Courtesy of Mish.

Doug Short at Advisor Perpspectives picked up my post Shiller Drinks the Kool-Aid.

Footnote from Doug Short

Doug emailed me a bit ago, adding a few charts of his own to my post.

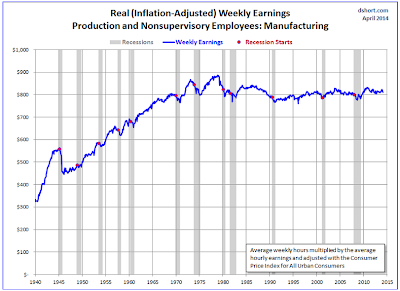

When I read Mish’s commentary this morning, I was interested in what the real (inflation-adjusted) weekly earnings of this employment cohort would look like over the past seven-plus decades. Here’s what I came up with, courtesy of data from the FRED repository. This snapshot clearly supports Mish’s perspective.

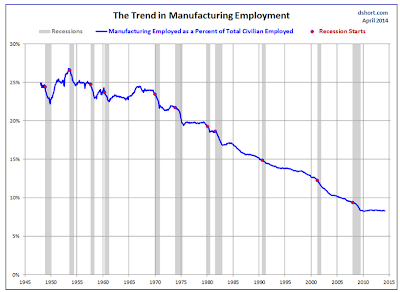

I would also emphasize the secular trends since the early 1980s that underly Mish’s third chart above: The general decline in US manufacturing triggered by the growth offshoring and the accelerating efficiencies of technologies that replace human labor. Over this timeframe, real wages have been stagnant for a shrinking manufacturing labor force.

I’ll close this footnote with a look at the Manufacturing Workforce as a percent of the Civilian Employed.

Tail Risk

Do economists understand tail risk and how economies can turn on dime for no apparent reason other than a change in consumer sentiment? Apparently not.

Yesterday, the IMF Cut Downturn Danger to Near Zero.

The fund’s World Economic Outlook now estimates only a 0.1 per cent probability of global recession in 2014, compared with a 6 per cent chance last October, with similarly reduced risks for 2015.

Most of the IMF’s forecasts were little changed, with expectations of stronger growth in the US, the UK and Germany boosting the outlook.

…