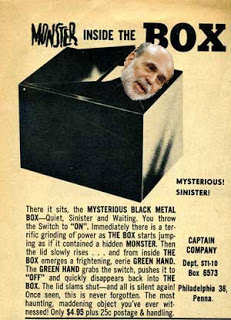

Ben In A Box

Courtesy of John Nyaradi of Wall Street Sector Selector

Courtesy of John Nyaradi of Wall Street Sector Selector

After nearly five years of quantitative easing, Ben Bernanke and his Federal Reserve now find themselves in a box.

For several years, the only game in town has been “The Reflation Trade,” engineered by the U.S. Federal Reserve’s quantitative easing program and the Fed’s unprecedented effort to jumpstart the U.S. economic recovery. Now it seems that Dr. Bernanke wants to dial back the $85 billion/month in bond buying but finds that market forces and current conditions have him trapped in a spot from which there might be no escape.

Regarding the potential end of quantitative easing, Warren Buffett has said it would be the "shot heard round the world," and markets got a little taste of what that world might look like when Dr. Bernanke made his comments in May that sent markets on a wild ride.

Equities dumped, gold dumped, interest rates spiked as investors contemplated just the possibility that Ben might pull the punchbowl away.

Since then, we have seen a parade of Fed Presidents and even the Chairman, himself, saying, in effect, that they were “just kidding” (JK) and that their easy monetary policies were here to stay for a long, long time. Clearly, the trial balloon regarding the end of quantitative easing went over like a lead balloon which leads us to today’s unfortunate situation:

1. The Fed can’t withdraw easily from quantitative easing, if at all. Markets have made this more than clear with the sharp response to even the hint of quantitative easing coming to an end, now widely known as the “taper tantrum.” All of the recent action reflects today’s environment which is still all about the Fed. Recent assurances that the easy money environment was going to continue have been successful as major indexes are now back at levels last seen before Dr. Bernanke’s first comments.

2. The Fed has to withdraw from quantitative easing eventually. It’s becoming increasingly evident that the long run of easy money has created asset bubbles, is laying the framework for higher inflation, and that continuing down the current path will only make the eventual withdrawal even more painful and dramatic. (Economatters makes a good argument that QE Policy has been a failure when it comes to the economy, anyway. The Economy is not the Stock Market…)

3. The Fed is quickly descending into confusion and disarray. Last week saw yet another Bernanke Rally triggered after his mid-week comments, while Friday saw dueling Fed Presidents Charles Plosser and James Bullard presenting conflicting views of “to taper or not to taper.” In between, Fed Governor Elizabeth Duke, resigned and her departure further muddies the waters. On top of that, it’s now becoming widely accepted Dr. Bernanke will also be leaving the scene when his term expires in January and markets will be eagerly watching to see who his replacement will be. The first hint of this came when Dr. Bernanke announced that he wouldn’t be attending the Fed conclave in Jackson Hole in August which is like Santa Claus missing Christmas, and any uncertainty regarding his successor will likely be met with significant volatility in global markets.

This confusion and disarray within the Fed could prove to be dangerous should investors lose faith in the central bank’s seemingly invincible power. The markets will continue to be whipsawed by Fedspeak and “taper talk” and we’re due for another significant round this week when Dr. Bernanke treks up to Capitol Hill on Wednesday and Thursday for testimony before the House and Senate.

So “Ben in a Box” presents the potential for danger as well as opportunity. We've already witnessed the adverse reaction from markets as they threw a temper tantrum at just the thought of the easy-money punch bowl running dry. One can only imagine what market reaction might be if and when the $85 billion per month in Federal support actually starts seeping away.

Over the past several years, “buy the dip” has been the name of the game, but there could soon be a new game if Ben can’t get out of the box and a new age of austerity and even recession is at hand.

Put options: Just because the "Bernanke Put" might be history, doesn't mean you can't go out and buy your own to protect profits or hedge against potential downside moves.

Inverse/bear ETFs and mutual funds: Bear ETFs and mutual funds are designed to help investors avoid the risks of falling markets and might also offer downside hedges to long positions should the market continue its recent decline.

Cash: Cash is the ultimate hedge in times of stress, and when markets go south in a big way, cash is always king.

U.S. dollar/Treasury bonds: While there will be few safe havens if things get really ugly, the U.S. dollar and U.S. Treasury bonds will most likely be the ultimate flight-to-quality trade. The United States might be a passenger on the Titanic, but it will be the last passenger to drown. If Titanic goes down, we can only hope that the Carpathia will arrive in time.

I think the easy money party will be coming to end soon, and that Dr. Ben is set to turn out the lights. We’ll find out more this week, but no central banker in history has ever attempted to do what he is doing, and nobody, including the members of the Federal Reserve, can know how this will turn out. But, as always, danger and opportunity always arrive hand in hand, and this time will be no different.

Wall Street Sector Selector remains in "yellow flag" status, expecting a high risk environment ahead.

Picture credit: Jr. Deputy Accountant