What a fantastic ride!

What a fantastic ride!

As you can see from Dave Fry's intraday SPY chart, we had that big, fake pop at the open which I told you to short (see yesterday's post) and we had a fantastic ride down until 1pm and we turned up about a half hour later but not before giving us some very nice gains from our morning short picks in our Live Member Chat Room:

- /NKD (Nikkei Futures) fell from 15,800 to 15,700 – up $500 per contract

- /YM (Dow) fell from 17,120 to 17,000 – up $100 per contract

- /ES (S&P) fell from 2,005 to 1,993 – up $350 per contract

- /NQ (Nasdaq) fell from 4,093 to 4,078 – up $300 per contract

- /TF (Russell) fell from 1,179.50 to 1,171.50 – up $800 per contract

As usual, the Russell was the most fun and this morning we already hit it again as it popped to 1,187.50 and back to 1,183.50 for a nice $400 per contract pre-dawn gain (so far). We prefer to take short pokes on the Futures as we're still generally long in our Member Portfolios, so it's better to balance our off-hours picks. On the whole, the way this market is going – it's probably easier just to go long off the bottoms!

As usual, the Russell was the most fun and this morning we already hit it again as it popped to 1,187.50 and back to 1,183.50 for a nice $400 per contract pre-dawn gain (so far). We prefer to take short pokes on the Futures as we're still generally long in our Member Portfolios, so it's better to balance our off-hours picks. On the whole, the way this market is going – it's probably easier just to go long off the bottoms!

We are long Silver Futures (/SI) at $19.20 and Gold Futures (/YG) at $1,270 but tight stops below those lines and only if the Dollar is below 83 (now 82.88). Futures can give you some fantastic, quick gains – but also have the potential to deal devastating losses as well.

This morning's pop in the Futures came on news of a cease-fire in the Ukraine, which sent the EU markets flying at the open but it seemed like the usual political nonsense to us and that's why we shorted into the excitement. Even as I write this (7:30), we're down to 1,182 on the Russell (/TF) futures (stop at 1,182.50) and now looking for some real breakdowns on the Dow (target 17,100), S&P (target 2,005) and the Nasdaq (target 4,100) to confirm a bigger downtrend and start shorting again.

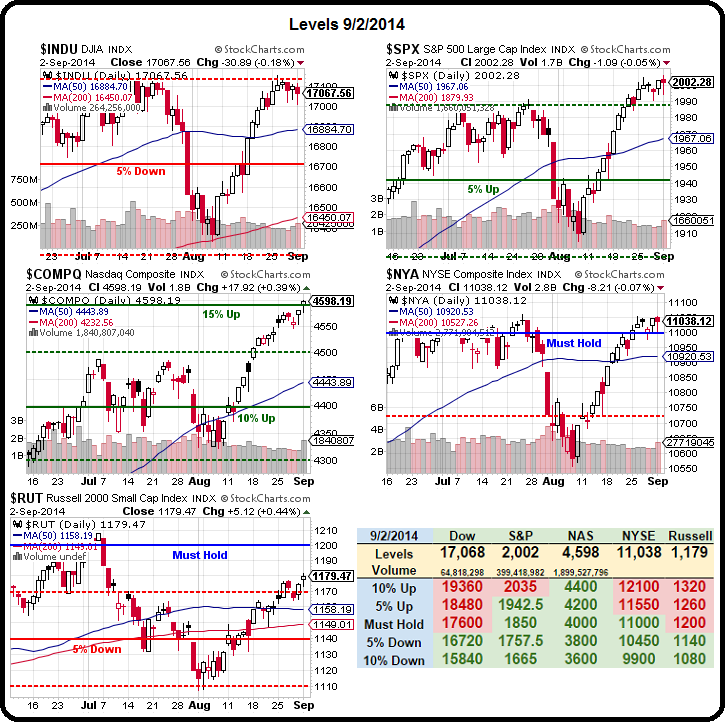

As long as we're holding 3 of our 5 "Must Hold" levels on the Big Chart, we remain long-term bullish but we are generally shorting the Nasdaq at this level (4,100 on the 100 and 4,600 on the Composite) as it's a bit silly and a pullback in AAPL, which we're also long on, will devastate the index. If there is a bubble – like 1999, this index is going to be bubble central.

As long as we're holding 3 of our 5 "Must Hold" levels on the Big Chart, we remain long-term bullish but we are generally shorting the Nasdaq at this level (4,100 on the 100 and 4,600 on the Composite) as it's a bit silly and a pullback in AAPL, which we're also long on, will devastate the index. If there is a bubble – like 1999, this index is going to be bubble central.

While there has been much debate about the relative p/e of the S&P 500, which has somewhat been able to justify it's rise because the component companies have, through stock buybacks and M&A activity, decreased the total amount of shares the generally flat earnings are divided by. That has kept the p/e of the S&P 500 well below the 1999 bubble levels and makes a good, bullish case.

The Nasdaq, however, has seen its p/e ratio TRIPLE since early last year and, while we are nowhere near the insane 150 times earnings that were being thrown at dot com companies back in the day, we're still at a pretty unreasonable p/e of 45 on the Nasdaq. That's 45 YEARS that it takes the average Nasdaq company to make back the money you are paying for each share of their stock.

The Nasdaq, however, has seen its p/e ratio TRIPLE since early last year and, while we are nowhere near the insane 150 times earnings that were being thrown at dot com companies back in the day, we're still at a pretty unreasonable p/e of 45 on the Nasdaq. That's 45 YEARS that it takes the average Nasdaq company to make back the money you are paying for each share of their stock.

As interest rates go, you are getting just over 2%. While that may be better than your bank, it's not better than the S&P, which, with dividends, is paying you about 5% to park your money there. The Nasdaq is in bubblicious territory simply because it is a much smaller index (in market cap) than the S&P and a disproportionate allocation of capital has been finding it's way into even the worst of the Nasdaq components, courtesy of a surge in index fund investing.

What kind of idiot is paying $286 a share for TSLA? Why you are – if you are putting money into QQQ or one of a dozen other index funds (including solar funds) it is a part of. The same goes for AMZN and their magical 543 p/e. That's right, it will take AMZN 543 years to make $342 per share at the current rate but at least, unlike TSLA, they are actually making money!

What kind of idiot is paying $286 a share for TSLA? Why you are – if you are putting money into QQQ or one of a dozen other index funds (including solar funds) it is a part of. The same goes for AMZN and their magical 543 p/e. That's right, it will take AMZN 543 years to make $342 per share at the current rate but at least, unlike TSLA, they are actually making money!

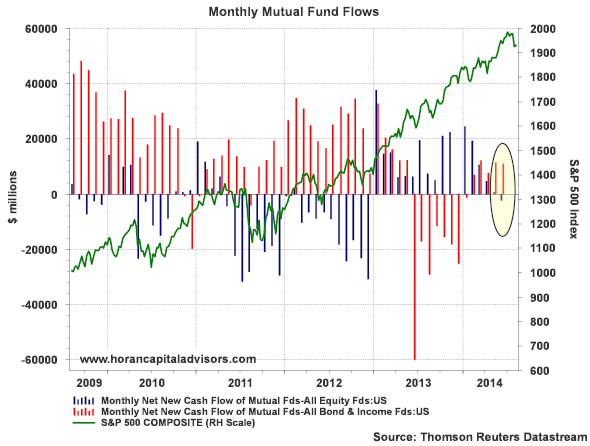

As you can see on the Fund Flow chart, all those "stimulus" Dollars that the Central Banks have been pumping out to the top 1% have not gone to create new jobs or to buy property, plant or equipment to increase production – it has simply put Trillions and Trillions of Dollars back into the stock market, which is why the price of all the indexes is rising so much faster than the actual earnings – there is simply more money around than there are places to put it.

So, while we are VERY skeptical of the merits of this rally, we're also not going to fight the Fed or the other Central Banksters as long as the money keeps flowing in. That's why, yesteray, our Live Trading Webinar was focused on 15 new BULLISH, long-term trade ideas for our Buy List and we'll be adding one or two of those each week those Must Hold lines hold up into the end of the year BUT FIRST – how about we see ONE, SINGLE DAY in which the S&P actually holds 2,000?

"What?" you may ask, "Haven't we been over 2,000 for over a week?" Actually, the truth is, just like yesterday's intra-day chart – we get pumped up over 2,000 for each open, sell off during the day and then get pumped back over it at the close. EVERY DAY. This is not what a strong market looks like – this is what a SCAM looks like:

| Date | Open | High | Low | Close | Volume | Adj Close* |

|---|---|---|---|---|---|---|

| Sep 2, 2014 | 2,004.07 | 2,006.12 | 1,994.85 | 2,002.28 | 2,819,980,000 | 2,002.28 |

| Aug 29, 2014 | 1,998.45 | 2,003.38 | 1,994.65 | 2,003.37 | 2,259,130,000 | 2,003.37 |

| Aug 28, 2014 | 1,997.42 | 1,998.55 | 1,990.52 | 1,996.74 | 2,282,400,000 | 1,996.74 |

| Aug 27, 2014 | 2,000.54 | 2,002.14 | 1,996.20 | 2,000.12 | 2,344,350,000 | 2,000.12 |

| Aug 26, 2014 | 1,998.59 | 2,005.04 | 1,998.59 | 2,000.02 | 2,451,950,000 | 2,000.02 |

| Aug 25, 2014 | 1,991.74 | 2,001.95 | 1,991.74 | 1,997.92 | 2,233,880,000 | 1,997.92 |

| Aug 22, 2014 | 1,992.60 | 1,993.54 | 1,984.76 | 1,988.40 | 2,301,860,000 | 1,988.40 |

As the great GW Bush once said: "Fool me once, shame on you – fool me, you can't get fooled again." Don't be a fool – let the market PROVE it deserves to be here, let Draghi SHOW US THE MONEY tomorrow – not just talk about it, before we commit more of our capital at these levels.

Be careful out there.