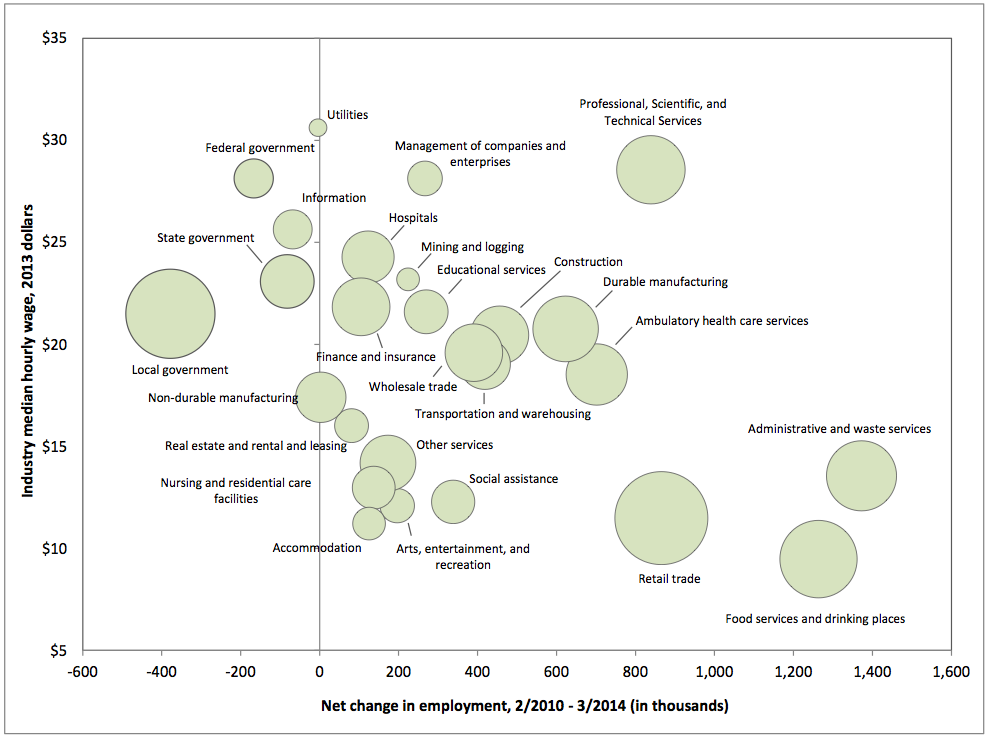

When the job sucks! We've all had crappy jobs in our lives – something we stay in to pay the bills but has no chance of being a career. As you can see from the chart on the right, a lot of career Government jobs have disappeared over the past 4 years – the kind of jobs that held advancement and retirement and health benefits.

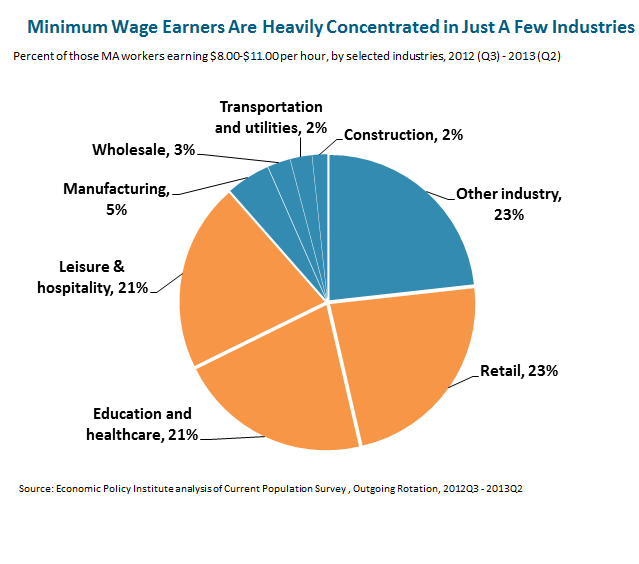

They have been replaced by Retail, Food Service and "Adminstrative and Waste Services" – ie., minimum wage jobs. That's why, when the GOP puts up charts with minimum wage data, they tend to have old data. The newer the data is, the worse the picture looks and the harder it is to spin into the "job creator" mythology.

Look at what America, your country, is turning into. Don't you care? If not for yourself, what about your children and grandchildren who are growing up in the "service economy" we feared we would become in the 80s, when we first began to export all of our manufacturing overseas?

Look at what America, your country, is turning into. Don't you care? If not for yourself, what about your children and grandchildren who are growing up in the "service economy" we feared we would become in the 80s, when we first began to export all of our manufacturing overseas?

Don't be fooled by the employment numbers today, the vast majority of the growth (if any) is concentated in the worst possible jobs. One lost Government or Manufacturing job paying $30 an hour has to be replaced by 3 to 4 minimum wage jobs just to keep consumer purchasing power even.

But it's not even, is it? Even then, disposable income drops off a cliff as more and more of a person's minimum wage goes to simply trying to stay alive long enough to show up for work the next day. That's why the ultra-capitalists are taking over Health Care, Energy, Waste Management, Water Systems – the things you can't live without and have no choice but to pay up for – no matter how poor you are. They have you by the throat and they can squeeze and squeeze until they have every last dime that you do manage to scrape together – that's the game of American Capitalism.

And who do they attack? The powerless, the disenfranchised, the people in society politicians don't care about – women! That's right, women make up 64.5% of all minimum wage workers and most of them (33%) are women 25 and older – not the teenagers the GOP would have you believe they are.

These are women who are trying to support themselves, trying to support their families – and are simply more accepting than men of degrading jobs and less apt than men to assert themselves and demand higher wages or promotions as well as being less likely to be promoted or have their salaries raised in a clearly sexist system where any woman makes and average of 25% less than a man in the same profession.

Thank goodness for the MINIMUM wage or they'd have women working for $5 an hour or less doing the same jobs at the same Retail, Food, Admistrative and Waste jobs that we are replacing real jobs with these days. So, it is with bated breath that we await the Non-Farm Payroll number at 8:30 but it won't matter whether we create 150,000 crappy jobs or 300,000 crappy jobs – we're still 14M jobs in the hole and it would take 3 years at 300,000 just to get back to where Bill Clinton left us (4%).

Thank goodness for the MINIMUM wage or they'd have women working for $5 an hour or less doing the same jobs at the same Retail, Food, Admistrative and Waste jobs that we are replacing real jobs with these days. So, it is with bated breath that we await the Non-Farm Payroll number at 8:30 but it won't matter whether we create 150,000 crappy jobs or 300,000 crappy jobs – we're still 14M jobs in the hole and it would take 3 years at 300,000 just to get back to where Bill Clinton left us (4%).

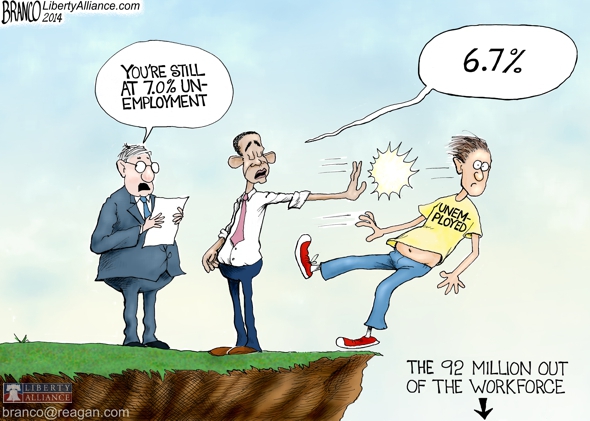

At 6.5%(ish), Obama has now improved our unemployment picture by 3.5% from where it topped out during the recession – that's actually better than Clinton at this point. But the QUALITY of the jobs isn't the same and so we have 0.1% GDP growth despite the "improving" jobs picture. Not only that but the main reason unemployment is dropping is that our workforce is shrinking – as 6 years of slow growth in the real economy have simply led many people to dial-down their lifestyle and give up on the Amercican Dream – and there will be Hell to pay when it comes time for people to retire, as 40% of US families have NOTHING saved up at all:

8:30 Update: 288,000 jobs! Unemployment down to 6.3%! Sounds good, right? It's at the top of our expectred range and 50% higher than what was expected by leading economorons, who are paid to follow this stuff. I already told our Members in this morning's Alert that below 350,000 would spike us higher but then will present a shorting opportunity. In the Futures, it's at Nasdaq 3,600 (/NQ), Dow 16,550 (/YM), S&P 1,885 (/ES) and Russell 1,130 (/TF). Oil, as you know from yesterday's post, we're shorting at $100 (/CL) – that already paid off very nicely yesterday.

Underneath the fluff of the headline number, we have 806,000 people giving up on the labor force – that's why the Unemployment Rate is down to 6.3%, 806,000 people out of 155.4M is half a percent right there! You won't here that from the MSM though, because their sponsors want you to think everything is great so you can whip out your credit card and BUYBUYBUY!

Underneath the fluff of the headline number, we have 806,000 people giving up on the labor force – that's why the Unemployment Rate is down to 6.3%, 806,000 people out of 155.4M is half a percent right there! You won't here that from the MSM though, because their sponsors want you to think everything is great so you can whip out your credit card and BUYBUYBUY!

Average hourly earnings fell off a cliff since last month, from 2.3% to 1.9% year/year. Do you really think 1.9% is keeping people up with inflation? If people are only making 1.9% more money – even if they spent every penny of it, then how much more revenues could our Corporate Masters make? That's right, less than 2% – and that's being reflected in Q1 revenue reports. Earnings are a bit better, though. And why? Because they are paying their workers less! See how great Capitalism can be when you "work it"?

That's why, yesterday, Personal Spending was up 0.9% in March, while Personal Income was only up 0.5%. That means consumers are digging themselves 0.4% further in a hole in order to keep up appearances and, of course, keep in mind that 90% of that 0.5% rise in income went to the top 20% (and most of that to the top 5%).

That's why, yesterday, Personal Spending was up 0.9% in March, while Personal Income was only up 0.5%. That means consumers are digging themselves 0.4% further in a hole in order to keep up appearances and, of course, keep in mind that 90% of that 0.5% rise in income went to the top 20% (and most of that to the top 5%).

The bottom 80% still have miles to go before their Real Household Incomes even get back to where they were when Bill Clinton left office. Raising the minimum wage would go a long way towards fixing that but, since those excess profits would drain away from the outsized income gains captured by our Corporate Masters and since our Corporate Masters already control one branch of Congress and the Supreme Court – don't count on it.

That's why, I remind our Members to make sure they work hard to get into the top 1% – because it really, really sucks to be excluded from that club in this country!

Have a great weekend,

– Phil