Republicans are coming to the White House!

Republicans are coming to the White House!

European markets are treating this like it's a good thing, with thier markets popping 1.5% this morning.

Our own Futures are up about 1% and, fortunately, we already made some bullish adjustments as I had interpreted yesterday's Fed Minutes as bullish in Our Member Chat (also tweeted out in the afternoon), which led us to cash out some of our bearish winners (TSLA, NFLX).

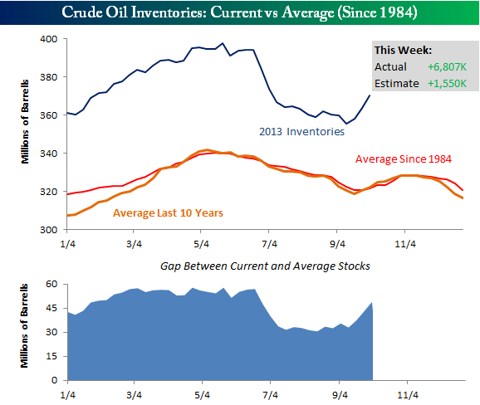

We did, however, keep our oil shorts as it looks to me like $101.50 will break after that horrific inventory report that netted a 10 MILLION BARREL BUILD! As you can see from this Bespoke Chart, a build like this is almost unprecedented, representing 1.5 days of imports at our currently, ridiculously low rate of imports.

The failure of the NYMEX Trading Cartel to be able to cut off enough of our supply of crude to offset the profound drop in demand is making it very hard to maintain the charade of the artificial shortage of oil. Like a house of cards – as that narrative begins to crumble – so will the price of oil:

The failure of the NYMEX Trading Cartel to be able to cut off enough of our supply of crude to offset the profound drop in demand is making it very hard to maintain the charade of the artificial shortage of oil. Like a house of cards – as that narrative begins to crumble – so will the price of oil:

Although they are making good progress, there are still 222,000 FAKE orders for 222,000,000 barrels of oil that, as very obviously illustrated by yesterday's build, no one ACTUALLY wants to have delivered in November. So the traders must roll those contracts to December – so they can pretend there is demand there but, there's a problem – December is already stuffed with 322M barrels worth of FAKE orders.

At the moment, only contracts for January and February of next year are fetching over $100 as this glut of oil shows no signs of abating (and gets worse with every electric car sold and every solar panel installed) and, if you can wait to have your 42-gallon drums of oil delivered until December of 2015, $87.47 is the going rate and, if you believe people will still be using oil at all in 2020 – $79.96 seems like a reasonable price and 779,000 barrels are on order already. Surely if you believe oil will go over $102 again in 2013 – you must like the idea of betting it's over $80 7 years from now, right? Not if it's a complete scam and the people trading oil know it!

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Nov'13 | 101.46 | 102.27 | 101.39 | 101.89 |

08:11 Oct 10 |

– |

0.28 | 27377 | 101.61 | 222305 | Call Put |

| Dec'13 | 101.25 | 102.08 | 101.25 | 101.73 |

08:11 Oct 10 |

– |

0.30 | 10188 | 101.43 | 322958 | Call Put |

| Jan'14 | 100.83 | 101.65 | 100.83 | 101.24 |

08:11 Oct 10 |

– |

0.27 | 3294 | 100.97 | 134946 | Call Put |

| Feb'14 | 100.32 | 100.96 | 100.32 | 100.65 |

08:11 Oct 10 |

– |

0.33 | 2043 | 100.32 | 63459 | Call Put |

| Mar'14 | 99.60 | 100.11 | 99.60 | 100.10 |

08:11 Oct 10 |

– |

0.49 | 1341 | 99.61 | 92030 | Call Put |

| Dec'14 | 93.28 | 93.86 | 93.28 | 93.67 |

08:11 Oct 10 |

– |

0.35 | 2123 | 93.32 | 245025 | Call Put |

| Dec'15 | 87.41 | 87.88 | 87.41 | 87.80 |

08:14 Oct 10 |

– |

0.33 | 147 | 87.47 | 119434 | Call Put |

| Dec'20 |

– |

– |

– |

79.98 * |

08:08 Oct 10 |

– |

– |

– |

79.96 | 779 | Call Put |

Of course, this is no different than what I was pointing out last Thursday, when there were 300,767 open orders when I wrote the morning post and called for shorting the lot of them at $104. Yesterday, not even a week later, we hit $101.50 for a $751,917,500 gain on those short contracts – not bad for a week's work.

This Thursday I'm telling you we are playing short below the $101.50 line (tight stops above) with a target of $98.50 on the remaining 222,305 contracts for a potential, additional $666,915,000 gain. We'll check back next Thursday and see how it goes. We also maintain our short positions on oil using USO and SCO the virtual Short-Term Portfolio we track for our Members.

Tempting though it was to cash in great gains yesterday as we tested $101.50, we couldn't ignore that massive build in inventories as indicating a potentially nice breakdown from here – and, keep in mind, last year, at this time, oil was $90 a barrel in early October and $84.05 on Halloween ($31 on USO)!

Tempting though it was to cash in great gains yesterday as we tested $101.50, we couldn't ignore that massive build in inventories as indicating a potentially nice breakdown from here – and, keep in mind, last year, at this time, oil was $90 a barrel in early October and $84.05 on Halloween ($31 on USO)!

At the same time, any commodity bull has to be concerned about the Dollar and it's failure to fail at 80 (21.50 on UUP). Notice what a minor (4%) move up in the Dollar last fall did to the price of oil! Gold also fell about $100 at the time, but that was from $1,798 to $1,675 – not the same thing at all when we're starting at $1,300 so we're still generally bullish on gold from here – although a rising Dollar may give us a better entry still.

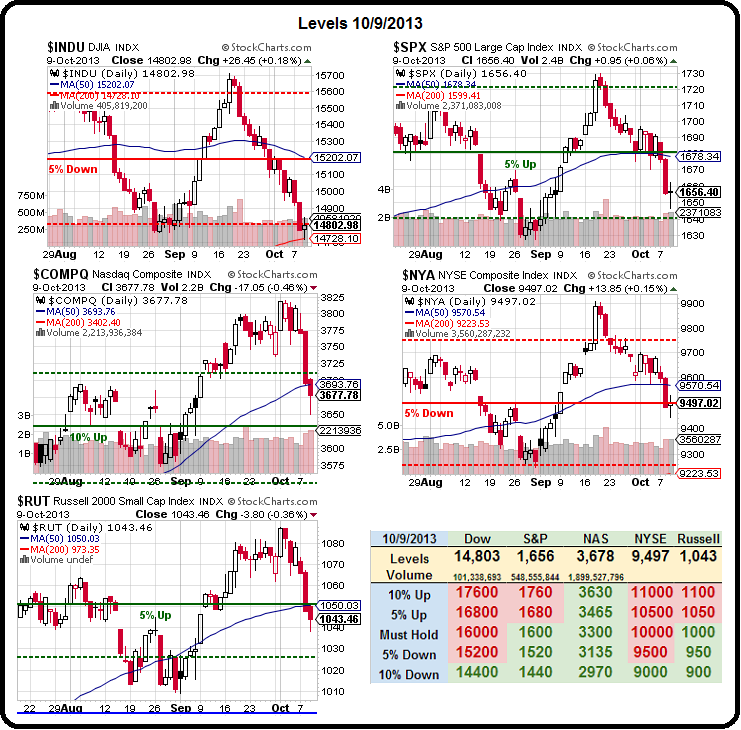

As to our indexes, we have taken quite a tumble and we'll see if we get weak or strong bounces and, more importantly, whether or not we hold them. Very simply, our 5% Rule™ looks for a 20% retrace of the drop, especialy after a 5% move in the index. 5% off 15,700 on the Dow, for example, was 14,915 so we already blew that by 112 points, which makes the proper 5% line a 160-point move up from 14,900 (we do a lot of rounding) so 15,060 is the LEAST we expect to see from the Dow before we are impressed. Since the Dow actually tested 14,800, we have a 900-point drop and then a 180-point retrace to 14,980 but close enough to 15,000 that that becomes the line we'll be watching very closely this morning. Anything less than that, and we'd be more prone to re-short than go long.

Come and join our Member Chat, where we'll go over the rest of our market watch levels.