These are not good chart patterns:

These are not good chart patterns:

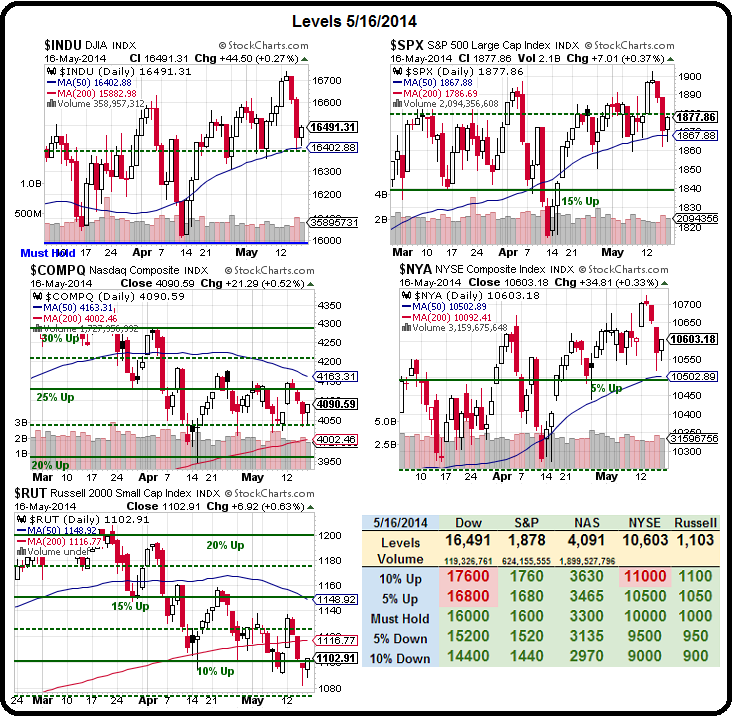

We haven't gone anywhere on the Dow, S&P or NYSE since early March and we've lost 6% on the Nasdaq and 8.3% on the Russell yet, to hear the mainstream media tell it – there's no better time to invest.

Nazi propagandist Joseph Goebbels said: "If you tell a lie big enough and keep repeating it, people will eventually come to believe it." Clearly that's the template being used today by the MSM and even our politicians these days.

President Bush himself said: "See, in my line of work you got to keep repeating things over and over and over again for the truth to sink in, to kind of catapult the propaganda." Unfortunately, no one told him he wasn't supposed to actually repeat what they told him in the strategy meeting to the general public – but we all know that's the way things work, don't we?

As you can see from Dave Fry's SPY chart, we got a very exciting pop into the close on Friday for no particular reason and now, for no particular reason the Futures have given back most of those gains. But don't worry, into the open, while the volume is still low, it's sure to get jammed back up again – just in time for the Funds to dump their shares on the retail crowd.

As you can see from Dave Fry's SPY chart, we got a very exciting pop into the close on Friday for no particular reason and now, for no particular reason the Futures have given back most of those gains. But don't worry, into the open, while the volume is still low, it's sure to get jammed back up again – just in time for the Funds to dump their shares on the retail crowd.

We don't care IF the game is rigged, as long as we can figure out HOW the game is rigged and play along. This morning I posted to our Members that Silver Futures (/SI ) were a long at $19.50 and that Gasoline Futures (/RB) were a short at $3. Already silver hit $19.65 for a $750 per contract gain and gasoline fell to $2.985 for a $630 per contract gain – and the Egg McMuffins are paid for!

We KNOW it's rigged and we KNOW the moves were fake so, when they hit good resistance points, we knew it was very unlikely they'd get past them. If they did get over the resistance, we'd take small, quick losses and be done with the trade. Of course we went over the news and the data from around the World to make sure our premise was sound but those are the basics and we teach them every month in our Live Futures Trading Workshops.

This weekend, we went over our basic strategy for long-term investing, reviewing how we can turn $25,000 into $500,000 in 15 years using our conservative, long-term strategies. While we have a lot of fun making aggressive short-term trades and earnings plays and futures trades – THIS is where we like the bulk of our investing to be – making slow, steady long-term gains.

This weekend, we went over our basic strategy for long-term investing, reviewing how we can turn $25,000 into $500,000 in 15 years using our conservative, long-term strategies. While we have a lot of fun making aggressive short-term trades and earnings plays and futures trades – THIS is where we like the bulk of our investing to be – making slow, steady long-term gains.

Long-term investing shouldn't be exciting. If you want exciting, try a hedge fund – though most of them aren't worth a damn. Barron's reviewed the top 100 Hedge Funds this weekend and the 23rd fund on the list failed to make 20% over the last 3 years. That's the same 3 year when the S&P began 2010 at 1,000 and finished 2013 at 1,600 – up 60%. Only 22 hedge funds in the World beat the S&P for the past 3 years.

In fact, had Glenview (the #1 fund) not made 101.74% last year, they wouldn't have even been on the list. When you are down 2 years in a row, a fund is incentified to "go for it" so they can get paid. If they lose for the 3rd straight year – you're going to withdraw your money anyway – so better to bet it all on a couple of big scores. 5 of the other top 22 funds made 50% or more last year – otherwise they too would have been mediocre at best.

Barron's notes that many of the top fund "are equity specialists that focus on a short list of companies they get to know extremely well." Glenview's 20 biggest long positions are 2/3 of his porfolio with Larry Robbins following our lessons on "Smart Portfolio Management," as do most of the major funds. Glenview made most of their money betting on Biotech and Health Care – the same stocks Pharmboy and I have been advoctating since my "2010 Investing Outlook".

That sector was a giveaway, Obamacare was coming and that means more people would be using health services over the next 3-5 years, so that's what we bet on. Of course things went up and down in between but focusing on the LONG-TERM macro premise and, as of last September, our 15 health care picks were up an average of 64% – and that's just the stocks – with option strategies, the returns were ridiculous.

That sector was a giveaway, Obamacare was coming and that means more people would be using health services over the next 3-5 years, so that's what we bet on. Of course things went up and down in between but focusing on the LONG-TERM macro premise and, as of last September, our 15 health care picks were up an average of 64% – and that's just the stocks – with option strategies, the returns were ridiculous.

Since we are able to use options to leverage our positions to make 40-60% annual gains when we're right, we like to have a lot of cash on the side for those times when we get it wrong.

Maybe we're wrong about the dangers the economy is facing (see today's news alert for more scary stuff) but so what? By being cautious and taking our profits off the table, we free ourselves up to do some bargain hunting and last week, in our Live Weekly Webinar, I outlined 9 great trade ideas that can all give us 20% or better annual returns – and we don't even have to pay any fund fees!

This year's top fund manage, David Tepper, agreed with me last week about remaining "Cashy and Cautious," so I'm not feeling like I need to build a big case for it this week. I laid our our DXD and DIA hedges on Friday and there was ample opportunity to get into either or both on the afternoon climb – AS WE PREDICTED.

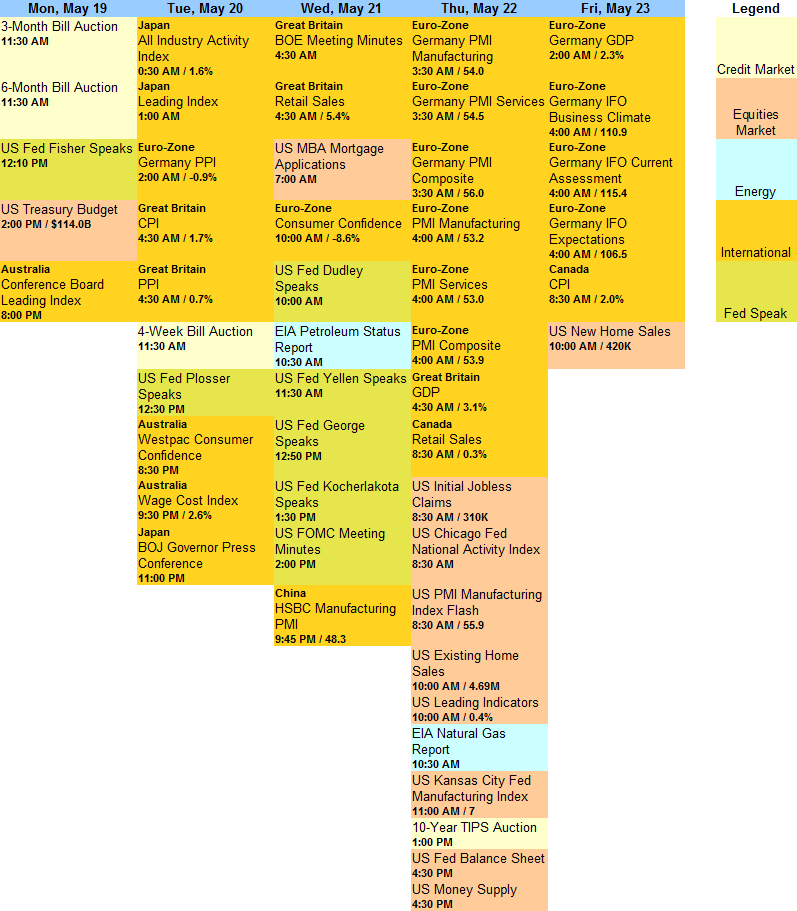

This week is highlighted by Global PPI Reports, Quad Fed Speak and Minutes on Wednesday and bad US Housing Data. Oops, I'm not supposed to tell you it's bad until after the report – silly me.

Just be careful out there!