Fed Minutes Today (2pm).

Fed Minutes Today (2pm).

That gives the bullish pundits another chance to read the tea leaves and promise MORE FREE MONEY to those who are silly enough not to be fully invested in stocks. As you can see from Dave Fry's SPY chart, only 56.7M shares were transacted yesterday and nearly half of those people were selling.

Perhaps 10% more buys than sells is 5.7M shares at $198.28 means it cost just $1.1Bn to move the $60Tn markets up 0.5% ($300Bn) – now that's leverage! With a lack of participation, those few buyers can really shove the markets around. Also, as Dave noted:

Hobson owned a livery stable and he rotated his horses to different stalls. He offered customers the choice of taking the horse in the first stable or none at all. Henry Ford also offered a variation of Hobson’s Choice since customers could buy a car in any color they liked, as long as it was black. The stock market offers many choices but only stocks are effective as bonds offer no yield while Fed policies have forced investors to stocks or nothing else.

This is basically the issue for investors in financial markets, buy stocks or nothing else. Farmland is admittedly in a bubble as Iowa farmland now goes for $8,500 per acre. If you can buy it right, some residential real estate offers a decent rental yield. Then there is the weird world of collectibles where you really need to know what you’re doing and have adequate cash.

So stock markets remain in play at least for most institutions. We’ve seen heavy volume sell-offs meaning most retail investors continue to loathe and leave markets. It remains a market for captive retirement money and institutions including financial and hedge funds.

Lack of choice has pushed our indexes up 1.5% in the first two days of the week, albeit on no volume, and now the S&P faces a big test of that 1,984 top we hit in mid-July – just before we plunged all the way back 5% to 1,900.

Lack of choice has pushed our indexes up 1.5% in the first two days of the week, albeit on no volume, and now the S&P faces a big test of that 1,984 top we hit in mid-July – just before we plunged all the way back 5% to 1,900.

Of course, the catalyst for the fall at the time was Putin moving into the Ukraine and ISIS attacking in Iraq and Hamas attacking Israel — thank goodness all those things are fixed, right? Now we only have race riots in Ferguson to worry about, along with some anemic Economic Data – what, us worry?

What I do worry about is how shallow this recovery really is. Endless Free Money pumped out by the Fed doesn't trickle down to the bottom 90%, the money has generally gone to top 1% Corporatation, who use it to buy smaller Corporations (putting even more people out of work and decreasing competition) as well as their own stock (narrowing the ownership even more to the top 1%) and, of course, to buy politicians who vote to continue this madness.

We've had $12 TRILLION worth of stimulus in the US economy since 2009, enogh to hand each of our 300M citizens $40,000 in cash yet the average worker's salary has gone up one-half of one percent over 5 years (and 90% of those gains went to the top 10%). Over the past year, lower-wage industries such as retail, wait staff and home health aides accounted for 41 percent of the positions created. Overall, since the recession lower-wage jobs have grown by 2.3 million while medium- and higher-wage jobs actually contracted by 1.2 million, the NELP said.

This, of course, argues for the Fed to keep up their easy money policies in the HOPES that the top 1% will take the next Trillion or so they are given and spend a little of it to hire some workers. But they are not – they are spending thier money, if at all, on robots to permanently get rid of those pesky money-wanting workers. Check out these great examples (thanks Advill).

This, of course, argues for the Fed to keep up their easy money policies in the HOPES that the top 1% will take the next Trillion or so they are given and spend a little of it to hire some workers. But they are not – they are spending thier money, if at all, on robots to permanently get rid of those pesky money-wanting workers. Check out these great examples (thanks Advill).

The joke on the workers is (aside from being made obsolete) that they are the ones PAYING for all this stimulus as it generally ends up being Governement debt, which forces the Government to raise taxes (and I bet your lobbyist hasn't done a good job making sure tax increases don't affect you) and cut services – even when those "services" are entitlements that the workers have been contributing to, like Social Security and Medicare.

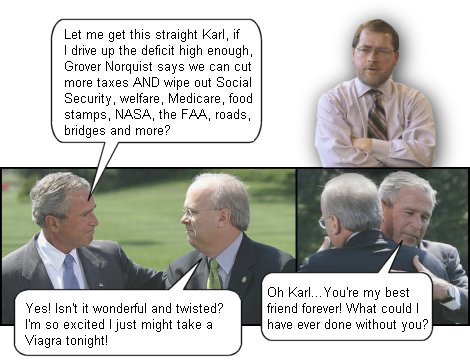

This is a policy championed by GOP Strategist, Grover Norquist called "Starving the Beast" in which Conservatives in power run up the deficits (through wars and tax cuts) in order to back future administrations into a corner where austerity (and smaller Government with less of those pesky regulations) seems like the only option.

This is a policy championed by GOP Strategist, Grover Norquist called "Starving the Beast" in which Conservatives in power run up the deficits (through wars and tax cuts) in order to back future administrations into a corner where austerity (and smaller Government with less of those pesky regulations) seems like the only option.

Once upon a time in America and Europe, we solved economic hardships by funding big Government projects that put people to work building things that would have lasting benefits like railroads, highways, dams and bridges – things that would last and benefit future generations. Now we have a Government that has cut spending while people are out of work while all the "stimulus" goes to those who need it the least.

Do you really think this is the kind of economic "recovery" that will last?

If not – be very careful out there!