So maybe the civil courts will do what the criminal justice system won't – attempt to hold Corzine accountable for at least some of his alleged reckless conduct as head of MF Global.

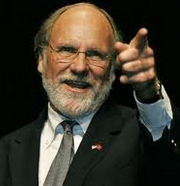

Mirabile Dictu! Someone (Bankruptcy Trustee Freeh) Finally Sues Jon Corzine Over MF Global

Courtesy of Yves Smith of Naked Capitalism

Courtesy of Yves Smith of Naked Capitalism

The great unwashed public might get to enjoy a bit of theater. MF Global bankruptcy trustee Louis Freeh filed suit against Jon Corzine and two other MF Global executives, Brad Abelow and Henri Steenkamp, for running the firm into the ground for breach of fiduciary duty of care, breach of fiduciary duty of loyalty, and breach of fiduciary duty of oversight. That’s legalese for doing a recklessly bad job of being in charge.

The suit does not include the issue that has many members of the investing public outraged: the appropriation of customer funds. (A class action lawsuit involves that. – Ilene) But even though the specific failings are familiar to anyone who has been following this sorry affair closely, reading them together is a reminder of just how astonishingly irresponsible Corzine was as an executive.

One of the basic requirements of a trading operation is you need to have solid controls and reporting. Yet Corzine instead entered into a outsided trading strategy that produced accounting earnings but drained liquidity. It’s frustrating that the suit misses this element, that the trade actually had a two day funding gap on top its other defects, including the fatal one, the risk of increased haircuts on a levered trade. That meant it drained cash even when it was showing accounting profits.

The repo to maturity trade that enabled MFG to disappear the position was an INTERCOMPANY trade between MFGI and MFGUK. The ACTUAL repo with the street (MFGUK to LCH) was repo to (maturity-2 days).

The external auditors and the regulators waved it through anyway.

Since the entire business model rested on this fiction, the customers were doomed at the point this was approved.

The resulting catastophe was inevitable and all the issues about chaos in the final moments and feuds between Treasury and Accounting and antiquated systems is noise.

The regulators could have shut him down on day one. Using intercompany accounting to game the regs is compliance 101 stuff, so the regulators can’t claim they were bamboozled by the slickest guy in town. They were idiots, genuinely or conveniently, you decide.

At least Lehman had the decency to pay its counterparties to rent their balance sheet to pull off their scam. Fuld must surely envy Corzine.

Of course, the fact that complaint auditors and “see no evil” regulators permitted this bogus treatment is the reason Freeh and his lawyers chose to omit this issue. Corzine et al. could simply take the position that who was he to second guess the experts? But the failure to put the focus on the central problem means complicit regulators escape the opprobrium they deserve.

And there was more than enough dereliction of duty to make for a juicy filing. Corzine knowingly relied on faulty reports, such as a “liquidity dashboard,” gave incomplete reports to his board, and ignored warnings of his Internal Audit department. And that’s only some of the high points.

Freeh v. Corzine et al., April 23, 2013

The fact that the suit was filed suggests that Corzine and his former partners in gross mismanagement were unable to reach a settlement. And as readers no doubt know, roughly 95% of all lawsuits are settled. But here, Freeh has already done a huge investigation prior to filing the suit, so the usual motivation to escape discovery costs isn’t a big driver; there’s not much additional work to be done to prepare for trial. Corzine has a big enough ego, an established appetite for risky courses of action, and deep enough pockets so as to be far less deterred by courtroom costs and process than most defendants. So the odds are way higher than normal that this filing will lead to trial than most cases.

Unfortunately, some embarrassing cross examinations and a diminution of Corzine’s net worth falls far short of what Corzine deserves, which is jail time. But this suit may pave the wave for other litigation. If we are lucky, Corzine will be tortured in court for years.