Courtesy of Mish.

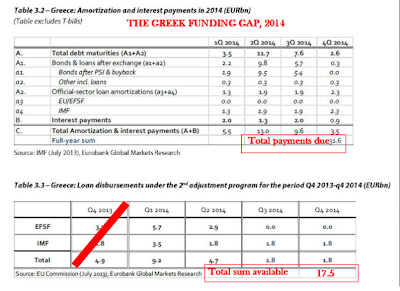

Cash flow analysis shows Greece is in serious trouble again in spite of having a current account surplus.

Specifically, Greece needs a change in payback terms or another bailout or it will default in August, if not May. I use the words “will default” imprecisely.

The only way Greece is making loan payments now is with money from the Troika.

The scam works like this: bailout money is allegedly given to Greece, but Greece cannot really touch it. Instead the money goes right back to the Troika to for interest and capital payments, with perhaps a miniscule portion finally getting to Greece.

Realistically, Greece defaults on every payment already.

Greece Bailout Cash Flow

Even this game is in trouble now as Greek Cash Flow Charts show.

Just two days before New year 2014, Antonis Samaras told his People that Greece would leave its bailout programme next year without needing a third aid package. “In 2014 we will make the big step of exiting the loan agreement,” said the Greek PM in a nationally televised address. “In 2014, Greece will venture out to the markets again [and] start becoming a normal country… There will be no need for new loans and new bailout agreements”.

But figures obtained by The Slog show he lied.

Mr Samaras told the Greeks during October that debt relief would come by Christmas. It didn’t. He is now suggesting there is no budget shortfall. There is.

He says the much-trumpeted €800m surplus obtained last year will help solve the problem. It won’t.

…