Wheeeeee – down we go!

Wheeeeee – down we go!

We couldn't be happier, of course – as we were feeling a little silly having cashed out a month ago, with the market making new highs on us. Still, we stuck to our Fundamental guns and now we are outperforming the market by a mile this year and, even better, we have some exciting opportunities to use our sideline cash to do a little shopping – but not yet.

There's no hurry. Those XRT May $84 puts I mentioned in yesterday's post that went from 0.85 last Thursday to $1.42 yesterday morning hit $2.35 into yesterday's close. That's up another 65% in a day and that's money that's compounding for us on the way down, up 176% in 3 days now. This is what we do with our sideline cash – so it's not like we sit around twiddling our thumbs…

I sent out an Alert to our Members yesterday to sell the T July $35 calls for $1.10 to cover a long position we have on T. Pre-market they are down 1% and those short calls are up 10% on day one already – but there's 100 more days to go. Again, this is what we can do with our sideline cash. We also shorted JPM in an earnings spread – that trade is here from our Live Daily Chat Room.

We had lots of fun in our Futures trading, flip-flopping our bets for the bounces and catching nice moves in both directions – but mostly down. We even made some quick money with long plays on the Momo stocks – also playing for bounces. Our last trade idea of the day was shorting /NKD as it failed the 14,800 mark into the close (coupled with a falling Dollar and rising Yen) and that index fell straight down to 14,450, good for $1,750 per contract. We were already longer-term short position on the Nikkei through our EWJ puts in the Short-Term Portfolio, this was just a bonus bet. We also added JNJ May $95 puts at .80, those could be fun if the weakness continues.

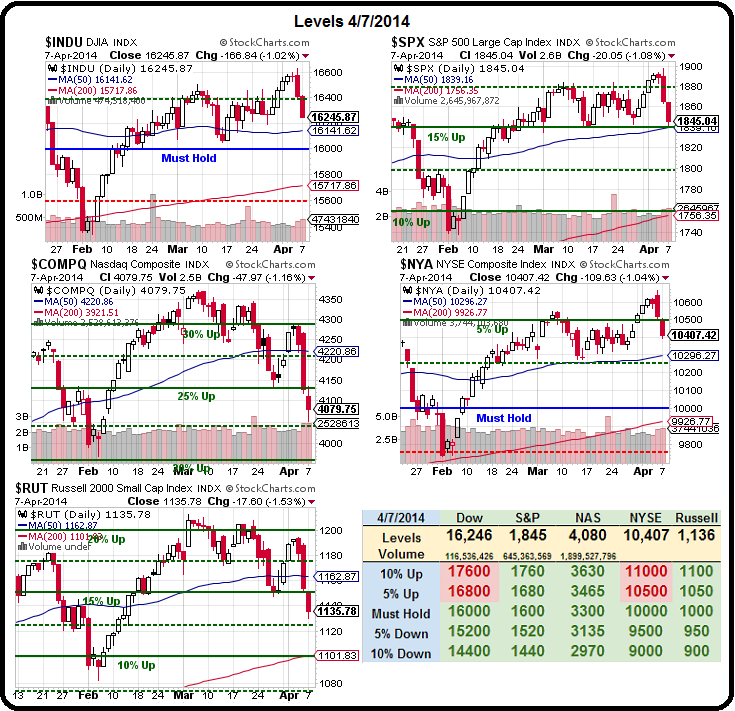

Now things are going to get interesting at the Nasdaq has fallen from 4,375 to 4,050, which is 325 points or 7.5%. The 5% drop line was at 4,150 and the 10% line is 3,950 – we'll see which one gets tested first! On the Russell, we'd down from 1,210 to 1,130 so 80 points is 6.6% with the 5% line convenienctly at 1,150 and the 10% line at 1,090, which is right about the 1,100 line we expected to fall too, which is also the 200 dma on the Russell.

Now things are going to get interesting at the Nasdaq has fallen from 4,375 to 4,050, which is 325 points or 7.5%. The 5% drop line was at 4,150 and the 10% line is 3,950 – we'll see which one gets tested first! On the Russell, we'd down from 1,210 to 1,130 so 80 points is 6.6% with the 5% line convenienctly at 1,150 and the 10% line at 1,090, which is right about the 1,100 line we expected to fall too, which is also the 200 dma on the Russell.

Per our 5% Rule™, we ignore the spikes and we concentrate on the move from the major consolidation at 800 to the 50% move to 1,200 and, from there, we expect a HEALTHY correction of 20% of the run-up, back to 1,100, which is still bullish (if it holds). That's why we're still bullish in our Long-Term Portfolio (but well-hedged, of course), we think this is just a minor, and very normal, correction and, unless those levels break – that's how we're going to be playing it.

Meanwhile, we'll be playing close attention to the 15% line on the S&P, which is also the 50 dma at 1,840 and isn't it funny how we were able to make these predictions over a year ago?

Meanwhile, we'll be playing close attention to the 15% line on the S&P, which is also the 50 dma at 1,840 and isn't it funny how we were able to make these predictions over a year ago?

Actually, it's not funny, the stock markets are rigged and run by computers and all we do with our humble 5% Rule™ is show you how the programs work. Keep in mind, we haven't changed our lines from last year, when we felt the 10% line (1,760) on the S&P was what the index was worth. That's still our target for this year – unfortunately, still down from here.

We're willing to change our mind (and our targets) if earnings tell us a different tale than what we expect to hear this quarter and, of course, the Dollar is a factor in re-setting the index levels and this morning it's so weak that it's failing the 80 line as neither the BOJ or the PBOC has stepped in with more stimulus yet. So, like spoiled babys used to getting a constant supply of free-money candy, the markets are having a little temper-tantrum. We had some notes on monetary policy in our morning news report, which I tweeted out (you can follow me here) and also put it on our Facebook Page (which you can follow here).

This chart is an excellent summary of WHY we are bearish into earnings. As I noted above, we flipped bearish on Friday, Feb 21st, when the S&P was at 1,840 and it's only back to 1,840 now though, as noted yesterday, we've actually had an excellent month of hit and run trading from the sidelines.

In that post we suggested the TZA April $16/19 bull call spread at .80, selling the $15 puts for .62 for net .18 at the time and we were looking for a $9,000 pay-off so we added 30 contracts for $540 and, two weekss from expiration, those spreads are net $1 or $3,000 for 30 and up $2,460 or 455%, right about our 500% goal (the post was, after all, titled "5 New Trade Idease that can Make 500% if the Market Falls").

In that post we suggested the TZA April $16/19 bull call spread at .80, selling the $15 puts for .62 for net .18 at the time and we were looking for a $9,000 pay-off so we added 30 contracts for $540 and, two weekss from expiration, those spreads are net $1 or $3,000 for 30 and up $2,460 or 455%, right about our 500% goal (the post was, after all, titled "5 New Trade Idease that can Make 500% if the Market Falls").

So we don't have to have a huge sell-off to make very good money on well-constructed hedges. We practiced our "BE THE HOUSE – Not the Gambler" strategy that is our focus for training our Members in 2014.

We also suggested, in that same post, a longer-term hedge using a combination of AAPL and SQQQ (ultra-short Nasdaq) right in the morning post (get yours every day RIGHT HERE):

We can sell 1 AAPL 2016 $450 put for $42.50 ($4,250) and buy SQQQ 15 June $50/59 bull call spreads at $3 ($4,500) and that's a net of $250 in cash out of pocket for $13,500 (5,300% on cash) worth of protection and our worst case is owning 100 shares of AAPL for net $452.50 ($45,250).

Despite AAPL selling off again, the 2016 $450 puts are now $40.75 ($4,075) but the SQQQ spread is already right in the money with SQQQ at $58.83, just .17 below our target and the net of that spread is now $4.89 ($7,335) for a net of $3,250 off our initial $250 cash investment – up 1,204% in 6 weeks. Considering the upside potential of the trade is 5,300%, this hedge is merely "on track" at the moment.

How did we know to make the Nasdaq and the Russell our primary hedges 6 weeks ago, when they were both trending to new highs? That's simple, we have our 5% Rule™ and we have FUNDAMENTALS – as I said yesterday, we're happy to teach you to trade like this – but you have to be willing to learn!