Courtesy of Lee Adler of the Wall Street Examiner

The May headline seasonally adjusted aggregate Manufacturing Purchasing Managers Index reading of 49 was well below the consensus expectation of 50.9. Economists, buying into the myth of the rebirth of US manufacturing, overestimated its strength.

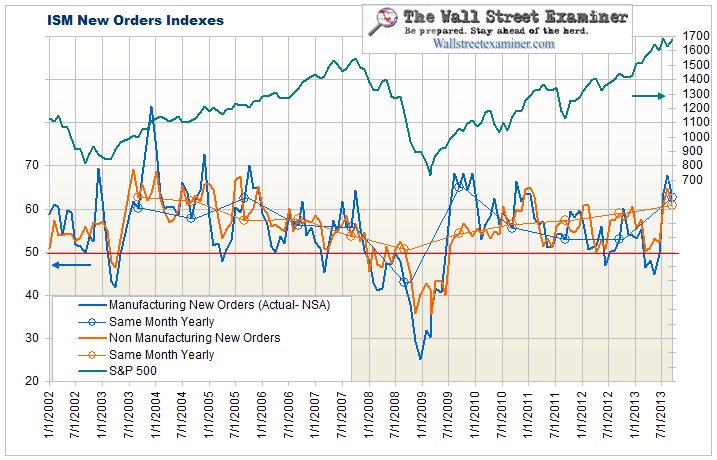

Because the number is seasonally adjusted, it sometimes does not represent what actually happened during the month. To get a clearer picture of the manufacturing economy I track the not seasonally adjusted ISM Manufacturing New Orders index. It fell from 48 in April to 44.9 in May. In this case the facts supported the seasonally adjusted number (See Why Seasonal Adjustment sucks). The numbers were dismal.

The ISM reports only the seasonally adjusted data. To derive the actual data we need to divide the reported data by the SA factors applied, which the US Department of Commerce supplies each year in advance. Each year, all of the data SA is benchmarked and restated. In January the ISM issued a restatement of all the Manufacturing and Non Manufacturing indexes since 2009, making the previously reported headline numbers reported for each month essentially garbage.

To get an idea of how good or bad the actual, not seasonally adjusted number is, I compare it to the same month in past years. On the chart, a line connecting the same month each year helps to show the trend. With the exception of the pits of the recession in 2009, this is the worst reading of the past 10 years. US manufacturing isn’t coming back.

Comparing the change in May to past months, the index fell this year by 3.1 points. May has no clear seasonality. It was an up month in 7 of the past 10 years. May’s average month to month change over the previous 10 years was +2.5. Last year the reading was +4.3. So by this metric as well, this year was terrible.

The fact that the readings are below 50 indicate contraction. If you’re looking for a correlation with stock prices, you won’t find one. The market has shown that it can go on its merry way for years even as US manufacturing slowly disappears.

The New Orders index trended lower from late 2003 to 2007 while stock prices continued to rise. The index briefly went negative in early 2007, but then recovered until October 2007, which was about when the Fed pulled the plug on the System Open Market Account (see below). The index next went negative in January 2008, by which time the market was down for the count. US manufacturing and stock prices march to the beat of different drummers. There’s just no meaningful correlation between the two.

The manufacturing sector represents about 12% of the economy. The ISM manufacturing new orders index isn’t even a very good indicator of the overall US economy, and it is completely useless as an indicator of the stock market trend.

The services sector data representing the bulk of the US economy is released a few days after the manufacturing data.

Track the really important data with me and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money and Liquidity Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.