The Times They Are A Changin’

The line it is drawn

The curse it is cast

The slow one now

Will later be fast

As the present now

Will later be past

The order is

Rapidly fadin'

And the first one now

Will later be last

For the times they are a-changin'.

~ Bob Dylan

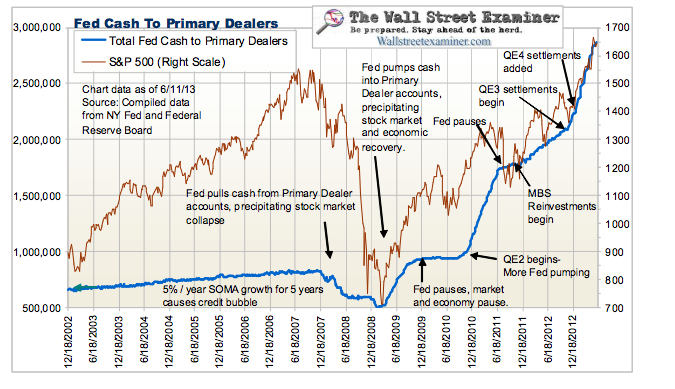

Courtesy of Lee Adler of the Wall Street Examiner

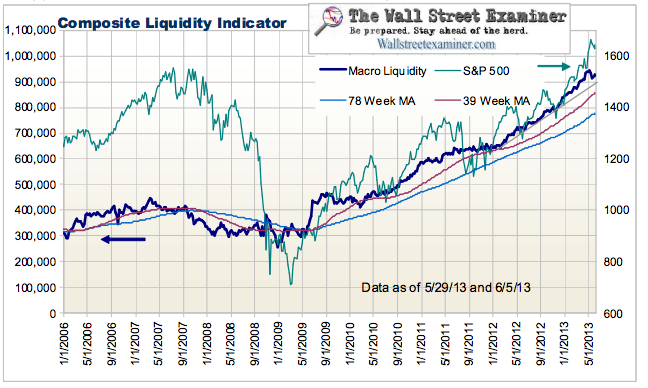

It may be too early to call an end to the bull market in stocks, but in terms of the forces of macroliquidity, it's clear that change is afoot, and that change isn't in a bullish direction. This week, when the Fed holds its regular mid month settlement of its forward mortgage-backed securities (MBS) purchases from Primary Dealers, should give us some signals of where this is headed.

Composite Liquidity Indicator

The Fed’s usual mid month round of MBS purchase settlements June 13-20 will add cash to Primary Dealer accounts this week and boost the composite liquidity indicator, which has stalled over the past couple of weeks. Many components have pulled back. Fed Cash to Primary Dealers slowed its growth path for a couple of weeks as only Fed Treasury purchases have settled since May 21. In spite of the pullback, the index remains in a powerful uptrend.

This looks like just a minor pause, but we need to keep an eye on slowing deposit growth. That could be a sign of a renewed trend of debt liquidation which is often accomplished through the sales of securities, in particular fixed income, in order to pay down debt. We are seeing the effect of that selling on the prices of Treasuries. The drop in stocks this week may be a taste of things to come. It will be interesting to see how the market responds to the big wad of Fed cash that will hit dealer accounts over the next 8 days.

Macroliquidity Component Indicator: Fed Cash to Primary Dealers

Fed Cash to Primary Dealers measures the flow of cash into Primary Dealer accounts from Fed securities purchases. This indicator has the heaviest weighting in the composite. The current growth under QE3/4 is the fastest in history. It will be bullish until the Fed ends QE. Stocks will stall or pull back from time to time, occasionally hemmed in by trend resistance and buffeted by news flow, but the Fed’s cash will find its way into equities sooner or later.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.