Yuch, this is getting ugly!

Yuch, this is getting ugly!

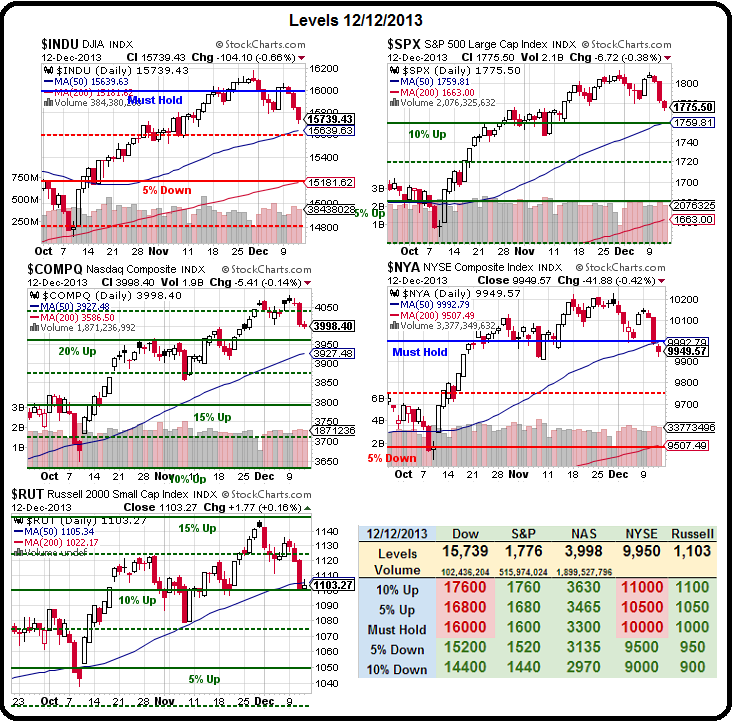

The NYSE and the Russell, our erstwhile leaders, are now leading us down, having fallen over 2.5% from their Thanksgiving highs and, more importantly, finding no support at the 50-day moving averages. Even worse, there's no panic-selling yet, no volume spikes, just a relentless grind down that has, so far, earased all of November's "amazing" gains that had everyone so excited.

Well, not us, we were predicting doom and we got wisely to cash at the top but THEY (my fellow pundits) have never been more unified on the bull side and I had never felt more alone sticking to my guns while the market went up and up.

Could I have been more bullish right up to the last minute? Sure, but that would have put our MONEY at risk and we do not like to risk out money, plentiful though it may be in today's environment. So plentiful, in fact, that Argentina needs 26.8% more of it to buy the same goods and services they bought last year and the police are now on strike, demanding wages that keep up with the surging cost of living, allowing looters to have free reign of the streets. Government spending jumped 44% to keep up and relented to the police (33% raises) but now the public workers are threatening to strike too.

Is this the inflationary future for America? Argentina's debt to GDP is just 43.2%, that would be like America having just a $7Tn debt and not $17Tn and rising. Argentina will take a page out of the US book to fix inflation as well as their GDP – by adjusting the way they gather and report the data!

Is this the inflationary future for America? Argentina's debt to GDP is just 43.2%, that would be like America having just a $7Tn debt and not $17Tn and rising. Argentina will take a page out of the US book to fix inflation as well as their GDP – by adjusting the way they gather and report the data!

We've already forgotten that the US boosted their GDP by 0.5% last Q by changing the way they value intellectual property like TV shows and films, adding hundreds of Billions of Dollars of implied value to potential re-runs of the Kardasians. Not a mention of it last week, as we simply accept it as fact now – as if it's always been that way…

And if all others accepted the lie which the Party imposed – if all records told the same tale – then the lie passed into history and became truth. "Who controls the past," ran the Party slogan, "controls the future: who controls the present controls the past." And yet the past, though of its nature alterable, never had been altered. Whatever was true now was true from everlasting to everlasting. It was quite simple. All that was needed was an unending series of victories over your own memory. "Reality control," they called it: in Newspeak, "doublethink." (Orwell, 1984 – 1.3.18)

The Party lie of the day is the positive numbers you may be seeing in the Futures. What really happened is, after the bell and into the close of the index Futures, they were pushed down about 0.25% so, when they reopened, the Futueres base-line was set 0.25% below where the indexes actually closed yesterday. Now, in the morning, the Futures are back to where they closed, but that let's the MSM tell you that the Futures are looking up – to give the the very false impression that buyers are stepping in. Clever, isn't it?

The Party lie of the day is the positive numbers you may be seeing in the Futures. What really happened is, after the bell and into the close of the index Futures, they were pushed down about 0.25% so, when they reopened, the Futueres base-line was set 0.25% below where the indexes actually closed yesterday. Now, in the morning, the Futures are back to where they closed, but that let's the MSM tell you that the Futures are looking up – to give the the very false impression that buyers are stepping in. Clever, isn't it?

Who benefits from this nonsense? Well, just watch that TV until the commercials come on and write down the names of each sponsor. In the newspaper or one the Web, look at who the ads are from. Rupert Murdoch, for example has $13.4Bn and most of it is tied up in stocks. He is so interested in maintining the top 1%'s status quo (#33 on the Forbes list) that he bought the company that controls the Dow Jones Industrial Average, which itself has been re-written to make it look better this year (adding NKE, V and GS in October).

Do you think Mr. Murdoch wants his paper printing articles that say his holdings are worth less? No, he wants to have MORE money next year than he had last year, not less. T is a front-page sponsor (isn't it GREATthat they'll stop subsidizing smart phones?), Chanel is on page 2 along with Forevermark Diamonds, Jaquet Droz watches, Canali and Tourneau (luxury goods are the place to be investing!), followed by Breitling, Tiffany and Beluga on page 3.

Do you think Mr. Murdoch wants his paper printing articles that say his holdings are worth less? No, he wants to have MORE money next year than he had last year, not less. T is a front-page sponsor (isn't it GREATthat they'll stop subsidizing smart phones?), Chanel is on page 2 along with Forevermark Diamonds, Jaquet Droz watches, Canali and Tourneau (luxury goods are the place to be investing!), followed by Breitling, Tiffany and Beluga on page 3.

What really amazes me, more than the blatant manipulation of the media, is the fact that anyone making less than $100,000 could possibly believe the WSJ gives a crap about them. It's one thing to be aspirational but, as we discussed extensively in Member Chat this morning, upward mobility is essentially a myth in America. If it weren't the WSJ would have ads from executive training schools or business incubators, right? As it is, it's news by the 1% for the 1% (including the ever-popular "house porn" section) and propaganda for the rest of you.

Of course, other than the moral outrage, we're fine with the fact that the markets are fixed. It's much easier to bet on a manipulated market than a free one – just ask JPM or GS, who only lost money on 2 days in Q1, 6 days in Q2 and 15 days in Q3 (out of about 60 in each Q). Why are they starting to lose more? More scrutiny as the Volker Rule finally kicks in. Still, the house usually wins and that's why, at Philstockworld, we teach you to BE THE HOUSE – Not the Gambler!

As I noted yesterday, you can get our trade ideas like every day by becoming a Member at Philstockworld. A PSW Annual Report Membership gives you access to all of our daily posts as well as archived chat sessions AND a subscription to Stock World Weekly, all for less than $1 per day. Doesn't that make a perfect Christmas gift for all the investors on your list?

Just yesterday, in fact, in the morning post (which is delivered to our Members in progress at 8:35 and finished before the bell – usually), I mentioned that we were shorting oil at the $98 line. This morning, oil is at $96.75 for a gain of $1,250 PER CONTRACT – isn't that kind of information worth $1 a day? The XRT Jan $90 puts we liked opened at $3.80 and finished the day at $5, up a very nice 31% on the day.

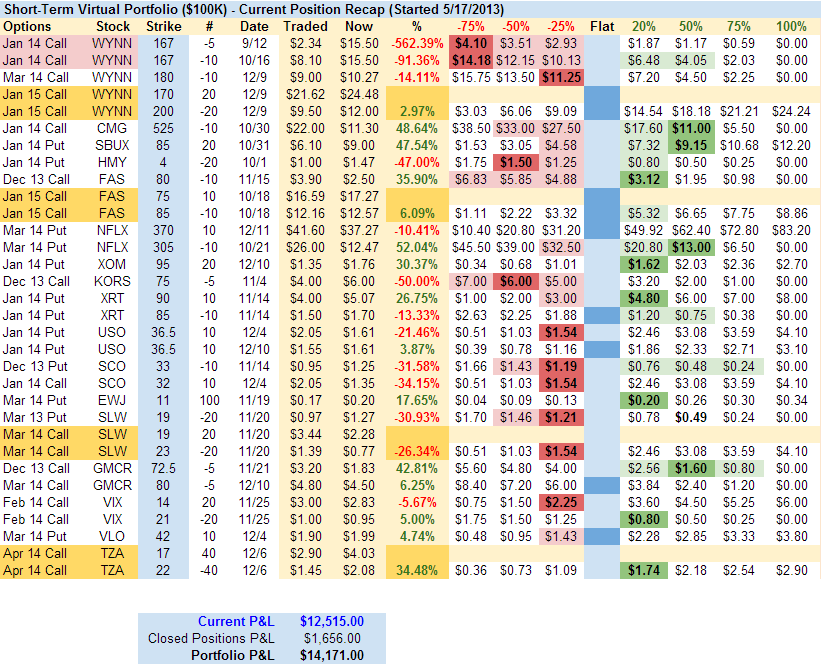

In our Member Chat, as I noted, we were already extremely short in our Short-Term Portfolio and that did well enough during the day (up a virtual $14,000) that we decided to cover with 50 TNA weekly short puts ($65.81s) at .70, giving us $3,500 worth of upside protection, in case the market reverses.

In our Member Chat, as I noted, we were already extremely short in our Short-Term Portfolio and that did well enough during the day (up a virtual $14,000) that we decided to cover with 50 TNA weekly short puts ($65.81s) at .70, giving us $3,500 worth of upside protection, in case the market reverses.

If it continues down – well, we didn't make any changes (note the large amount of oil shorts!) so we are on track to make another $14,000 today in a big move down – so the potential cost of insurance is reasonable. This is a very similar move to the profitable trade we made live, in Tuesday's Webcast.

Keep in mind though, as I said Monday, this is just fund trades for fun money, on the whole, I much prefer CASH in this uncertain market. That includes having a long-term, very well-hedged portfolio (because we don't like to go in and out of 2-year postiions if we don't have to) but the more cash the better. Just yesterday, in our Member Chat, we found several good long trade ideas – there's always something, in any kind of market but, at the moment, I'd rather have a green Christmas and wait for January to jump back in. Take some of that money and go shopping – the economy needs you!

Have a great weekend,

– Phil