Kill, kill, kill, kill, kill the poor!

Kill, kill, kill, kill, kill the poor!

That's what they were singing in the Republican side of the United States of America's House of Representatives (that's right, YOUR representives, carrying out YOUR will in YOUR name) as 216 Congresspeople (all Republicans) defeated 196 Democrats and 12 Republicans whe didn't think that passing a farm bill with ZERO food stamp money was going to be a good idea.

That's right (and I know it sounds like an insane plot to a movie about society gone mad) the GOP actually took Food Stamps out of the Farm bill – effectively de-funding a program that feeds 47M Americans (the bottom 15%). Fortunately, we still have a Democratic President and the White House has vowed to veto the bill, rather than simply cutting off food to 47M human beings at the end of the month. A statement released overnight said that the food stamp program "is a cornerstone of our nation's food assistance safety net, and should not be left behind as the rest of the Farm Bill advances."

Even in a chamber used to acrimony, Thursday’s debate in the House was particularly brutal. Democrats repeatedly called for roll-call votes on parliamentary procedures and motions to adjourn, delaying the final vote by hours and charging Republicans over and over again with callousness and cruelty.

Republicans shouted protests, trying to silence the most strident Democrats, and were repeatedly forced to vote to uphold their own parliamentary rulings.

"It's all about denying the working poor the right to food," Rep. Jim McGovern, D-Mass., claimed, accusing Republicans of attacking "poor people."

Asked before the vote Thursday if he would allow a compromise bill to come to a final vote in the House, Speaker John A. Boehner of Ohio shrugged and said: “If ands and buts were candy and nuts, every day would be Christmas."

Now, before you say "Oh Phil, stop being such a Liberal, the Republicans are only trying to save some money" – let's consider that the United States spent $74Bn on food stamps last year. This money, of course, goes right back to the local economy and helps keep your favorite grocery store open (well, maybe not Whole Foods, but the normal ones) and that creates jobs for grocery people and farmers, etc – which is why it's part of the FARM BILL!

Now, before you say "Oh Phil, stop being such a Liberal, the Republicans are only trying to save some money" – let's consider that the United States spent $74Bn on food stamps last year. This money, of course, goes right back to the local economy and helps keep your favorite grocery store open (well, maybe not Whole Foods, but the normal ones) and that creates jobs for grocery people and farmers, etc – which is why it's part of the FARM BILL!

Sure we might want to shave $74Bn off our Governments $3,000,000,000,000 budget as that's a whopping 2.4% but just the other day, the Chairman of the Federal Reserve said he will continue giving $85,000,000,000 PER MONTH to Bankers, which they then use to pump up the markets which, unfortunately, makes food (a commodity) more expensive. How sick is that?

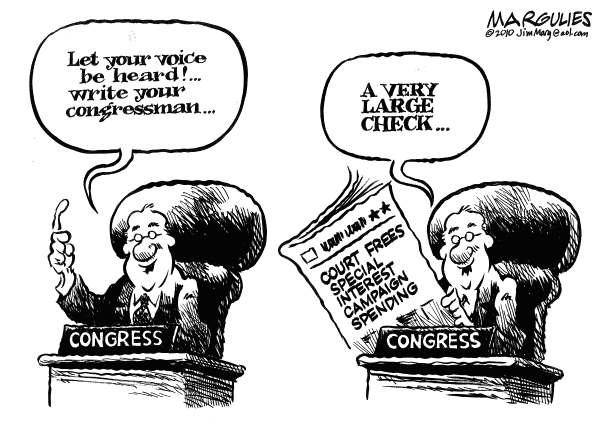

This ATROCITY is being carried out in YOUR name, by YOUR Representatives (if they are Republican) and if YOU don't let them know that YOU do care enough to feed your fellow countrymen – then they will just continue to do this, as well as many other terrible things – in YOUR name. Write your Congressman here – PLEASE!!!

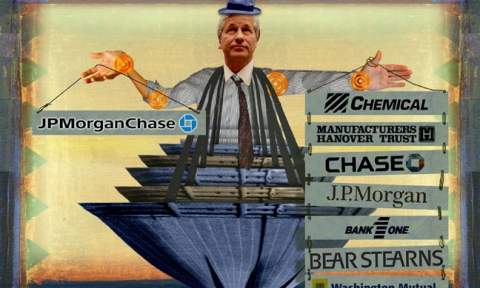

JP Morgan (JPM), one of the poor Banksters the Fed is contributing to, made $6.5Bn over the past 3 months on $26Bn in revenues with $25Bn pouring into their Asset Management division (top 5%) and Investment Banking client deposits (top 1%) at $369.1Bn! At least someone is putting that $85Bn a month to good use – not wasting the money on feeding the poor – bah, humbug!

JP Morgan (JPM), one of the poor Banksters the Fed is contributing to, made $6.5Bn over the past 3 months on $26Bn in revenues with $25Bn pouring into their Asset Management division (top 5%) and Investment Banking client deposits (top 1%) at $369.1Bn! At least someone is putting that $85Bn a month to good use – not wasting the money on feeding the poor – bah, humbug!

The picture on the right should be the company's logo – a picture of the founder beating a prole with a cane while his chauffeur tries to hold him back…

By the way, when I call for writing Congresspeople, you don't have to only write to evil Republicans – you can also take a minute to THANK those Representatives who stand up to them, especially the brave 12 Republicans who stood up to their own party as Boehner cajoled and threatened in an attempt to get all of his party in line. 12 men of couscience deserve a little praise now and then – for want of them Sodom and Gamorrah fell!

By the way, when I call for writing Congresspeople, you don't have to only write to evil Republicans – you can also take a minute to THANK those Representatives who stand up to them, especially the brave 12 Republicans who stood up to their own party as Boehner cajoled and threatened in an attempt to get all of his party in line. 12 men of couscience deserve a little praise now and then – for want of them Sodom and Gamorrah fell!

Speaking of Republicans of good conscience, kudos to "thank God he's not President" John McCain, who has teamed up with Super Senator Elizabeth Warren to introduce a "21st Century Glass-Steagall Act" aimed at separating trading activities from the Big Banks.

It should be noted that, if trading activities were separated at JPM, they would have had a big miss this Q as Consumer and Community Banking Revenue was off 3%, Interest Income down 1% and non-interest revenues (activity fees) down 7%. Even Mortgage Revenues were down 7% from last quarter and, had it not been for a .24 gain to net income from reducing loan loss reserves (ie. stupid accounting tricks) – the company would have missed expectations instead of beating by .16.

It should be noted that, if trading activities were separated at JPM, they would have had a big miss this Q as Consumer and Community Banking Revenue was off 3%, Interest Income down 1% and non-interest revenues (activity fees) down 7%. Even Mortgage Revenues were down 7% from last quarter and, had it not been for a .24 gain to net income from reducing loan loss reserves (ie. stupid accounting tricks) – the company would have missed expectations instead of beating by .16.

We already shorted the overall banking sector by selling FAS calls in our Short-Term Portfolio. WFC is our other major reporting bank and it is PURE COINCIDENCE, I assure you, the the two best banks are the first to report in earnings season. Warren Buffett owns a lot of WFC and they beat estimates of .98 by .04 with 0.9 of the gain (10% of total earnings) coming from reversing loan loss reserves and the bank bought back 26.7M of their own shares, out of about 5Bn so there were half a percent less shares to divide the earnings into this quarter – smart!

With the stock trading 33% higher than last year, what could possibly go wrong when they spend $1Bn buying their own stock? After all, it worked out so well during the buying frenzy of 2007 and 2008, didn't it? $1Bn is .20 per share so that's what was spent to increase earnings by 0.005 per share. On the whole, I'd rather get the diviidend, thanks.

With the stock trading 33% higher than last year, what could possibly go wrong when they spend $1Bn buying their own stock? After all, it worked out so well during the buying frenzy of 2007 and 2008, didn't it? $1Bn is .20 per share so that's what was spent to increase earnings by 0.005 per share. On the whole, I'd rather get the diviidend, thanks.

We sold the FAS Aug $70 calls for $3.35 on the 10th for our virtual Short-Term Porfolio and we backed it with a Jan $70/78.33 bull call spread at $3.45 – just in case we're wring and XLF stays above $20 (FAS $71) but it's not JPM and WFC we thought would miss but we do expect tepid guidance in their Conference Calls (later this morning).

We've had a bit of a pullback in oil (/CL on the Futures) and we just caught another short opportunity at $106 this morning but we already crushed it from $107 all the way back to $104.50 yesterday for a $2,500 per contract gain so we're not very excited about shorting oil into the dangerous weekend pump-job and expect it to settle around $105 into the weekend – to maximize the consumer gouging.

On the whole, I'm very concerned that the markets are dangerously overbought and, overall, the Global news-flow still SUCKS – so it's hard to get excited about buying long positions at this very toppy-looking market. As you can see from Dave Fry's McClellan Chart, we're as overbought as we've been since last September, just before the S&P fell from 1,474 back to 1,343 (9%).

On the whole, I'm very concerned that the markets are dangerously overbought and, overall, the Global news-flow still SUCKS – so it's hard to get excited about buying long positions at this very toppy-looking market. As you can see from Dave Fry's McClellan Chart, we're as overbought as we've been since last September, just before the S&P fell from 1,474 back to 1,343 (9%).

To get me to change my mind, we want to see this indicator fly back to neutral on the smallest pullback – that would be encouraging. I hate to mention fundamentals (and see this morning's news rundown, via Twitter for our morning news round-up) but it IS earnings season and, generally, it's a good idea to wait a bit and see which sectors are doing well and which ones are not before tossing money into stocks that are trading at or near their all-time highs.

But I'm old-fashioned that way.

Have a great weekend,

– Phil