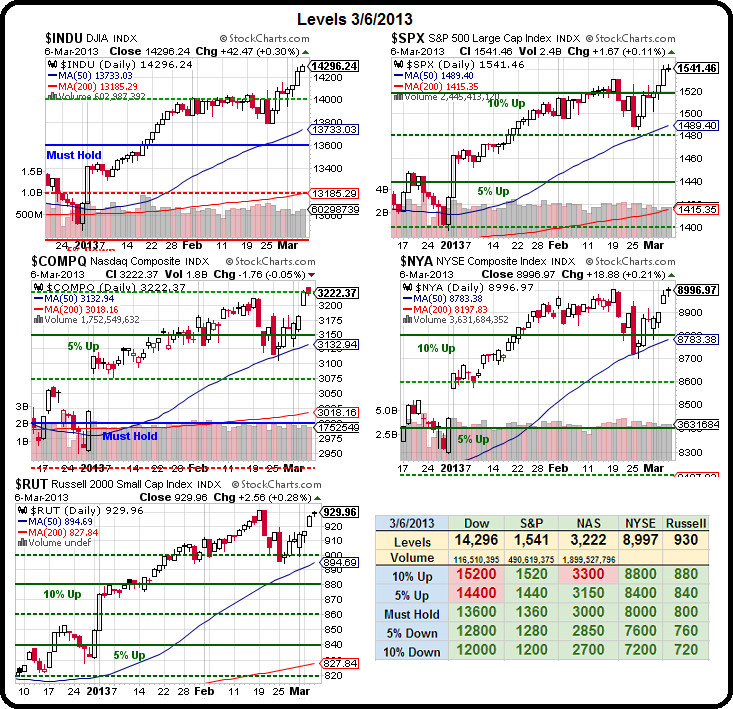

That's the question investors have for the Dow as we continue onward and upward to record highs. Our own Big Chart has a target of 14,400 for the senior index and making and holding that line will finally get us to roll our targets higher – per our 5% Rule, which has been right on the money since 2009 so no sense in ignoring it now, is there?

I mentioned in yesterday's post that the Dow today is not the same Dow as we had in 2007 so, in general, comparisons are silly but we have to play the hand we're dealt and keep in mind that any index that is based on 30 stocks that are now selected by a Rupert Murdoch company is certainly nothing any serious investor should be basing decisions on.

What we can take very seriously is S&P 1,440 – long gone already along with our targets on all our other indices save the Nasdaq, which has been dragged down by AAPL's 40% drop, costing that index 8% or about a 250-point handicap and it's STILL just under that 10% line.

In fact, the NYSE is about to test a critical 2.5% line at 9,000 and 1,550 is the 12.5% line on the S&P and the Russell is closing in on 17.5% over it's own Must Hold line (940) so a lot of thing lining up for the big cross that will officially put us up and over the top and will raise our Must Hold lines up to those 5% lines as the market confirms it's next leg higher.

So it's the Dow that is WAY behind and needs to catch up and, to see if it has the gas to get going – let's look at the individual components and see if they are likely to let us move higher or if they themselves are toppy after a 10% run for the year.

So it's the Dow that is WAY behind and needs to catch up and, to see if it has the gas to get going – let's look at the individual components and see if they are likely to let us move higher or if they themselves are toppy after a 10% run for the year.

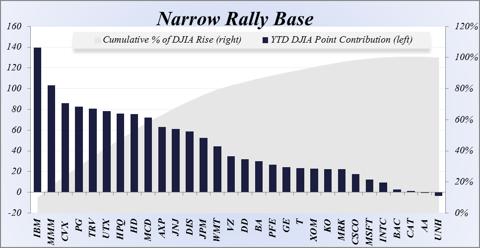

Tom Luongo put up this useful chart showing who has contributed the most and the least to the Dow's rally this year. Not surprisingly, in the price-weighted index, it's IBM getting the lion's share as that stock has gone from $190 to $208 – up $18 and adding about 140 points to the index (8 points per Dollar is about right). Here's a fun fact, had AAPL been put in the Dow when KFT went out last fall, the Dow would have lost 2,400 points due to it's inclusion. The economy would be the same, the rest of the market would be the same but the Dow would be at 12,000 now, rather than challenging 14,400 – due solely to the arbitrary inclusion of one stock over another. See how silly the Dow is?

Still, think about the psychological effect it has on us as 12,000 would certainly not have put the other indexes on such a tear, would it? If you think about it, you realize what a house of cards the whole market is when you see that the inclusion or exclusion of a single stock in a single index could completely turn the tide on investor sentiment and the EXACT SAME companies that you are now willing to pay +20% for could just as easily have followed AAPL lower and been -20%. No change in their business, no change in the economy – just the simply substitution of one stock in one index and everyone's view of the markets would be drastically changed….

Still, think about the psychological effect it has on us as 12,000 would certainly not have put the other indexes on such a tear, would it? If you think about it, you realize what a house of cards the whole market is when you see that the inclusion or exclusion of a single stock in a single index could completely turn the tide on investor sentiment and the EXACT SAME companies that you are now willing to pay +20% for could just as easily have followed AAPL lower and been -20%. No change in their business, no change in the economy – just the simply substitution of one stock in one index and everyone's view of the markets would be drastically changed….

At the moment, the Dow is acting like an anchor and the other indices are going to have a very hard time moving more than 7.5% away from the Dow so it's a good idea to look at the components to see if we have any room to run. CVX and XOM, for example, are major components in the price-weighted index, accounting for $208 out of $1,861 (11%) and we think oil is staying low, so no help will be likely from those two and possibly a negative 10% for -$20.

AXP, BAC, GE, JPM and TRV represent the Financials at $231 for 12.5% and those should have room to grow under QE3 so let's say a conservative 15% for $35 more in that group. AA, BA, CAT, DD, and UTX actually make stuff for $317 (17%) and, if the global economy ever gets going, these guys should be our stars but Europe and China as stuck in the mud so let's say 10% can be expected for $32 at best.

Despite missing AAPL, tech is well represented with CSCO, HPQ, IBM, INTC, MSFT, T and VZ (better than separate Telco category) at $384 (20.6%) and they have been mixed this year and the laggards should have room to run if Q2 earnings aren't terrible – call it 10% for $38 there. That leaves consumerish stocks like DIS, HD, JNJ, KO, MCD, MMM, PG and WMT at $595 (32%) who have already had massive runs and have very little room to improve ($0) and, finally, health care stocks: JNJ, MRK, PFE & UNH with $203 (11%) who have, as a group, gone nowhere so we should expect inflation alone to buy us 10% this year for $20.

Despite missing AAPL, tech is well represented with CSCO, HPQ, IBM, INTC, MSFT, T and VZ (better than separate Telco category) at $384 (20.6%) and they have been mixed this year and the laggards should have room to run if Q2 earnings aren't terrible – call it 10% for $38 there. That leaves consumerish stocks like DIS, HD, JNJ, KO, MCD, MMM, PG and WMT at $595 (32%) who have already had massive runs and have very little room to improve ($0) and, finally, health care stocks: JNJ, MRK, PFE & UNH with $203 (11%) who have, as a group, gone nowhere so we should expect inflation alone to buy us 10% this year for $20.

So, we're just finding $105 of likely improvements in the near future and that's just 5.6% up from here – not exactly rally fuel is it? No wonder the Dow is having so much trouble getting over the 5% line – it's already exhausted and 10% is very likely to be its limit! But, on the other hand, we don't have any particular reason to short it at the moment so we'll just have to watch earnings very, very closely in the month ahead as there will have to be substantial reasons to get us past 15,200, which is EXACTLY where that +$105 would take us. Isn't it funny that a fundamental analysis of the Dow should line up with our 5% Rule target 4 years later? I'll take that over TA voodoo any day!

Meanwhile, we know investors are sheep and the Dow Theorists will still be plowing some money in between here and 14,400 and, if that pops on this run – all the way to 15,200 so it makes sense to look at our Dow laggards and figure out who will get some lovin' over the next few months. CSCO, MSFT, INTC, BAC, CAT, AA and UNH are our underperformers and we love CSCO and already grabbed them for our new Income Portfolio at $20.80 last week (now $21.72). AA is also in there as our 6th trade in our rebooted Conservative Portfolio, and those we grabbed at $8.50 but still just laying around at $8.57.

BAC was our "One Trade" for 2013 but that was at a ridiculous $5.75 (even more ridiculous than this year's One Trade with AAPL at $425) and now BAC is $11.92 and I already predicted that $15 would be about their top so hard to get excited about here BUT, through the magic of stock options, you can sell the 2015 $10 puts for $1.22 and buy the 2015 $10/15 bull call spread for $2.05 for a net 0.83 entry on the $5 spread and your worst case is being assigned the stock at net $11.83, so you have a built-in $1.09 discount – about 10% at worst. Best case is you make $4.17 off your .83 cash commitment and that's a nice 500% return on cash so I do like it, but too risky for the Income Portfolio – just a fun way to be bullish on the Financials in general.

MSFT is still run by Steve Ballmer so I wouldn't put a dime into them and, if you read this article by MG Siegler, I won't have to explain that statement any further. CAT I would love to see lower so we could get a good buy-in as China and Europe are not likely to get worse while US housing is very likely to pick up and make them much better. Tempting though it may be to get in now – we're going to patiently wait for a "crisis" to scoop them up. UNH is tricky to call with the new Health Care laws but what a great company and they are low in their channel so nothing wrong with selling the 2015 $45 puts for $4.20 as the worst-case is you get assigned at net $40.80, which is 24% below the current price and, if you don't get your cheap entry, then you keep the $4.20 anyway and ThinkOrSwim tells me it's just $4.50 in net margin so there are certainly worst things to do with $4.50 than either make 93% in two years OR get to buy UNH for 24% off, right?

MSFT is still run by Steve Ballmer so I wouldn't put a dime into them and, if you read this article by MG Siegler, I won't have to explain that statement any further. CAT I would love to see lower so we could get a good buy-in as China and Europe are not likely to get worse while US housing is very likely to pick up and make them much better. Tempting though it may be to get in now – we're going to patiently wait for a "crisis" to scoop them up. UNH is tricky to call with the new Health Care laws but what a great company and they are low in their channel so nothing wrong with selling the 2015 $45 puts for $4.20 as the worst-case is you get assigned at net $40.80, which is 24% below the current price and, if you don't get your cheap entry, then you keep the $4.20 anyway and ThinkOrSwim tells me it's just $4.50 in net margin so there are certainly worst things to do with $4.50 than either make 93% in two years OR get to buy UNH for 24% off, right?

That leaves us with INTC and just yesterday I said to Members I don't like buying them between the 50 ($21) and 200 ($22.70) dmas as I'd rather wait for clarity and that's how we feel about the Dow on the whole as we've had a 10% run from 13,000 to 14,300 this year and that means – according to the same 5% Rule that predicted the move in the first place – that we can expect a 260-point pullback to 14,040 at some point. To that end, we have taken some DIA June $135 puts ($1.90) in our Income Portfolio, to protect us from a sudden drop or to allow us to pick up a little cash on the EXPECTED pullback. We can offset the cost of those ($9,500) with the sale of 10 of the UNH puts ($4,200), which should be more than adequate to pay for us to roll to January if the Dow sails through earnings and on to 15,000 – which is the next spot we'd expect a nice pullback.

Waiting and seeing is our primary battle plan at the moment. As long as the Dollar behaves itself – no reason this ride should end – for now.