Cyprus: Will the Mouse That Roared be Gored? (Updated)

Courtesy of Yves Smith, Naked Capitalism

Cyprus, as its President Nicos Anastasiades predicted but no one outside Cyprus quite believed would happen, has resoundingly defied the will of the Eurozone in failing to surrender a single Parliamentary vote to a diktat to haircut depositors to save its number two bank, whose failure would in all likelihood bring down Cyprus’s entire banking system. The members of the President’s own party abstained despite his resigned support for the deal. And mind you, this was after the terms revised to allow for deposits under €20,000 to be spared.

The EU was utterly unprepared for this rebellion. Heretofore, threat of withholding of funds and financial armageddon were sufficient to bring legislatures and national leaders to heel. Anastasiades, by contrast, didn’t even try to keep Parliament voting until the results changed. The finance minister tendered his resignation as an admission of failure but Anastasiades rejected it and has him negotiating with the Russians, at a minimum to restructure a €2.5 billion loan from 2011 but clearly to see if Russia will ride in to the rescue.

Although I have not seen an official announcement that banks will remain closed beyond their last scheduled opening time of this Thursday, it now appears the new target date is next Tuesday. Cyprus seems to be working on several backup plans in parallel (more on that later): a good bank/bad bank plan, trying to persuade Russia to bail it out, and leaving the Eurozone. Note that it is also working to put capital controls in place; these seem inevitable even if, miraculously, the Russians decide to write a very large check (although those controls might be less restrictive than under other scenarios). But absent a retreat by the Troika (which seems extremely unlikely) or a big Russian bailout (which is also unlikely but less so), it seems difficult to imagine than any other plan could be implemented by next Tuesday (eg, either a bank restructuring or a Euroexit). So considerable dislocation is likely to result, with unknown but potentially serious knock-on effects.

The reaction from Germany was vitriolic. From the BBC:

Germany’s finance minister has warned Cyprus that its crisis-stricken banks may never be able to reopen if it rejects the terms of a bailout.

Wolfgang Schaeuble said major Cypriot banks were “insolvent if there are no emergency funds”.

In reality, this was merely repeating the ultimatum he’d apparently issued when delivering the deposit haircut, um, tax ultimatum last week, but there’s a big difference between a private threat and a public one.

But despite the browbeating, the Germans appear to realize they’ve created a huge problem for themselves. It’s key to understand that this crisis was created by the Troika. Cyprus asked for a bailout nine months ago and the deadline is a bond payment this June. And while it has become fashionable to pin the blame for this mess on Cyprus, the backstory is more complicated. From Cyprus.com:

Not all the banks are in the same condition.

(a) Cyprus has two money-center type banks: Laiki (Popular) Bank and Bank of Cyprus.

(b) Laiki was purchased by a Greek vehicle (Marfin Investment Group) backed by Gulf money. Marfin’s purchase of Laiki took Laiki from being a fairly conservative local bank to being highly exposed to Greece. Laiki is definitely insolvent and needs to be restructured.

(c) Bank of Cyprus has been more conservative vis-a-vis Greece, but still has meaningful exposure. It is conceivable that, given time, Bank of Cyprus could survive.

(d) Beyond the main two banks, there is Hellenic Bank (a much smaller bank with much less Greek exposure), Cyprus Development Bank (no Greek exposure), the Co-ops (no Greek exposure) and the Cyprus subsidiaries of foreign banks (aka, Russian, English, etc banks), also with no Greek exposure.

(e) All the local oriented banks (BoC, Laiki, Hellenic, Coops) have exposure to the local real estate market that went through a bubble during the 2000-2009 period. This exposure however is not short-term and could be resolved over the period of years. It is a problem, not a crisis, and is offset by the fact that the two main banks have quasi-monopolistic earnings power locally. Given the time and some financial represssion (a la the United States) and the local issues would be manageable.

In other words, the bank that is the epicenter of the problem was driven into the ditch by foreign buyers. Now admittedly, the local bank supervisors did nothing to stop that, but can you point to a single national bank regulator (ex the Canadians) that put much in the way of constraints on their banks prior to the crisis?

And the idea that Cyprus is a hotbed of Russian Mafia money also appears to be exaggerated. This looks to be a combination of a need to scapegoat the latest supplicant to the Trokia plus Anglo-German prejudice against Central and Southern Europe.

Not to put too fine a point on it, Wachovia laundered over $800 million of Mexican drug money, and Standard Chartered admitted to “at least” $250 billion of Iran related money laundering. And HSBC, which paid the biggest fine ever in the US for drug-related money laundering for Central American groups, is now being charged by Argentina for similar activities. Let’s not kid ourselves. Citigroup has had a huge wealth management business, concentrated on Latin America, since the 1980s. What do you think that is about? To a significant degree, like Swiss private banks, Citigroup is the recipient of funds expropriated from national governments. For people like Martin Wolf of the Financial Times to get sanctimonious about what Cypriot banks are up to is more than a tad disingenuous, particularly when his own paper, the same day, describes how five Russian M&A transactions are having to be reworked due to the bank freeze in Cyprus. Yes, there is clearly dirty banking going on there. But it appears only 28% of the deposits are Russia related. A significant, if not overwhelming amount of that activity appears to be no worse than GE’s tax avoidance. And remember, depositors of every bank are being haircut to bail out the miscreant Laiki. That includes the roughly €3 billion of largely Russian deposits in the perfectly solvent Cyprus subsidiary of the Russian bank VTB.

The bail-in demand was sprung on Anastasiades with no warning, apparently in the hope that a new President would cave. That looks to have been a serious miscalculation.

Handelsblatt, for instance, was handwringing over the Cypriot refusal, stressing that it put the EU in an untenable situation. The second largest bank, Laiki, will become ineligible for ELA loans without a rescue. But as Schaeuble has said, Cyprus’s entire banking system is at risk under that scenario. And the EU has designated Cyprus as systemically important. So letting it founder would be “almost impossible”. At the same time, the Germans are acutely aware of the risk of letting a country defy them and win concessions as a result. In the charming broken English of Google Translate:

…the Euro-rescuers are in a dilemma: either they lose even more confidence or help Cyprus – no matter what the cost.

Buckling would be long-term effects. “The signal for future bailouts would be fatal,” says [Nicolaus] Heinen [Europe expert at German Bank Research]. “Conditions for future bailouts could be formulated even softer to prevent the negative attitude of the parliaments catching on.”

This issue was not lost on other countries. For instance, KeeptalkingGreece, in Greeks stunned to hear Cypriot MPs attacking EU and reject the bailout, wrote (hat tip Richard Smith):

Greeks are deeply stunned and green from envy, to hear the debate inside the Cypriot Parliament during the crucial voting on bank deposits tax….a friend called me.

“Look at them, look at them. They say NO to Troika, they will down vote the bank tax and our politicians said Yes to every dot and comma imposed by the Troika. Shame on them!”…

Unbelievable things are spoke, down there in the Cypriot Parliament.

Something that neither conservative Nea Dimocratia nor socialist PASOK ever did. Every parliament debate before loan agreement voting turned to a blame-game between the two parties that governed the country for almost four decades and ruined it with their policies.

Instead for fighting a minimum of negotiation, they instead signed one loan agreement after the one and caused sheer panic among the Greek citizens with the total economical state collapse. As if we the loan agreements, we do have heating oil or medicine for our patients….

And where might the Cypriots go from here? It’s important to understand that Cyprus only had options ranging from bad to worse, thanks to the ham-handed EU intervention. Even if the Parliament had accepted the depositor cram-down, the very announcement of the idea has done tremendous damage to the banking system. You can expect capital flight, even with controls in place. This bailout is certain to be inadequate merely due to the economic impact of the loss of wealth. That almost assures a second goring of depositors. Why sit around and wait for that to happen? And you can’t be an international banking center with capital controls in place.

Now the IMF is supposedly working with Cyprus on a good bank/bad bank plan for its two biggest banks. But I can’t fathom how that works, since, as Macro Man pointed out, the real point of a good bank/bad bank plan would be to leave all those nasty English law bonds that would normally have been hard to restructure in the bad bank (now maybe the IMF is actually up for stiffing those investors, who knows). But you’d need also to have a hard look at what authority the local banking regulator has, and what resolution procedures are like (bank seizures and liquidations are basically special variants of bankruptcy law that apply only to banks). And as we indicated, this solution still torches the international banking business in Cyprus and thus will put the economy into a serious recession, if not a depression.

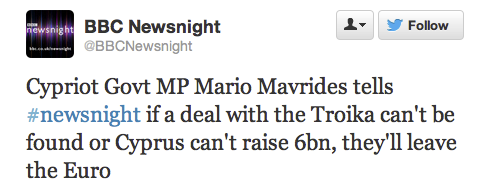

Second is to leave the Eurozone. This is not an idle threat.

As you can tell from above, the Troika has done so much damage already that the incremental costs of leaving the Eurozone would likely be considerably offset by depreciating the currency and being able to stimulate the economy by deficit spending. They also have greater hope of restoring something in the way of an international banking business after the shock of the currency devaluation wears off than they do under the tender ministrations of the Troika.

The cynic in me wonders if the crippling Cyprus international banking business is not simply an accidental by-product, but in fact was the motivator for the ambush of the new President. As the Financial Times indicates, legitimate Russian businesses are scrambling to move their deals to other tax haven centers, like Luxembourg. Remember that Russia is funneling arms to Syria. That means paying arms merchants. I would assume it’s harder to move those payments quietly through banking centers in the US or UK banking complexes than one largely outside it (well, you can always use overinvoicing and other tricks, but I assume that is more cumbersome).

Now the Eurozone is actually not keen about the idea of a Cyprus exit, since any country leaving raises the ugly possibility that someone else will depart. That in turn will lead to deposit flight of the countries seen to be most at risk (Portugal, Spain, Italy). That was straining the Eurozone prior to the OMT, which managed to calm down depositors enough to arrest money-moving. If the Cypriots were to impress upon the Troika that they were deadly serious about leaving, there is a small possibility that the Troika will blink and allow the ECB to keep funding Laiki while they wrangle. I am not certain that this leads to happy endings so much as keeping a tense situation in play.

The final alternative is that Russia stumps up enough cash to salvage Cyprus. Cyprus approached Russia nine months ago for assistance and was rebuffed, but as we will discuss, there has been one change in the interim that might lead Russia to change its posture.

To take the EU out of the question entirely is probably on the order of €30 billion, which seems a tall order for a €17 billion or so economy before the Eurozone stomped, Godzilla-like, all over its international banking business. Many people have focused on the rumor that Gazprom had offered to lend €13 billion in exchange for development rights in offshore gas fields, which Gazprom later denied. Now aside from the fact that these fields no doubt have others vying for development rights, the Troika would also probably want to retrade a deal that had Russians getting their hands into the country’s major economic asset. So even if Gazprom resurfaces, it is unlikely to act as a savior.

But Cyprus has another asset which the Eurocrats seem to have forgotten about: its real estate. Cyprus has a major airbase which is important to British operations in the Middle East. As reader Claudius pointed out in comments yesterday:

What has really pissed-off Russia was when, despite denials and assurances from the US state department, a meeting was held in Ankara (November 2012) with the American Ambassador to Cyprus, John Koenig, along with British, Greek and Turkey government heads. The meeting discussed a plan: British bases in Cyprus will be turned into NATO bases – the ‘three-party guarantee’ of Britain, Turkey and Greece will be abandoned – and NATO will take over. America wants its ships there.

However, there was one small snag; for Cyprus, the plan is neither legal nor constitutionally permissible. When, last year, Nikos Anastasiades pushed for a majority in the Cyprus parliament to vote for and pass an act for the Cyprus to join NATO’s ‘Program for Peace’ (PfP); Cyprus being the only member of the 27-nation European Union that is not in NATO. President Christofias (whom helped broker the Russian $2.5Bln investment) vetoed it, citing that the act violated the Constitution and the separation of powers (one of Cyprus’ ‘basic principles’) as the PfP is neither “an international organization nor a treaty of alliance”.

Nevertheless, and much to the Russia’s chagrin, the UN Secretary-General’s Special Advisor on Cyprus Alexander Downer has continued to develop talks with, now, Prime Minister Anastasiades whereby British bases in Cyprus will be handed to NATO as part of a new ‘Cyprus Peace Plan’ (one that encompasses PfP).

How long the veto is, somehow, voided or nullified, is not an easy guess. So, if Russia can buy time, presence and influence in Cyprus by paying $30Bln to bail out Cyprus and save the day, it can keep NATO out and import all the couscous it wants; it’s a bargain.

Now €30 billion is a lot to pay for a soft assurance and to merely serve as a spoiler for an uncertain period of time. A more hardball strategy would be military Keynesianism. Russia would love to have a port in the Mediterranean, or alternatively, an airbase (Cyprus apparently has four big ones, one its main commercial airport, one the British airfield, one dormant one in DMZ and one in the north. Query whether there are any open or low population areas that could be converted to an airbase).

Now would Russia get very far with a scheme like that? The Americans and Nato would go absolutely bonkers. I’m not sure how this would game out, but the mere announcement of a Russian-Cypriot pact would put the US, England and Germany in overdrive figuring out how to get the Russians out. And that would seem to at least mean improving on the financial terms offered to Cyprus, and giving the Russians some assurances on the Nato plan.

In other words, the Russians could throw a serious monkey wrench into Nato’s plan to stick a base into what Russia regards as its back yard. Whether Russia sees the opportunity and is willing to escalate international tensions to a fever pitch remains to be seen, but it would be a very clever way to exploit the Trokia’s blunder.

Update 8:30 AM: Ekathimerini apparently reports (the site is busy!) that Russia will buy Laiki for €4 billion. This will put the Troika in an amusing quandary, since they had demanded that Cyprus stump up €5.8 billion but the threat was cutting off Laiki from the ELA. If Russia will now make sure Laiki is solvent, the Troika’s grenade has been disarmed. And for €4 billion plus ongoing support, they might have gotten a handshake on that airbase too. This looks to have been well played, given the circumstances, if the rumor pans out.

Ah, so much for rumors! Like the Gazprom investment story, it has now been denied.

Update Bloomberg pieces on the ramifications of a Russian bailout, the latest from the ECB re ELA, and from Renaissance Capital on why Russia has a dog in this fight (video).

Oh, and then there’s Turkey’s dog; and the ECB sticks to its guns.

The banks in Cyprus are now to stay closed until Tuesday…