KO disappointed.

KO disappointed.

It's not good when Coca-Cola misses revenues. It's usually an indication that the consumer is really hurting. Net Income fell to .59 for the quarter, down from .61 last year but it was the 3% drop in Revenue that was surprisingly light, leading CEO Muhtar Kent (a straight-shooter – see my 2010 interview) to state he "was not happy with our performance." The beverage maker cited "a challenging global macroeconomic environment" and bad weather for its performance.

Rather than shorting KO, we're shorting oil this morning and I sent out a tweet early this morning, identifying a shorting opportuntiy on /CL Oil Futures at $106.45 but we stopped out of those at $106.50 and now we're looking at the $107 line as our next shorting target, waiting for the big drop we are fairly positive is going to come as we head into the NYMEX contract rollover next Monday. I'm not going to get into it again (see last few weeks of posts) but the bottom line is they have faked way too many orders for September and now they have just 5 sessions to cancel or roll 130,000 contracts, about 25,000 contracts per session and, yesterday, they only managed to get rid of 13,000 – that does not bode well for the NYMEX Fraudsters.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Aug'13 | 106.44 | 106.74 | 105.91 | 106.47 |

05:23 Jul 16 |

– |

0.15 | 16473 | 106.32 | 138979 | Call Put |

| Sep'13 | 105.96 | 106.24 | 105.46 | 106.05 |

05:23 Jul 16 |

– |

0.13 | 6807 | 105.92 | 336220 | Call Put |

| Oct'13 | 104.64 | 104.80 | 104.11 | 104.66 |

05:23 Jul 16 |

– |

0.17 | 1101 | 104.49 | 125043 | Call Put |

| Nov'13 | 103.20 | 103.20 | 102.75 | 103.06 |

05:23 Jul 16 |

– |

0.07 | 561 | 102.99 | 74312 | Call Put |

| Dec'13 | 101.63 | 101.82 | 101.16 | 101.77 |

05:23 Jul 16 |

– |

0.21 | 1132 | 101.56 | 211463 | Call Put |

By next Monday, all but maybe 15,000 of those contract (1,000 barrels per contract) will disappear. This will create an artificial shortage of oil in August as no orders mean no deliveries and no deliveries mean inventories will be drawn down, whether demand is actually there or not. We'll watch this crime in action this week as NYMEX Terrorists threaten our Nation's energy security by tearing up oil contracts (that are already approved for delivery), choking off the supply of oil to our great nation and extorting Billions of excess Dollars from US Consumers at the pump, in the Airlines and to heat, cool and power their homes and businesses.

As usual, our leaders will do nothing.

As usual, our leaders will do nothing.

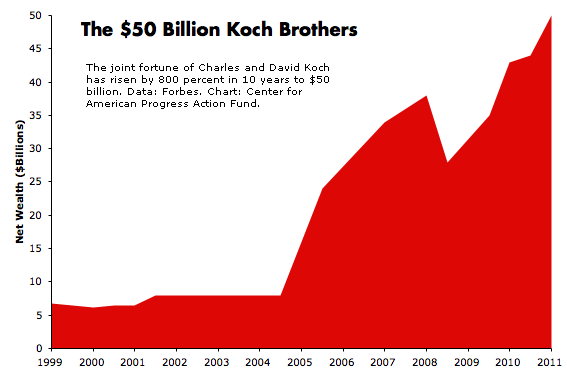

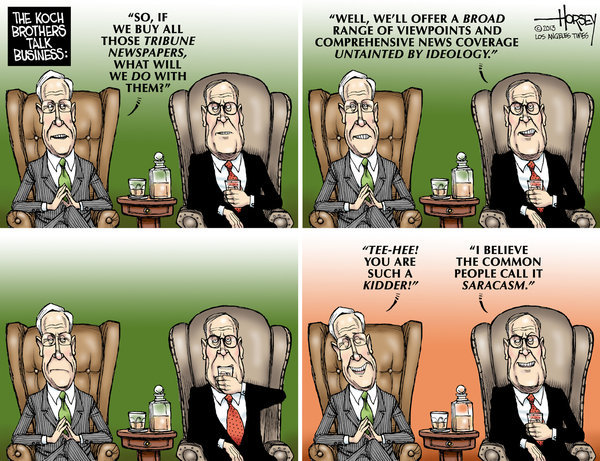

No wait, I take it back. As usual, our leaders will collect another $30M in bribes from the Koch Brothers. That's the Koch's average annual spending to buy better themselves better Government. It's only a sliver of their $50Bn fortune (50,000 Million and, as you can see from the chart on the left – they sure get their money's worth) but there's only 435 Members of the House of Representatives and 100 Senators and $30M/535 is still $56,000 per Congressman from the Koch brothers alone. Given that about half of those Congresspeople are Democrats, who generally get $0 from the Kochs – we're into 6-figure pay-offs to the average Republican.

In fact, according to the Kochs, those bribes alone makes their Republican cronies 3x richer than the top 1% (I kid you not, this is their actual video explaining it):

That's right you "poor" people – suck it up, you're 10 TIMES richer than people who are REALLY poor so stop your whining and vote to end that minimum wage so you can compete fairly with people making $2.50 a day in China!

According to the Koch Brothers, making $34,000 a year for a family of 4 puts you in the Global Top 1% – so your interests and their interests are perfectly aligned! If this is the kick-off to the 2014 mid-term election strategy for the GOP, I know a lot of Democratic strategists who will be having a party this weekend!

According to the Koch Brothers, making $34,000 a year for a family of 4 puts you in the Global Top 1% – so your interests and their interests are perfectly aligned! If this is the kick-off to the 2014 mid-term election strategy for the GOP, I know a lot of Democratic strategists who will be having a party this weekend!

The GOP is convinced they are going to take back the Senate next November because Americans are sick and tired of getting JOBS and having PEACE and PROSPERITY, with a stock market that is now up 200% since finally getting rid of George Bush II in 2009. We don't want those high-mileage cars or roads without potholes to drive them on. We want FREEly poluted water and air that you can cut with a knife – just like China!

That's how we compete globally in the Koch Brothers Fantasy Camp – drop US wages to be on-par with the rest of the World (10% of what we make now on average), stop taxing Corporations and Wealthy Individuals (like the Kochs) and let those Corporations do what they want (as if they don't already).

That's how we compete globally in the Koch Brothers Fantasy Camp – drop US wages to be on-par with the rest of the World (10% of what we make now on average), stop taxing Corporations and Wealthy Individuals (like the Kochs) and let those Corporations do what they want (as if they don't already).

If you aren't for those things – you are a Godless, Anti-American Communist who should stop voting and leave the country (where the new immigration laws will prevent you from coming back).

Speaking of Godless Communists, China financial instability du jour is an 800% increase in WMPs, or "Wealth Management Products" where over $1Tn of Chinese savings (the size of Australia's total economy) is now in instruments that are, essentially, Ponzi schemes, where the investor puts in money for "guaranteed" 1% WEEKLY returns.

As investors pile in, financial firms need more inflows of cash to pay off maturing products, resulting in mounting risks that prompted China Securities Regulatory Commission Chairman Xiao Gang to call them a “Ponzi scheme” even before the latest record purchases. Issuance of new products and borrowing from the interbank market are among the most common ways banks pay out maturing WMPs, according to Fitch.

As investors pile in, financial firms need more inflows of cash to pay off maturing products, resulting in mounting risks that prompted China Securities Regulatory Commission Chairman Xiao Gang to call them a “Ponzi scheme” even before the latest record purchases. Issuance of new products and borrowing from the interbank market are among the most common ways banks pay out maturing WMPs, according to Fitch.

“The WMP market has inflated to a huge size,” said Wilson Li, a Shenzhen-based analyst at Guotai Junan Securities Co. “Should they go bust, Chinese banks have their reputation on the line, and they face the risk of compensating investors because of pressure from the general public.” A record 1,137 WMPs were sold by about 70 banks in the two weeks ended June 28, an increase of almost 50 percent from the first two weeks of the month, according to Benefit Wealth, a Chengdu, China-based consulting firm that tracks the data back to 2007.

“In an environment where liquidity is tight, banks will find it more and more difficult to attract fresh money to keep the game going,” said May Yan, a bank analyst at Barclays Plc in Hong Kong. “Until investors are hit by a real default, they won’t understand what they are really buying into.

Our June CPI was 20% too strong (up 0.5% for the month) and our Chain Store Sales were 20% too weak (up 3% from last year vs. up 3.6% last week) and Retail Store Sales were DOWN 1.1% for the week vs +3% last week and that's dropped the annual run rate from +2.9% to +1.7% on this week's total disaster as people's disposable income goes into the gas tank – THIS IS NOT COMPLICATED FOLKS!!!

The American consumer is at the end of their rope and it's not like Europeans or Asians or Emerging Marketeers are carrying the consumer ball for the Global Economy. Corporations are not spending and the Fed is telling them that, IF they hire, THEN the Fed will cut off the Free Money. So, surprise, surprise – THEY'RE NOT HIRING! Again, not complicated – very simply cause and effect all around.

The American consumer is at the end of their rope and it's not like Europeans or Asians or Emerging Marketeers are carrying the consumer ball for the Global Economy. Corporations are not spending and the Fed is telling them that, IF they hire, THEN the Fed will cut off the Free Money. So, surprise, surprise – THEY'RE NOT HIRING! Again, not complicated – very simply cause and effect all around.

On the bright side, Goldman Sachs DOUBLED their profits to $1.93Bn as endless supplies of Free Fed Money was converted into incredible trading gains on the stocks, currencies and commodities they manipulate – accounting for $2.46Bn of the bank's Revenues. Oh, and please, please, PLEASE do not bee fooled by "just $1.93Bn" in profits for GS – that's AFTER they distributed $3.7Bn to compensate their employees (32,000, so $1M each if distributed evenly, which it's not!) through bonuses on the $1.93Bn the company allowed to trickle down to their stocksuckersholders.

Don't bother sending this article to your Congressman if you want things to change – send them a check instead – that's how the Koch brothers get things done!