Intro by Ilene

The Pension Rate-of-Return Fantasy is an excellent article exposing another problem we're going to face sooner or later. Andy Kessler suggests that "Pension math is more art than science." I submit that it's only an art when making projections. When it's time to pay the bills, pension math becomes a science.

Andy correctly noted that expanding stock price/earnings ratios (P/Es) due strictly to falling interest rates is probably a thing of the past. This is because interest rates are already near zero (i.e. Zero Interest Rate Policy, ZIRP). However, there's another factor at play: unlimited money printing by central bankers is driving demand for equities. The supply of money is growing while the value of cash is falling. (In Japan's case, the value of the Yen is plunging lower.) Holding equities and other assets helps counteract the dilutive effect of massive QE programs on the value of a country's currency. Thus increased demand is driving equity prices higher. Commodities prices are experiencing the same pressure to move higher.

Thus even if P/Es no longer expand due to interest rates falling, another factor, increased demand, can still drive prices higher. Price/earnings multiples are expanding due not only to ZIRP, but also because the demand for non-cash assets rises as the value of money/cash declines. People don't want to hold cash in this inflationary environment. (See Washington's Biggest Lie.)

According to Paul Price, "A huge amount of new money chasing a finite number of shares sent the Japanese index into orbit. The same thing has been happening here in America but in slow motion.

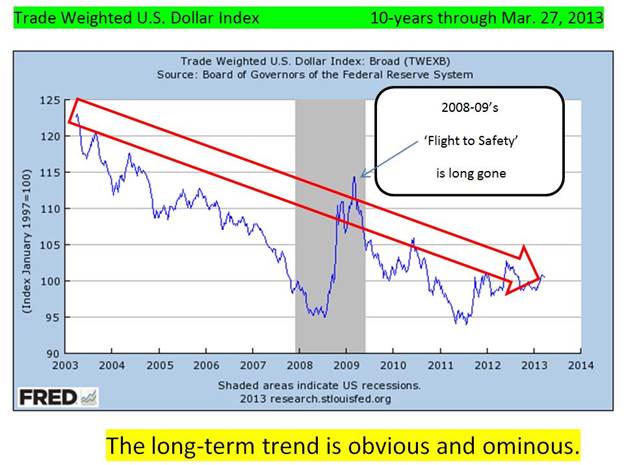

"U.S. dollars are the world’s reserve currency and subject to political forces in addition to economic ones. The 2008-09 financial disaster caused a short-lived run into dollars that were seen as a safe haven in a dangerous world. That effect dissipated long ago…

"The drop in the trade-weighted dollar came despite other countries’ attempts to ‘race to the bottom’ with their own currency units. QE programs from Chairman Bernanke are set to continue indefinitely. $85 billion a month equals a trillion a year of dilution. Smart money is chasing assets that can appreciate rather than wither."

The Pension Rate-of-Return Fantasy

By ANDY KESSLER

Counting on 7.5% when Treasury bonds are paying 1.74%? That's going to cost taxpayers billions.

Full article at the wsj: http://online.wsj.com/article/SB10001424127887324100904578403213835796062.html

It has been said that an actuary is someone who really wanted to be an accountant but didn't have the personality for it. See who's laughing now. Things are starting to get very interesting, actuarially-speaking.

Federal bankruptcy judge Christopher Klein ruled on April 1 that Stockton, Calif., can file for bankruptcy via Chapter 9 (Chapter 11's ugly cousin). The ruling may start the actuarial dominoes falling across the country, because Stockton's predicament stems from financial assumptions that are hardly restricted to one improvident California municipality.

Stockton may expose the little-known but biggest lie in global finance: pension funds' expected rate of return. It turns out that the California Public Employees' Retirement System, or Calpers, is Stockton's largest creditor and is owed some $900 million. But in the likelihood that U.S. bankruptcy law trumps California pension law, Calpers might not ever be fully repaid.

So what? Calpers has $255 billion in assets to cover present and future pension obligations for its 1.6 million members. Yes, but . . . in March, Calpers Chief Actuary Alan Milligan published a report suggesting that various state employee and school pension funds are only 62%-68% funded 10 years out and only 79%-86% funded 30 years out. Mr. Milligan then proposed—and Calpers approved—raising state employer contributions to the pension fund by 50% over the next six years to return to full funding. That is money these towns and school systems don't really have. Even with the fee raise, the goal of being fully funded is wishful thinking.

Read the rest: Andy Kessler: The Pension Rate-of-Return Fantasy – WSJ.com.