Courtesy of The Automatic Earth.

Marion Post Wolcott Farmer’s son making sorghum molasses, Racine, West Virginia Sep 1938

Yesterday, we saw that despite a tepid rebound in new home sales, the underlying numbers are far from promising. In particular, prices, which had been holding up despite sagging sales, are down YoY. We also saw that some big investors are now -openly – betting against housing. We saw that the Fed is as a rule so far off in its official forecasts that one needs to wonder about its level of honesty. But what I think was the main item yesterday is the fact that world trade has landed in negative growth territory. The implications of that are hard to overestimate. Global GDP until now has been up quite a bit more than that of the US, Europe, Japan. But now all are tipping their toes on the other side of the much feared red line. And it’s high time for everyone, including Americans, to start realizing what’s going on, and that it looks nothing like the brightly colored pictures of grandeur just around the corner that are consistently being painted for your consumption.

Yesterday afternoon Bloomberg reported that US Q1 retail numbers were hugely and painfully below analysts’ estimates.

U.S. Retailers Missing Estimates by Most in 13 Years

U.S. retailers’ first-quarter earnings are trailing analysts’ estimates by the widest margin in 13 years after bad weather and weak spending by lower-income consumers intensified competition [..] … the expectations the chains are missing have been significantly lowered. While analysts now project retailers’ earnings fell an average of 4.1%, back in January they had estimated a 13% gain. Lower- and moderate-income consumers had little discretionary spending power [..]

That difference is so stunning one must wonder what goes on. As Alhambra Investment Partners’ Jeffrey P. Snider does, in a piece posted by David Stockman:

We keep hearing about pent up demand as if it is a foregone conclusion. For some, particularly orthodox economists, it really is – it has to be. If there is no pent up demand awaiting some ephemeral trigger, then their whole theory of the economy is wrong, from the ground up. [..]

Back-to-school sales were “unexpectedly” low, leading to whispers about retailers stuffed with inventory. That was fine, though, because Christmas sales were going to be the first real treat since before the panic. Even though Kmart started advertising its Christmas deals in September, that was dismissed as idiosyncratic. Then it turned out Kmart was actually emblematic and Christmas (for the retail industry) ended up as the worst since 2009. But that, too, was fine, because holiday hangover would be less significant. So retailer expectations, as with those for overall economic growth, were tremendously optimistic until it snowed in winter.

In the space of only three months or so, retailers went from (yet again) expecting fortune and finding instead more “mysterious headwinds.” But this is beyond the usual ridiculous affair, to miss by that much implies something far more serious. To go from +13% to -4% that quickly is an outrage, not just to the economy as it sinks further under the weight of these commandments, but also in those businesses that continue to rely on orthodox forecasts and assumptions.

In another article, at Real Clear Markets, Snider backs up the numbers with a look at sales at the biggest US retail chains:

Target, Staples And The Same Poor Mess (Alhambra)

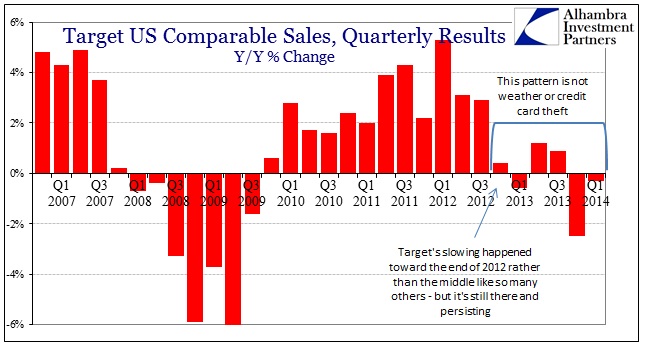

At what point do “struggling consumers” begin to register as something more than a mysterious headwind? The state of US households is more like a recession than some tangential factor that is just running below expectations. The results speak for themselves – there was an obvious slowdown in 2012 followed by revenue and spending patterns that very much equate to late 2007 and early 2008. [..] The ups and downs throughout the chronology of the past seven years sure look like two recession cycles. It really doesn’t get much clearer than this:

You can make the case that the current down cycle is nowhere near as bad as 2008, especially into 2009, but that is an exceedingly low standard. We have been promised repeatedly and assuredly that there would be a recovery, even to the point of having to withstand four separate, immense QE paroxysms. To what gain? To what loss? If it was only Target and the rest of the retail industry was doing fine, then you can dismiss these results (actual dollars spent as they are, in contrast to sentiment surveys) as Target’s individual missteps. But Wal-Mart has shown the same exact pattern, though actually faring far worse in terms of its 2008 comparisons. Wal-Mart and Target are #1 and #3 in terms of size.

That suggests that consumers were downgrading their shopping impulses in 2008 from more expensive outfits to bare bones essentials. In other words, the Great Recession almost benefitted Wal-Mart by shifting the whole retail scale toward “cheap.” Now, in 2013 and 2014, they can’t even get away with that. It’s almost as if the country and economic system have grown far poorer throughout this “recovery.”

Of course he doesn’t mean ‘it’s almost as if’, he means America has gotten poorer and is well on its way to get poorer still. The very prolific Snider takes on US housing while he’s on a roll:

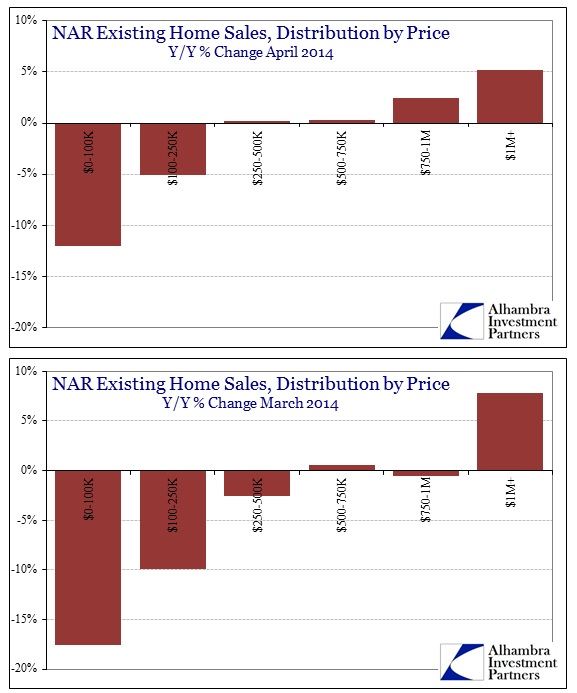

• Total Y/Y Home Sales Down 7%, But Plunged 17% At Bottom

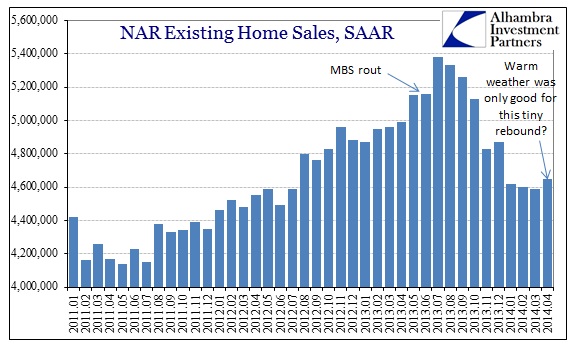

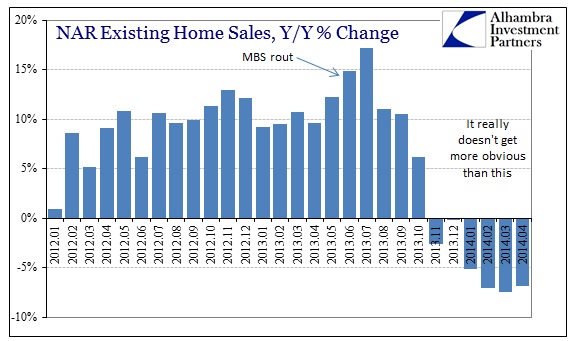

The depressed level of existing home sales throughout 2014 so far continued into April despite all projections of pent up demand after a cold and wintry start. There was some growth in the month-to-month change of the seasonally adjusted figures, but even there the clear problem that has been evident since mortgage finance collapsed starkly remains. [..] Protestations aside, the future of real estate will be decided by these financial factors, including both mortgage finance and household impoverishment.

The true pattern really jumps out when viewing these figures Y/Y.

First time home buyers continue to be absent from the housing market. The level of this category of purchasers remains at about only 29% of all sales. That speaks to both affordability (lack of) and household formation. It also shows clearly the shortcomings of the continuous appeal to the insidious wealth effect as it fails to trickle to anyone other than those directly experiencing asset inflation.

The picture that emerges of the new America is starting to get into focus. We can see what goes on, no longer distracted by the media, the markets or the political system. At least, it is there for us to see, and the need to be distracted is gone. Whether we will actually choose the clearer picture over the rosier fuzzy one is another matter altogether. Do we even want to know why American housing and retail are getting so much worse so fast? Why not turn to Jeffrey P. Snider again?

Interest Rate Manipulation Comes Back to Haunt Its Most Ardent Supporters

It is difficult to give too much deference to commentators, particularly economists, that speak to the value of quantitative easing in such bland and generic terms. It almost sounds exceedingly easy, as if the Federal Reserve buys a bunch of mortgage bonds, mortgage rates decline, more people can afford to buy houses and the world is full of sunshine again. It usually doesn’t get more detailed than that, partly because it is now ironclad law that in order to reach a mass market demands such simplicity, but also partly because that is the extent and depth of the profession’s actual knowledge of the inner workings. I hear it all the time when these same persons, who are nearly monolithic in their undying devotion to the sanctity of the FOMC, try to describe something so basic as the “money supply.”

Such a notion in the 21st century is so entirely fungible as to lose all proper and tangible meaning, yet that doesn’t stop a considerable number of respected commentators from removing all real world complexity. For example, Deutsche Bank announced last weekend a new “capital” campaign whereby the bank will raise €8 billion in order to focus more on the high yield and leveraged debt markets in the United States (this is not a joke). Part of the reason is that those debt markets are where all the action is now (thanks to what, exactly?) given that FICC [fixed income, currencies, commodities] trading, boring fixed income and bond trading, is almost completely dead today – the very segment that had sustained the global banking enterprise from the depths of near total despair.

How will Deutsche Bank get its new euro capital from Frankfurt to NYC? It’s all the more amazing since 60 million shares are to be (have been) sold to the investment company of a (the?) Qatari Sheikh. There will be a wonderful trip through derivatives markets and bank balance sheets (no doubt including Deutsche’s London and US subs), requiring the accounting and finance acumen of dozens of systems including risk management. Do we include or exclude the Sheikh’s initial funding toward the US$ money supply?

More interesting is why FICC trading has become so unprofitable. The short answer is the very same people who thought interest rate manipulation was a terrific idea in the first place. But such a generic statement plays right into the very critique I offered at the outset. There is obviously, given this setup, much more “nuance” and “texture” to how policy built up FICC only to tear it apart and set the world of finance into a much more unsettled position. First, you have to realize that the Fed through FRBNY’s Open Market desk doesn’t just buy some mortgage bonds as if they were like US treasuries. QE actually operates deep within the bowels of mortgage bond trading in a place called TBA [to-be-announced, some portion of a pending pool of as-yet unspecified mortgages]. The entire purpose of the TBA market is to provide liquidity to something that is, at its core, completely and totally illiquid. A mortgage loan is about as static as it gets in banking.

The manipulation of interest rates by central banks must at some point backfire. First of all because, as I wrote not long ago, if a market cannot set interest rates, it is by definition dysfunctional, since there’s no way to tell which asset is worth what price. That is of course the reason why the Fed suppresses rates: so highly indebted TBTF corporations can borrow at gutter-scraping rates, and made to look like they’re doing just fine, thank you. But the manipulation also drags down rates that those corporations once used to make money with, so the ‘policy’ is essentially self-defeating from the get-go.

It’s all just a matter of time. And the players in the financial world would like to pride themselves on being able to get the timing right. A tempting self-image for those who make millions a year, and think that means they’re smart. In fact, they’re not, and it all only works as long as the Fed makes up for their losses. Which it will no longer be able to do once upward pressure on interest rates becomes too strong. Or US housing and retail, together good for over 70% of GDP, plunge too much. As they inevitably must, precisely because of the near-freezing-point rates the Fed has set. It’s a closed circuit vicious circle. To put it mildly: we may be close. As for what to expect from the Fed going forward, count on it being found wanting, a lot. And count on the real economy, here’s looking at you, being the real victim, not the broke(n) financial institutions the Fed is tasked with saving. David Stockman:

Financial Storm Chasing With Blinders On: How The Fed Is Driving The Next Bust

The latest iteration of the Fed’s meeting minutes is surreal. Its another economic weather report consisting of trivial, random observations about the quarter just ended that are as superficial as CNBC sound bites. Along with that prattle comes guesses and hopes about the next 30-90 days—including the expectation that the weather will “seasonally normalize” and that auto production schedules, for instance, which were down in March, will stabilize at that level “in the months ahead”. Likewise, after noting that consumption spending moved “roughly sideways” during January and February, it detected that “recent information on factors that influence household spending were positive” – a guess that turned out to be wrong based on data we already know from April retail sales.

The data on new and existing home sales had indicated the continuation of a 5-month trend of sharp drops from prior year, but the minutes could muster only an on-the-one-hand-and-on-the-other-hand whitewash, accented with hopeful indicators on single-family permits and pending home sales. Business investment was treated the same way – that is, it was down in the first quarter but “modest gains” are expected soon based on sentiment surveys. And as you read further the noise just keeps getting more foolish, including the hope that the negative net export performance in Q1 would be off-set by improving global developments. That fond hope included this doozy: “In Japan, industrial production rose robustly, and consumer demand was boosted by anticipation of the April increase in the consumption tax.”

… the monetary politburo does indeed believe that it can steer our $17 trillion economy on a month-to-month basis, and attempts to do so with primitive “in-coming” data from the Washington statistical mills that is so tentative, imputed, guesstimated, seasonally maladjusted and subsequently revised as to be no better than anecdotal sound bites.[..] … its one size fits all control panel includes only interest rate pegging, risk asset propping and periodic open mouth blabbing by Fed heads. But these are no longer efficacious tools for driving the real Main Street economy because to boost the latter above its natural capitalist path of productivity and labor hours based growth requires artificial credit expansion – that is, a persistent leveraging up of balance sheets so that credit bloated spending rises faster than production and income.

I know many, if not most, people see Nicole and I as doomers and pessimists, and if only we did what Shinzo Abe told the Japanese to do: believe in Abenomics, things would be alright, since pessimism is such an corrosive attitude. But if pessimism means refusing to look the other way when confronted by lies, manipulations and tens of trillions in hidden losses, I guess we must accept the label, perhaps even with a shot of pride. Still, of course I realize that as the picture of the new America emerges and it’s not a rosy one, there are always plenty of sources to turn to that will serve a dose of optimism at demand.

The best thing I can do, as always, is to say: look at the data. What do you think you see? I can tell you what I see, and what I’ve been seeing for years, is a load of debt so gigantic that not restructuring it could only have been the worst possible decision, and yet it was made. The fact that this didn’t only happen stateside is no comfort, it just makes things worse: no-one left to unload your debt on. The Fed, the government and the media have ‘shielded’ Americans (and Europeans, and Japanese) from their own reality for many years now, so they wouldn’t notice how private debt was transferred to them. Retail and housing appear to be indicating that is not an effective strategy anymore, people overall are too stretched and stressed financially. What comes next is a scary thing to ponder. But it’ll be a new America, that’s for sure.