Courtesy of Mish.

A couple of recent reports will help put the bifurcated US home "recovery" in perspective.

Priced Out

First, please consider Many Seek New Homes Near Cities but are Priced Out

The average price of a newly built home nationwide has reached $320,100 — a 20.5 percent jump since 2012 began. That puts a typical new home out of reach for two-thirds of Americans, according to government data.

Yet many builders have made a calculated bet: Better to sell fewer new homes at higher prices than build more and charge less.

Their calculation is partly a consequence of the growing wealth gap in the United States. Average inflation-adjusted income has declined 9 percent for the bottom 40 percent of households since 2007, while incomes for the top 5 percent exceed where they were when the recession began that year, according to the Census Bureau.

Buyers have historically paid about 15 percent more for a new home than for an existing one, a premium that's reached 40 percent today, according to the real estate data firm Zillow. An average new home costs about six times the median U.S. household income. Historically, Americans have bought homes worth about three times their income.

Construction has yet to rebound with vigor. Just 433,000 new homes were sold on an annualized basis in April. Over the previous half-century — when the United States had a smaller population — annual sales had averaged 660,000.

Sales of Priciest 1% Homes Soar (Bottom 99% Down)

Second, please note that a Redfin research luxury report shows Sales of Priciest 1% of Homes Climb While Rest of Home Sales Still Down

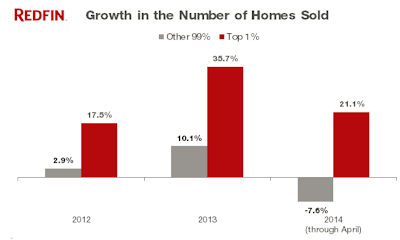

Home sales so far this year are lower than they were in 2013, but there’s one sliver of the housing market that’s going strong: the very top of it. Sales of the priciest 1 percent of homes are up 21.1 percent so far this year, following a gain of 35.7 percent in 2013. Meanwhile, in the other 99 percent of the market, home sales have fallen 7.6 percent in 2014.

Nationwide Sales