Courtesy of Mish.

I don’t believe the growth estimates of the IMF and neither does Steen Jakobsen, Chief Economist of Saxo Bank.

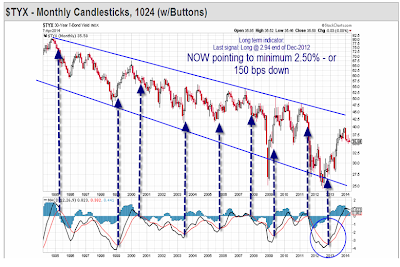

Steen goes one further and calls for the yield on the 30-year long bond to drop a minimum of 150 basis points to 2.5%.

From Steen via Email

2014 started with high expectations on growth. The IMF, World Bank and ECB were falling over themselves to upgrade growth forecast for 2014 in early January but by now Q1 growth in the US is expected to come in at +1.9% after the initial +2.6% advertised by the pundits in late 2014 (Bloomberg December 12th, Survey).

The IMF forecast is despite Q4 revised considerably down from 4.1% to 3.2%, ending at 2.7% in final count. (37% drop from early to final number).

This apparently was entirely due to weather….

But the fixed income market seems to have a different opinion: This is my long term chart which have maximum one signal per year.

The model has been good in calling bigger trend changes, the last one being end of December 2012 where it bought on the close @ 2.94% yield. It’s now getting ready to sell off indicating that the bond market “disagrees” more and more with the assumption on weather.

Furthermore, my gauge for central bank policy: The GDP weighted G-10 1 year interest is also making noises to the downside, although less so than long term interest rates….

The point here being that despite hearing daily from both investors and other strategist’s that: “We are in clear recovery on growth and that 2014 will be a good year for stock market again”…..I remain extremely disappointed on the REAL PROGRESS made in terms of structural and cyclical improvement in key indicators….