Day to day

Hour to hour

The gate is straight

Deep and wide

Break on through to the other side – Doors (of Perception)

Up and up the market goes, where she stops, no one knows.

We already had to roll up our DIA hedges in our new Income Portfolio yesterday as they had dipped (the June $135 puts) from $1.90 to $1.40, costing us $2,500 of our virtual profits already or, as a bearish optimist would say, setting us up to make a nice amount on the way back down as we plow another .55 into a roll to the $138 puts (as we couldn't fill our initial target of the $139s).

No matter how bullish we are (and all of our Income Portfolio positions are bullish so far), it's always prudent to have some hedges. When you are at a possible top in a range – it is more important than usual and we're sitting on the top of a 20% move from S&P 1,300 (last Q2) to the 1,560 that we're moving in to test in Q2 of 2013.

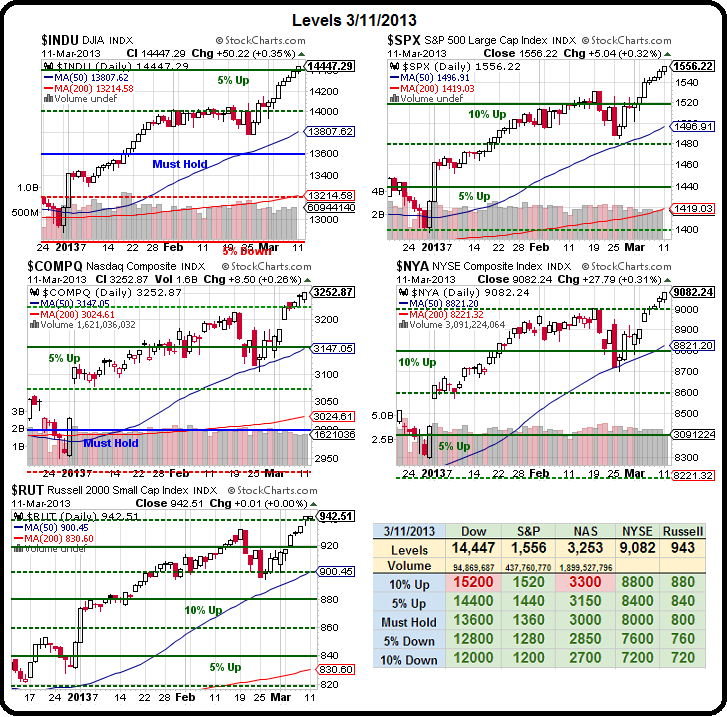

We're down to our last two red boxes on our Big Chart and if it wasn't expiration week, we would have already redrawn the lines to reflect our new trading range but we're still expecting a 2.5% to 5% pullback before breaking on through to what would be our 20% lines.

We're down to our last two red boxes on our Big Chart and if it wasn't expiration week, we would have already redrawn the lines to reflect our new trading range but we're still expecting a 2.5% to 5% pullback before breaking on through to what would be our 20% lines.

On the Russell (the leading indicator at the moment) that would be 1,000, along with NYSE 10,000, Nasdaq 3,600, S&P 1,700 and Dow 17,000. If the math seems confusing versus our current figures, it's because the Bigger Big Chart set those targets for a 5-year recovery back in March of 2009 (see our July 2010 update: "Charts from the Future" for a good explanation of how we use our 5% Rule) and we work our numbers backward from there, with the occasional adjustments for Dollar activity.

Using those lines, all our numbers change and our goals will become our "10% Up" lines – the top of our new expected range – and then we're forced to redraw all our lower numbers accordingly and our Must Hold lines become -10% from the top at Dow 15,300, S&P 1,530 (already over), Nas 3,240 (just over), NYSE 9,000 (over) and Russell 900 (over). As noted last Thursday, 15,200 is where we calculate the fair value of the Dow into earnings so that shouldn't be holding us back either – even with the aggressive adjustment.

It almost makes us feel silly taking short positions at all but we have to have hedges, as you never know when the market will go into panic mode again. Also, we have "smart" hedges like GDX and TLT that can go up for reasons other than just market panic – so we have a couple of ways to win – even if the market never does slow down.

It almost makes us feel silly taking short positions at all but we have to have hedges, as you never know when the market will go into panic mode again. Also, we have "smart" hedges like GDX and TLT that can go up for reasons other than just market panic – so we have a couple of ways to win – even if the market never does slow down.

We did find an interesting short on JNJ, with the May $77.50 puts at $1.02 as they are facing serious lawsuits and are currently priced to a p/e of 20 – more than twice what AAPL is "worth" according to market participants at the moment, so it's a good way to pick the Dow component most likely to fail (after XOM, which we shorted last week). Speaking of oil, OPEC just put out a report saying World oil demand will rise 800Mbd this year and oil is flying to $92.75 already on the NYMEX and will make a great short as traders have just 7 trading days left to dump 165Mb worth of contracts that they have pretended to want for April delivery.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Apr'13 | 91.94 | 92.64 | 91.60 | 92.64 |

08:34 Mar 12 |

– |

0.58 | 37598 | 92.06 | 165993 | Call Put |

| May'13 | 92.46 | 93.09 | 92.05 | 93.08 |

08:34 Mar 12 |

– |

0.56 | 13110 | 92.52 | 257824 | Call Put |

| Jun'13 | 92.75 | 93.42 | 92.43 | 93.40 |

08:34 Mar 12 |

– |

0.53 | 6642 | 92.87 | 173896 | Call Put |

| Jul'13 | 92.79 | 93.62 | 92.65 | 93.62 |

08:34 Mar 12 |

– |

0.54 | 2198 | 93.08 | 126406 | Call Put |

| Aug'13 | 93.20 | 93.62 | 92.74 | 93.62 |

08:34 Mar 12 |

– |

0.51 | 1255 | 93.11 | 68270 | Call Put |

As we predicted last month, they now have a log-jam with 257,000 fake orders already in May and 173,000 (1,000 barrels per contract) worth of fake demand for June and 126,000 contracts already written for July. As last month closed with just 11Mb of oil actually delivered to Cushing, a facility that only holds 48Mb of oil and is currently full – it is nothing but a blatant sham that these "orders" are even allowed to be placed but, if the NYMEX crooks want to pretend to want to take delivery of 165Mb of oil in April for $93 per barrel – we will be happy to promise to sell it to them, which obliges them to accept delivery FOB at Cushing, after which storage, transportation and eventual disposition of the oil will be entirely their problem!

In other alleged criminal activity: Goldman Sachs joins OPEC in goosing oil by raising their 3-month outlook for raw materials to "overweight," saying "The recent sell-off in commodities on worries about Chinese growth is overdone in our view and we upgrade to overweight on a 3-month horizon." Limited supplies of oil will support front-month prices near current levels, while longer-dated Brent pries will be “well-anchored” at about $90 a barrel, Goldman said.

In other alleged criminal activity: Goldman Sachs joins OPEC in goosing oil by raising their 3-month outlook for raw materials to "overweight," saying "The recent sell-off in commodities on worries about Chinese growth is overdone in our view and we upgrade to overweight on a 3-month horizon." Limited supplies of oil will support front-month prices near current levels, while longer-dated Brent pries will be “well-anchored” at about $90 a barrel, Goldman said.

Limited supplies? ROFL!!! As I said, let's sell those crooks the 165M barrels they are pretending to want and then we'll see how "limited" the supply is as we add to Cushing's weekly build in April to the tune of 40M barrels a week! Not only that but take a look at the EIA's projections for the next 3 years – Net imports are dropping, due to lower US demand and greater US supply, from the current 7.72Mbd all the way down to 5.44Mbd projected in Q4 of 2014.

That's 2.28Mbd LESS oil imported to the US. At $90 a barrel (good luck holding that price!), that's a $75Bn net change in our balance of trade per year and $75Bn less dollars we send overseas and $75Bn less Dollars being essentially burned to fuel our vehicles.

Not only that, but the EIA assumes fairly steady demand – as if small cars and electric vehicles won't continue to gain market share over the next 3 years – so these are conservative figures. No wonder Goldman is trying to con people into taking all those bad oil trades off their hands. Even mighty JPM has already seen a 16% decline in commodity revenues this year and, according to Reuters:

Wall Street's continued ownership of physical commodity assets, including power plants, oil storage tanks and metals warehouses, is also still under question after the conversion of Goldman and Morgan Stanley to Bank Holding Companies during the financial crisis.

So of course we're jumping all over the chance to short oil Futures (/CL) at the $93 line and, hopefully, they'll go a little higher than that and we can add short positions using SCO or USO in Member Chat as things can turn very ugly next week as the thieves try to wriggle out of the contracts they signed today in order to create a false impression of demand so they could screw the American public out of another few Billion this month. If everyone reading this post simply agrees to sell them 10 barrels for $93+ and then doesn't let them cancel the contract – we can flood the US with oil and crash the market – giving us a whole summer of low gas prices – wouldn't that be fun?

We've done this before – in June of 2011, with oil at $103, I called for similar action in an article titled "Let's Break the Speculators", saying: "If some idiot is stupid enough to pretend to want to buy oil at $103 for July delivery – we are happy to sell it to them." At that time (June 1st), there were a whopping 376,000 open contracts on the NYMEX and we caught a dip there all the way down to $90 – good for a $13 gain or a loss of $4.8Bn for the NYMEX crooks in less than a month. What other newsletter gives you tips that can lead to $4.8Bn gains?

Keep in mind though, that you can lose $4.8Bn as fast as you make it. Futures are very dangerous, which is why we use that $93 line as a very hard on/off switch for the trade (unless we get to $93.50 first, then we'll use that). It's a lot easier for smaller players to limit their exposure with something like USO April $33.50 puts, which should be about .75 at the open with USO right at $33.50 now. With SCO, we can just play for $95 not to happen and pick up the April $36/39 bull call spread at $1.80 as SCO is at $39.56 now so the trade is on the money to start and can lose 50% before you get in real trouble.

These are just some of the fun ways we can benefit from the criminal manipulation of the market by others.