The worst is now past.

The worst is now past.

That's the word from an HSBC economist after the PBOC's Ling Tao assures the bank will keep money-market rates "within reasonable ranges." The People’s Bank of China has provided liquidity to some financial institutions to stabilize money market rates and will use short-term liquidity operation and standing lending facility tools to ensure steady markets, according to a statement posted to its website today. It also called on commercial banks to improve their liquidity management.

The PBOC is giving the market “a pill to soothe the nerves,” Xu Gao, Everbright Securities Co.’s Beijing-based chief economist. “The message is clear: the central bank doesn’t want to see a tsunami in China’s financial markets and market rates will drop further.” That saved the Hang Seng from an additional 500-point nosedive and, in fact, they bounced back 400 points off the low at 19,426 to finish back at 19,855

As I said yesterday, it's an artificial crisis and one we felt had ran its course (see yesterday's post) and, in our Member Chat, we went more aggressively bullish off yesterday's low as we flip-flopped our bearish index positions at 10:07, pretty much catching the day's lows on the nose.

However, just because China is TRYING to stop their economic slowdown from turning into a crash doesn't mean they can successfully regain their lost momentum and now we need to turn our focus back to the myriad of problems that plague the rest of the World so we are in now way complacently bullish – merely playing for the bounce we expected to get into the end of quarter at some point this week – it just so happens that point came earlier than expected yesterday.

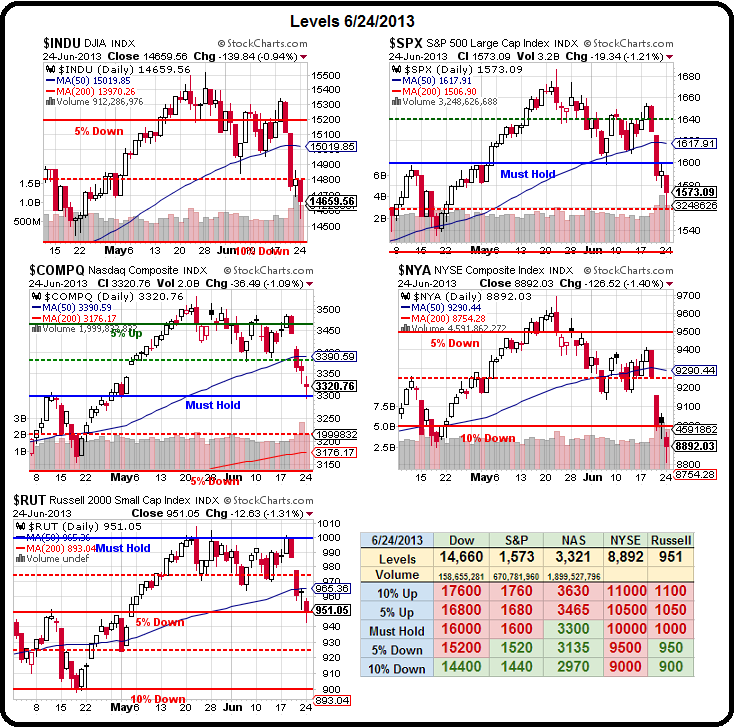

As you can see from our Big Chart, there's been quite a lot of technical damage done to our indices, with all of them breaking below their 50 dmas and already you can see them curling over but the 200 dmas (5-10% below the 50s) are generally rising so it would be easy to turn the 50s back up – if we can get over them by the end of the week.

As you can see from our Big Chart, there's been quite a lot of technical damage done to our indices, with all of them breaking below their 50 dmas and already you can see them curling over but the 200 dmas (5-10% below the 50s) are generally rising so it would be easy to turn the 50s back up – if we can get over them by the end of the week.

If, on the other hand, we stay below them – the daily dots will pull the line that connects them lower and we all know what happens when a 50 dma is falling and a 200 dma is rising, don't we? Death cross!

Fortunately, we have a very wise buffer for those death crosses kick in so no immediate threat but we're long-term investors and we like to know when to take our money off the table or change our stances sooner than later – right? So far, this is just a correction and, though it looks very ugly on a 3-month chart, we have to consider that this leg up began in November, with QInfinity from our beloved Fed.

Well, not surprisingly really, but it turns out "infinity" isn't as long as people thought it would be and this stimulus may have the same shelf expiration date as the others did and, the last two times, the Fed did not step in and take new action until those 200 dmas were once again threatened (because they like to paint charts for the very long-term picture).

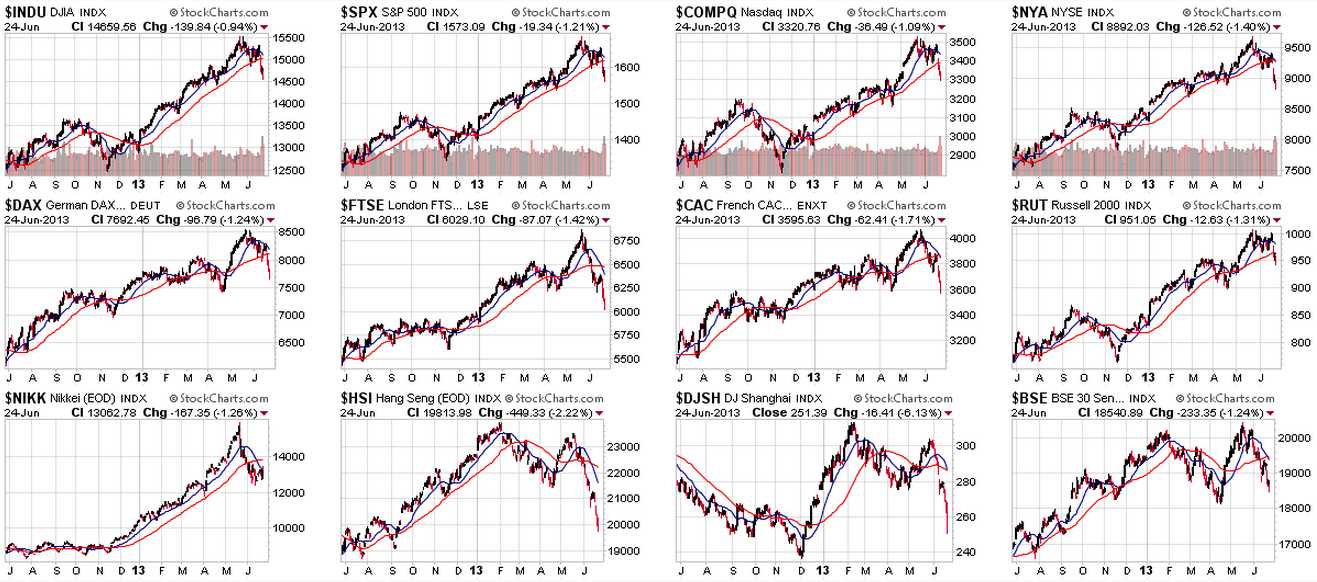

Looking at our International Multi-Chart gives us a better perspective and we can see that the Dow is up from 12,500 to 15,500 and has now pulled back 1/3 to 14,500 – a level that would make Fibonacci very happy. 40% back would take us to 14,300 and that's about as low as we expected to go on this little melt-down. Similarly, the S&P has journeyed from 1,350 to 1,650, so the same math there and they're only back at 1,550 for that same 1/3 pullback and the same 40% takes the S&P to 1,530 before we call this a real breakdown.

On the Nasdaq we've gone from 2,900 to 3,500 (600 points) so 3,300 is that 40% line, which we watched closely yesterday (and picked AAPL for a bounce to go with the index) and the NYSE will keep us ready to flip right back to bearish until they re-take 9,000 as they have risen from 8,000 to 9,500 and 9,000 is their 33% line but, sadly we finished at 8,892, just below the 40% line at 8.900. The Russell flew 25% higher, from 800 to 1,000 and that 950 line is a mild 25% retrace which kept us bullish when it held and, in fact, we caught a bounce there in the Futures (/TF) in early morning Member Chat and got a nice 5-point bump for a quick $500 per contract for the early risers!

In International index action – the DAX, CAC, Nikkei and BSE (India) are all in normal pullback territory but the UK only went from 5,750 to 6,750 and is now back at 6,000 – giving up 75% of it's move. The UK, of course, is not ruled by the ECB but weakness there is sort of an independent verification (or lack of, in this case) of how well the Fed, ECB and BOJ policies are doing for the rest of the World. And, of course, China has the PBOC and they've given up ALL of their last 6 month's gains and are, in fact, LOWER than they were in November (for a technical look at China – see this Dave Fry video).

So what, we need to wonder, is reality?

So what, we need to wonder, is reality?

I have long taken the stand that reality, if we were to remove Fed and BOJ stimulus, is about 1,450 on the S&P, another 6.5% below our current level so we're not very surprised to see a "nasty" pullback at the merest hint of the removal of that stimulus. We have a lot of Fed speak this week and that trumps data so, even though the Durable Goods were a beat at 3.6% (0.7% ex-transport) and Case-Shiller is up a MASSIVE 12.1% in April – it's not as important as what Fed Governors Kocherlakota and Fisher have to say tomorrow morning.

Draghi is holding his end up this morning, saying: The ECB's (as yet) uninitiated bond purchase scheme (OMT) "is even more essential now as we see potential changes in the monetary policy stance … in other jurisdictions of the global economy." (i.e., the Fed). "The overall economic outlook still warrants an accommodative stance." Peripheral bond yields are headed lower, as is the Euro (FXE) – now back to flat on the session. The Stoxx 50 (FEZ) is at a session high, +1.3%, so good work by Draghi and that bodes well for our pre-market rally having some legs.

Let's watch those recovery levels and continue to be careful out there!