Resumption of Regularly Scheduled European Crisis Programs Interrupts Treasury Sentiment Sea Change

Courtesy of Lee Adler of the Wall Street Examiner

Key points in Lee's full report for the week:

- The haircut to be administered to bank depositors in Cyprus, not yet finalized as of this writing, has again tilted the playing field to drive foreign capital into the Treasury market, which should prevent an upside breakout and send yields lower in the short run. The 1.85 to 2.10 range should remain intact for a while.

-

There will be plenty of excess cash around this week. Supply from the Treasury will be light, and support from the Fed will add net cash to the markets with the Fed settling $88 billion in forward MBS purchases from the 12th to the 19th. There’s always more cash around at mid month when the Fed is settling MBS purchases and less cash around at the end and beginning of the month when the Fed is more in the background. Market sentiment determines which investment sector gets the benefit of that, and lately it has been almost always stocks as the gradual sentiment turn against Treasuries continues. The partial confiscation of Cypriot depositors’ savings this weekend can least temporarily flip that relationship on its head – but these amounts haven’t been finalized and are subject to Cypriot parliamentary approval.

-

Foreign central bank (FCB) buying has entered the weak side of its short term buying cycle but renewed fears over the European financial crisis are likely sending more private foreign capital flooding into the US Treasury market, and more Fed cash is on the way, so weak FCB buying should not be enough to slow the markets.

-

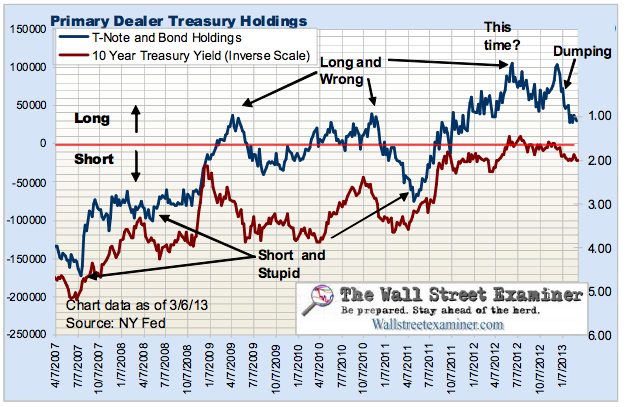

Public buying remained a bullish factor for bonds. Panic in Europe would add to that. Primary Dealer and bank selling remains a concern (chart below). The dealers were sellers in the week ended March 6, as they added to their shorts in the 10 year.

-

Under the circumstances most of the marginal Fed QE available for investment and risk capital would normally continue to be funneled toward stocks but the Cypriot situation introduces the fear element that drives capital into Treasuries again. Strength in Treasuries signals some investors to sell stocks.

-

Withholding tax collections have been very strong, more than can be accounted for by the increase in tax rates alone. This suggests that some sectors of the economy are much stronger than anybody realizes and may be overheating. The recent strength results in a windfall for the government. The sequester could reduce Treasury supply by a small amount, which would be a bullish factor for both Treasuries and stocks. With less Treasury supply, more Fed QE cash would be available for stock and commodity speculation.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.