Be careful looking at track records. How were they determined? Like law – procedure, procedure, procedure. Yeah, I know, it's no fun, it's tedious, but newsletters and funds are meant to sell.

Short selling and misrepresenting the truth – Infitialis edition

Courtesy of John Hempton

I am a short-seller by inclination. Moreover I short mostly frauds and stock promotes.

If you are going to call these publicly you need to be purer than Snow White. Alas I am finding some shorts I respect to be drifting.

I am going to pick on one – Infitialis – an anonymous group. This group (I am assuming there is more than one of them) have been pretty good getting more than a few things right. I read them because some of the analysis is good.

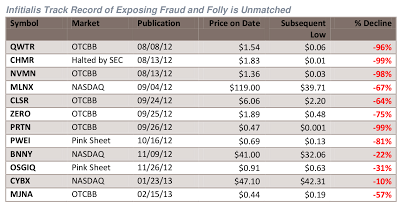

But they are also into the misrepresentation game. This table from a recent report is just slimey:

It purports to show a track record – but it measures everything against the "subsequent low".

Hey – wouldn't you love it if you could be paid performance fees on your longs versus their "subsequent high" and performance fees on your shorts versus their "subsequent low"?

This is misleading accounting. Infitialis knows better and should behave better.