Monetizing QE bonds

Courtesy of Sober Look

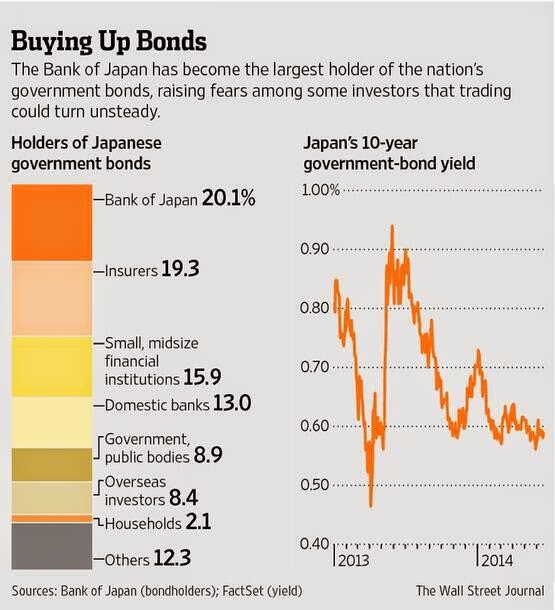

Congratulations go to the Bank of Japan who is now the largest holder of the nation’s government bonds. But no worries. This week Lord Turner of Ecchinswell, a former chairman of the UK’s Financial Services Authority (FSA) suggested that the bonds the Bank of England purchased as part of QE should be “monetized”. The bonds would remain permanently on the central bank’s balance sheet without the government ever paying them off. Of course it’s unlikely to happen in the UK in the near future, but Japan looks like a perfect candidate for monetization.