Everything is proceeding as I have foreseen.

Everything is proceeding as I have foreseen.

I do so love it when a plan comes together. Sure I was a bit early with my Monday headline "What Happened to Our Rally?," as it lasted until lunch but hey, it's a short week and I needed to save Tuesday's headline for actual news.

Also, it doesn't do much good if I am late with my calls, does it? So, over the years, I have pushed my timing from "right on time" to "a bit early," which gives everyone plenty of warning to get positioned for market nonsense.

As JFawcett said in chat last night about my call that oil would hit $100 into the holiday weekend: "Funny how Phil can see higher prices. He must have seen this movie before." My response was:

I wish it were funny but it's just sad that I can cynically predict that the markets will be manipulated to rip off the American people (and the rest of the World, for that matter) and then that's exactly what happens. It's not that it happens once but that it happens over and over again and NO ONE ever stops them. Not even Spitzer or Giuliani had the balls to go after commodity traders – they are truly untouchable.

The main purpose of crude price manipulation is to shift profits from refineries, which are typically located in politically stable countries with low risk of nationalization but higher tax rates, to exploration in countries that are typically low tax and corrupt.

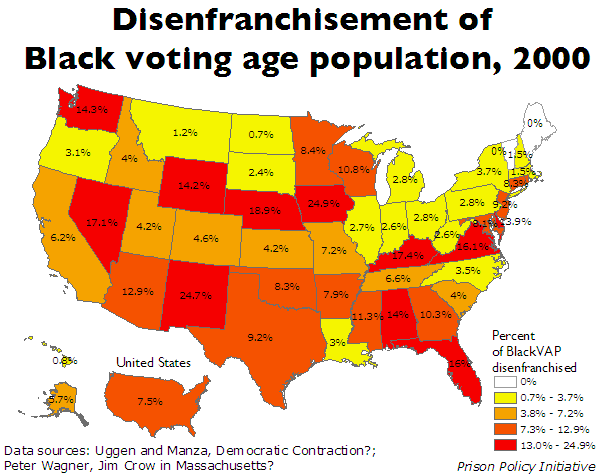

That's right, it's all about the money and our news today (follow same link) contained several examples of our Corporate Kleptocracy in action. It's ironic that, tomorrow, this country celebrates it's 237th anniversary of "Independence Day" and we have never been less free. We are a nation of wage slaves who are held captive by Big Business and spied upon by our own Government, both of whom control the once-independent Judiciary Branch who, just last week, struck down section 4(b) of the Voting Rights Act, that prevented states – or even counties – from disenfranchising voters without Federal approval.

Chief Justice John Roberts wrote for the majority: “The conditions that originally justified these measures no longer characterizes voting in the covered jurisdictions,” he declared, noting that “African-American voter turnout has come to exceed white voter turnout in five of the six states originally covered” by the provision.

This is not John Roberts, some judge from 1953, this is the CURRENT Chief Justice of the US Supreme Court counting blacks vs. whites in the same week Paula Dean got kicked off TV for using the "N-word"! The rules are there to protect EVERYONE, not to allow a Conservative judge to allow racist lawmakers to level the playing feel when his team feels out-voted!

This is not John Roberts, some judge from 1953, this is the CURRENT Chief Justice of the US Supreme Court counting blacks vs. whites in the same week Paula Dean got kicked off TV for using the "N-word"! The rules are there to protect EVERYONE, not to allow a Conservative judge to allow racist lawmakers to level the playing feel when his team feels out-voted!

Speaking of voting, it was value investor Benjiman Graham who said:

"The stock owner should not be too concerned with erratic fluctuations in stock prices, since in the short term, the stock market behaves like a voting machine, but in the long term it acts like a weighing machine."

This has been the theme of our Member Chat for the past two weeks as we have been trying to emphasize VALUE and PATIENCE during the current market turmoil. Now that we are heading into earnings season, and we'll see some real data (as opposed to analyst speculations) it's another quote that worries me ahead of earnings – it's from "A Knight's Tale": "You have been weighed. You have been measured. You have been found wanting."

We'll measure and weigh our stocks starting next week and we'll see if the results measure up to the expectations that have most companies trading at or near their all-time highs but, as William Koldus pointed out this morning (thanks Deano):

This time, the undervalued names are much fewer in number, with a higher degree of undervaluation. When the recent market capitalizations of four solar stocks, First Solar (FSLR), Solar City (SCTY), SunPower (SPWR), and SunEdison (SUNE), can eclipse the entire market capitalization of the U.S. coal sector, even when coal compromises over 40% (and growing) of the world's electricity generation, while solar contributes 1% (and growing) of the world's electricity generation, there is a historic, contrarian opportunity.

Let's hope that's not true of the entire, overbought market – hopefully a mild correction will be enough but, until then – Cashy and Cautious!

Have a great holiday,

– Phil