Wow, that was a close one!

Wow, that was a close one!

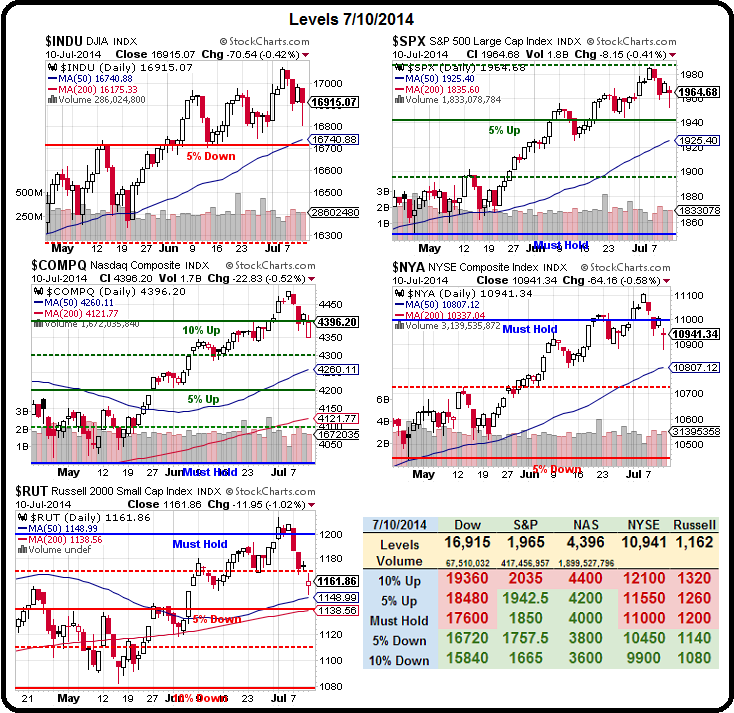

We ALMOST had a correction but, fortunately, dip buyers prevailed and we pulled a sharp reversal right after the bell yesterday and finished the day only down about 0.4% and about 2.5% down for the week (so far).

I do hate to be nit-picky about these things but – can we REALLY call it a reversal when, in fact, declining volume on the NYSE was 2,275,176,430 while advancing was only 834,544?

That's 3:1 declining! In fact, of the 3,241 shares on the NYSE, only 964 were positive yesterday – also 3:1 against. The same on the broader Nasdaq too.

In fact, yesterday was a complete catastrophe other than the low-volume "rally" from 10am to 2pm, with the other 75% of the day's volume being all downhill from 9:30 to 10:00 and again from 2pm to close (4pm EST).

In fact, yesterday was a complete catastrophe other than the low-volume "rally" from 10am to 2pm, with the other 75% of the day's volume being all downhill from 9:30 to 10:00 and again from 2pm to close (4pm EST).

Still, as the great President Bush once said: "fool me once, shame on — shame on you. Fool me — you can't get fooled again."

Of course, an even greater President, Lincoln (who had himself shot when he found out he was a Republican) actually said that you can, indeed fool some of the people all of the time and the stock market is certainly evidence of that, as dip buyers rush in on anything that even looks like it might be a rally – no matter how much of a charade it actually is.

You can see our predicted 1,150 line come into play on Dave Fry's Russell Chart but it doesn't show that the Russell Futures made it all the way down to 1,140 before being jammed back to 1,165 and, finally, settling the day at 1,160.

You can see our predicted 1,150 line come into play on Dave Fry's Russell Chart but it doesn't show that the Russell Futures made it all the way down to 1,140 before being jammed back to 1,165 and, finally, settling the day at 1,160.

As Dave points out, we're still down 4% for the weak week and all yesterday's action really was was a WEAK bounce off a 5% dip (1,200 to 1,140), which is EXACTLY what our 5% Rule™ predicted would happen.

Those TZA August $14 calls I told you about on Tuesday, when they were .91, topped out at $1.82 in the morning for an exact double – very good money for two day's work and a great offset for a quick dip. The main purpose of our hedges is to allow us to ride out a quick downturn and see if there is, indeed a real trend in play. So far, there isn't – not on the surface anyway.

And it's all about appearances in this market – no one seems too concerned about HOW we make our levels – as long as we make them. Fundamentally, I expect a full correction on the Russell back to 1,100 by the end of the month, but I am willing to revise my bearish prediction should earnings come in better than expected, especially retail. Speaking of retail – we shorted XRT two different ways last Tuesday, in our Live Member Chat Room, with me saying at 10:33 am:

XRT/DM – Thank you, I did want to add them. $88 is too beaucoup for XRT (and $50 was too beaucoup for GPRO it seems) and I like 5 Aug $86 puts at $1.10 in the $25KP and, in the STP, let's pick up 10 of the Sept $93/88 bear put spreads for $3.20 ($3,200) with $1,800 of upside (56%) if XRT simply stops going up here.

As you can see from the chart, our entry was well-timed and the Aug $86 puts are already $1.60, up $200 (45%) on 5 contracts in our $25,000 portfolio – where we specialize in small, affordable trades that fit in anyone's budget. The $3,200 spread is very much "on track" for the full $1,800 gain – as long as XRT does not recover $88 by September. Already the spread is $3.70, also up .50 per contract ($500), but just 15% on the more conservative, longer-term play (so far).

This is one of the reasons we keep 5 different virtual portfolios at Philstockworld, we can practice different strategies for different portfolio types as well as different levels or risk tolerance. Our Income Portfolio, for example, is risk-intolerant, as it's made for retirement accounts and simply seeks to gain 10% a year as safely as possible, with a tremendous amount of self-hedging in the positions. That portfolio is right on track, up 6.6% for the year.

This is one of the reasons we keep 5 different virtual portfolios at Philstockworld, we can practice different strategies for different portfolio types as well as different levels or risk tolerance. Our Income Portfolio, for example, is risk-intolerant, as it's made for retirement accounts and simply seeks to gain 10% a year as safely as possible, with a tremendous amount of self-hedging in the positions. That portfolio is right on track, up 6.6% for the year.

Our more aggressive Long-Term Portfolio (also $500,000) is down just a bit this week but still up 18.8% for the year and it is hedged by our $100,000 Short-Term Portfolio, which offsets the LTP's losses nicely and finished the day up 8.2% – which is exactly how they are designed to work together! Our Butterfly Portfolio ($100K) really doesn't care what the market does, and it's up 20.4% at the moment while the aforementioned $25,000 Portfolio is up 10.5% so far.

We reviewed all of our positions in Tuesday's Live Webinar and we weren't worried then and we're not worried now because, on the whole, we're very well balanced. If you are not well-balanced and were worried as the market dipped yesterday morning, consider this morning to be an opportunity to hedge a bit more or, at least – to lighten up on your bullish positions and get to more cash. Earnings season is here and things could get pretty rough!

We reviewed all of our positions in Tuesday's Live Webinar and we weren't worried then and we're not worried now because, on the whole, we're very well balanced. If you are not well-balanced and were worried as the market dipped yesterday morning, consider this morning to be an opportunity to hedge a bit more or, at least – to lighten up on your bullish positions and get to more cash. Earnings season is here and things could get pretty rough!

BALANCE is the key to enjoying your trading experience. As Mr Miyagi said:

"Better learn balance. Balance is key. Balance good, trading good. Everything good. Balance bad, better pack up, go home. Understand?"

Well, that's sort of what he said. Words to live by nonetheless.

Have a great weekend,

– Phil