$1.2 BILLION DOLLARS.

$1.2 BILLION DOLLARS.

That's how much was stolen from US consumers this week by the crooks who run their usual scam at the New York Mercantile Exchange (NYMEX) – the traders who set the price of our nation's oil and gasoline. The genius of the crime is that you, the American Consumer, only lose about $10 per week so – who's going to notice? Who's going to complain?

And that, my friends, is how they get away with it!

Americans used 10% LESS oil and gasoline than we used last year, when oil was $85.04 per barrel. Refineries used the same amount of oil as they used last year to stock up for the holiday weekend, despite the fact that we have 31M MORE barrels of oil in inventory than we did last year.

The refiners supplied 1.7Mb LESS refined products than they did last year but, somehow, there was a net draw in inventory reported of 14.7Mb (almost 10x) and that was the excuse they used to send oil prices back to $102 per barrel at yesterday's close. That's another $6 higher than the $11.32 higher than the $85.04 we paid last July 4th so now it's $15 PER WEEK being stolen from you – and THAT's assuming $85 a barrel is a fair price in the first place!

The refiners supplied 1.7Mb LESS refined products than they did last year but, somehow, there was a net draw in inventory reported of 14.7Mb (almost 10x) and that was the excuse they used to send oil prices back to $102 per barrel at yesterday's close. That's another $6 higher than the $11.32 higher than the $85.04 we paid last July 4th so now it's $15 PER WEEK being stolen from you – and THAT's assuming $85 a barrel is a fair price in the first place!

Of course, if you have two cars, then you're losing $30 a week and that's $1,560 a year – do you care now?

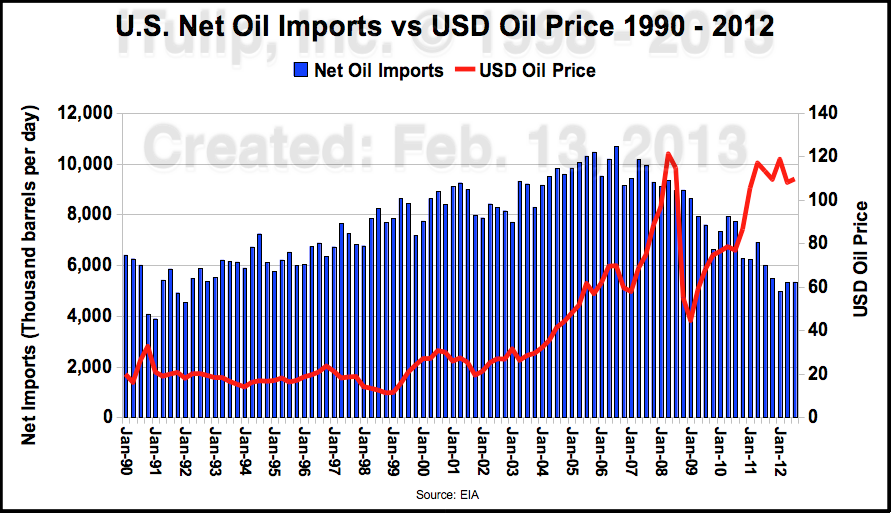

I'm sure you've heard that US Oil Production is on the RISE. In fact, we are now producing 7.267M barrels a day, that's up 19.2% from this time last year, adding 8.2M barrels a week to our weekly supply. That may lead you to ask the question: I

If we are producing 20% more oil than last year and using 10% less oil than last year – how can our inventories of oil be declining and why the heck is $1,500 being stolen from my family?

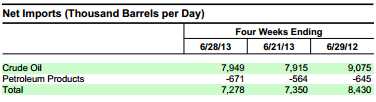

The answer is surprisingly simple: IMPORTS. The same crooks who set the prices on the NYMEX by creating BILLIONS of fake orders each month also CANCEL so many of those orders by delivery day that they actually are having 1.8Mb LESS oil delivered each day than they did last year. No, this is not a joke – 12.6Mb PER WEEK of oil, over 50M barrels PER MONTH are being cancelled at the NYMEX and THAT is creating an artificial shortage that drives up the price of oil and gasoline in America.

The answer is surprisingly simple: IMPORTS. The same crooks who set the prices on the NYMEX by creating BILLIONS of fake orders each month also CANCEL so many of those orders by delivery day that they actually are having 1.8Mb LESS oil delivered each day than they did last year. No, this is not a joke – 12.6Mb PER WEEK of oil, over 50M barrels PER MONTH are being cancelled at the NYMEX and THAT is creating an artificial shortage that drives up the price of oil and gasoline in America.

Not only are they cancelling our imports, but they are EXPORTING 671,000 barrels of refined product OUT of the country. Artificially creating the impression that there is 4.7Mb per week more demand than there actually is in the US. While it's a small bite of our 133M barrel weekly usage (3.5%), those who follow oil trading know that just a 1Mb swing in inventories one way or another can make a $5 difference in the week's oil prices. That's $20 out of YOUR pocket we're talking about, not some stranger's…

Not only are they cancelling our imports, but they are EXPORTING 671,000 barrels of refined product OUT of the country. Artificially creating the impression that there is 4.7Mb per week more demand than there actually is in the US. While it's a small bite of our 133M barrel weekly usage (3.5%), those who follow oil trading know that just a 1Mb swing in inventories one way or another can make a $5 difference in the week's oil prices. That's $20 out of YOUR pocket we're talking about, not some stranger's…

This is not just a crime, this is TREASON – this is the willful destruction of the United State's Energy Security while charging American's $102 per barrel instead of $85 per barrel by creating this artificial shortfall is costing the American Consumer (that's you, sucker) $9.69Bn per month and is sucking $116Bn a year out of the US economy (enough to fund 2.3M $50,000 jobs) – AND WE'RE HANDING A GOOD PORTION OF THAT MONEY OVER TO COUNTRIES THE FUND TERRORISTS!

Keep in mind that we're only focusing here on the $17 EXTRA that you are being charged over and above last year's $85 per barrel despite the fact that America is producing more of it's own oil (now the World's second largest producer of oil) and using 10% less (because we're buying smarter cars).

Keep in mind that we're only focusing here on the $17 EXTRA that you are being charged over and above last year's $85 per barrel despite the fact that America is producing more of it's own oil (now the World's second largest producer of oil) and using 10% less (because we're buying smarter cars).

It's no coincidence that traders picked this week to send oil prices to the highest level since April of 2012 – which was just before prices collapsed (similar shenanigans) all the way down to $77.28, but not before robbing Americans of tens of Billions of Dollars. The same scam was run on consumers in April of 2011 ($114.84 to $75.72) and, unless you Email this article to your friends and tell them (and you!) to write your Congresspeople and complain about this (it takes 30 seconds to find your Representative, past a link to this article with your comment and hit send!) – nothing will ever change.

A crime is being committed here – oil prices are being manipulated by traders who are, at this very moment, pretending to order 250,000,000 barrels of oil for August delivery. In just 2 weeks from Monday, they will have cancelled roughly 95% of those orders to short-change America once again, to strangle our energy supply, create artificial supply shortfals and to rob your family of another $60 per car for the month.

I can only tell you you're being robbed – it's up to you to stop being a victim!