S&P 2,000 – YAY!!!

S&P 2,000 – YAY!!!

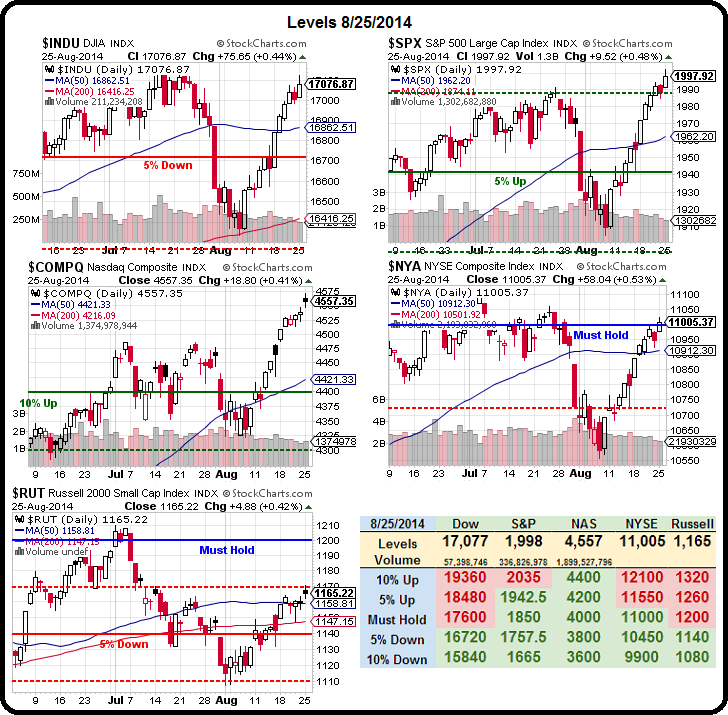

We did it, congratulations, fantastic, go markets! OK, now what? Now we'll see if we can pop 17,160 on the Dow, which is 2.5% below the Must Hold Line on our Big Chart. We also need to firm up over 11,000 on the NYSE (another Must Hold Line) and then we'll be looking for 1,200 on the Russell and 17,600 on the Dow and THEN we are into the next leg of our rally.

Until then, we need to be just a little bit cautious. Fortunately, we already placed our hedges and now we're ready to BUYBUYBUY off our Buy List as well as 10 new bullish trade ideas we'll be discussing in today's Webcast (1pm, EST). This one is going to be Members only though, as we're picking new positions for our portfolios.

As you can see from our Big Chart, the Russell is our lagging index and has already been to the promised land over 1,200. That's why, last Thursday morning in our Live Member Chat Room, we added an aggressive long using TNA, the ultra-long Russell ETF:

With TNA at $73.30 today, the same logic applies and the Sept $72.50/76.50 bull call spread is $2 and the Sept $68 puts can be sold for $2 to offset or maybe the ABB March $24 puts at $2 instead. As with last month, this isn't a portfolio play for us as we're already very bullish in the portfolios – this is to cover yourself if you think you are too bearish and a pop over the highs will kill you.

It's only been 3 sessions but TNA has already popped to $75.10 and the Sept $68 puts have already fallen to $1.30 and the spread is now $2.40 for net $110 gained per contract – up infinity from the net zero cash basis! The ABB puts are a little slower moving at $1.50, but still very nice for a more conservative play.

I'd take that $110 per contract and run though as it's a nice 3-day profit and pays for our additional bearish hedges – which is all we ever wanted to accomplish. If we do take out 2,000 and hold it today and if the NYSE does hold 11,000 – we can certainly add another combination like this to give us a fantastic return if TNA is going to head back to the $80s. For now, though, we're going to watch and wait.

We're expecting a nice pop off the Durable Goods Report as Boeing deliveries should give us a good headline. We're getting housing data at 9 but it's June reports – so actually meaningless but Consumer Confidence at 10 am will be telling – below 90 would be very disappointing. To that end, we do want to short into a pop, hopefully at Dow 17,100 (/YM Futures) and, of course, /ES 2,000 (S&P Futures).

We're expecting a nice pop off the Durable Goods Report as Boeing deliveries should give us a good headline. We're getting housing data at 9 but it's June reports – so actually meaningless but Consumer Confidence at 10 am will be telling – below 90 would be very disappointing. To that end, we do want to short into a pop, hopefully at Dow 17,100 (/YM Futures) and, of course, /ES 2,000 (S&P Futures).

8:30 Update: Durable Goods orders are up 22.6%!!! That's the headline but, ex-aircraft/transports, they are down 0.8% – as we expected. That's going to keep us shorting on the Futures and our morning lines (see Live Member Chat – and you can join HERE) were:

We have /YM 17,058, /ES 1,995, /NQ 4,066 and /TF 1,163 and I still like /YM short below 17,050 (same sequence as yesterday) as long as /ES below 1,995, /NQ below 4,065 and /TF below 1,165 but, like yesterday, it's very likely the go for 2,000 again, so just going for quick money.

Ex-Transport, those durable goods numbers are back to the lows of the year. The big number is from the recent air show, where BA crushed it in the order department but imagine how BAD the headline number will be next month compared tot his month – let's keep that note on our calendar for the Sept report.

Ex-Transport, those durable goods numbers are back to the lows of the year. The big number is from the recent air show, where BA crushed it in the order department but imagine how BAD the headline number will be next month compared tot his month – let's keep that note on our calendar for the Sept report.

We're going to wait for those lines to cross, of course, we still may stay up into Consumer Confidence (10am) and that's going to be tricky as gas prices have come down a bit and the market is up, so people might be a bit more confident.

Also, of course, there is a big push to get the S&P up to that 2,000 line. We got there on SPY yesterday (see Dave Fry's chart), but the volume is anemic and all the gains came in the Futures, with selling the rest of the day – a real sucker's rally.

Speaking of suckers, check out this BAML chart that clearly outlines the march of the bag-holders into equities as Institutional Investors have been running for the exits.

Speaking of suckers, check out this BAML chart that clearly outlines the march of the bag-holders into equities as Institutional Investors have been running for the exits.

I know the bulls think the Institutions are wrong and they will come back and cause a massive rally but the Hedge Funds have joined the Institutions in heading for the exits while the Retail Traders have been BUYBUYBUYing for 18 months – taking the S&P up 33%.

Don't worry retail traders – I'm sure you are much smarter than professional investors and the rally will last forever – nothing to worry about at all, please continue to ignore all bad news and have 100% faith that the Fed will fix everything, forever and ever – Hallelujah!

Faith consists in believing when it is beyond the power of reason to believe. – Voltaire