We discussed them way back in December as they faked their own GDP data, that it was nothing more than window-dressing to keep them from LOOKING like they were in default – even though they were clearly heading that way.

So it should come as no surprise that, as the deadline finally comes, there is no surprising rescue for the World's 26th largest economy ($477Bn vs $499Bn for Norway, $394Bn for Austria, $385Bn for Thailand and $248Bn for Greece). Since it's not a surprise, we took the opportunity this morning to go long in the Futures, as the 1% dip around 4am seemed overdone. I sent out a special Alert to all of our Members, saying:

Still, I like /TF for a bullish over the 1,130 line (testing now) and /YM at 16,700 and /ES 1,950 for bounces but VERY TIGHT STOPS if any of them fail.

Fortunately, they did not fail and already (8am) we have /TF 1,135 (up $500 per contract), /YM 16,732 (up $160 per contract) and /ES 1,955 (up $250 per contract) and our Egg McMuffins are paid for and those trades are now off the table (tight stops at least), as we expect more selling at the open!

Fortunately, they did not fail and already (8am) we have /TF 1,135 (up $500 per contract), /YM 16,732 (up $160 per contract) and /ES 1,955 (up $250 per contract) and our Egg McMuffins are paid for and those trades are now off the table (tight stops at least), as we expect more selling at the open!

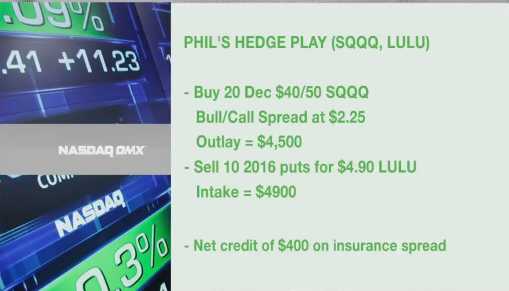

It's nice to play the Futures to offset bearish bets, like the SQQQ (ultra-short Nasdaq) trade we discussed in yesterday's morning post and the QQQ weekly $96 puts we added for .22 in yesterday's live Member Chat ahead of the Fed – as we expected the statement would disappoint. Those should come out well this morning and going long on the Futures locks in those potential gains for us.

Now, getting back to Argentina, ARGT is UP 32% this year and that is just silly so ARGT makes a nice short at $23.20 and you can, in fact, buy the Oct $23 puts for $1.45 and, if they give back that 32%, they'll be back to $19 and you'll have $4+ for a $2.55 gain (175%) – that's a fun way to play it.

I discussed other ways to play the market yesterday on Money Talk, where we reviewed my Trade of the Year (AAPL), which is already at $104,650 from the $24,000 initial cash outlay so up $80,650 (336%) in 6 months (March is when I last went on the show- we picked the trade for our Memmbers in January – you can become a Member here if you want to get picks like this every day).

I discussed other ways to play the market yesterday on Money Talk, where we reviewed my Trade of the Year (AAPL), which is already at $104,650 from the $24,000 initial cash outlay so up $80,650 (336%) in 6 months (March is when I last went on the show- we picked the trade for our Memmbers in January – you can become a Member here if you want to get picks like this every day).

Since the trade was only designed to max out at $150,000 in Jan 2016 – even though it's on track for another $45,000, we decided to take the quick 336% off the table and wait for a pullback to re-enter a more aggressive AAPL spread (stay tuned for that announcement), where we can use just a portion of our profits to make far more than $45K if all goes well. For now, in line with our market outlook – CASH IS KING!

For yestereday's TV spot, we also discussed a similar percentage play on GTAT but, much more importantly, we discussed that SQQQ hedge I keep reminding you of, using LULU as a bullish offset to pay for the $20,000 portfolio protection. Hopefully today's market action will remind people how important it is to have a hedge like this protecting their portfolios.

For yestereday's TV spot, we also discussed a similar percentage play on GTAT but, much more importantly, we discussed that SQQQ hedge I keep reminding you of, using LULU as a bullish offset to pay for the $20,000 portfolio protection. Hopefully today's market action will remind people how important it is to have a hedge like this protecting their portfolios.

CASH!!! has been a fantastic protector of our portfolios and yesterday, our Long-Term Portfolio officially crossed the +20% mark for the year, even as our Short-Term Portfolio popped 15%, which is very nice since the STP is there to protect the LTP, so making money on both ends is a big bonus for us! Our other Virtual Portfolios will be evaluated today but none are heavily invested – but that doesn't mean we're willing to lose the money we do have committed.

With the Dollar popping 2% this month, our sideline cash is doing better than our positions and that's NOT the kind of trend you want to see if you are a market bull. HOWEVER, we're not expecting too deep a correction before the Central Banksters rush in to save us (the top 1%) yet again with yet another free money scheme – God bless their black little hearts!

Be careful out there,

– Phil