Today is the day.

Today is the day.

There’s a lot riding on Apple’s massive iPhone 6 and iWatch event. Since the first iPad in 2010, the big question on everyone’s mind has been “what comes next?” Apple updates its lineup on a fairly predictable schedule, but products that push the company into entirely new categories have been few and far between.

That hasn’t hurt Apple financially by any stretch; in fact, it continues to make more on each device it sells than just about anyone. Still, a constant stream of promises from Apple’s top execs have drawn out the idea that something big is just around the corner. That something big is very likely making its debut at Apple’s event next Tuesday, which kicks off at 1pm EST / 10am PST and we'll be covering it live today during our Live Trading Webinar (1pm EST).

/cdn3.vox-cdn.com/uploads/chorus_asset/file/688024/17.0.jpg) On top of the rumor pile are expectations for:

On top of the rumor pile are expectations for:

- Bigger IPhones (to go after Samsung market share) + 10%

- NFC and Mobile Payments (transaction revenues) + 20%

- iOS8 (pushing iCloud) + 5%

- iWatch (new product) + 20%

- Apple TV (home integration) + 10%

So those are the most likely announcements and they have the POTENTIAL (if all goes well) to add 65% to AAPL's already massive market cap. Just enough, in fact, to make AAPL the world's first $1Tn company in 2016. We're already playing AAPL bullish in two of our PSW Portfolios but we have been since they were $450 ($64 post-split) and we're already up 50% (AAPL was our Stock of the Year selection), so we hedged a bit at $105.

The question for us is – do we remove those hedges in anticipation of AAPL's 2 consecutive 30% annual runs that we are predicting but, with AAPL already up 25% this year at $100 and having already been rejected at 30% ($105), we're keeping our partial cover – at least until we see the public's reaction to the new product line.

The question for us is – do we remove those hedges in anticipation of AAPL's 2 consecutive 30% annual runs that we are predicting but, with AAPL already up 25% this year at $100 and having already been rejected at 30% ($105), we're keeping our partial cover – at least until we see the public's reaction to the new product line.

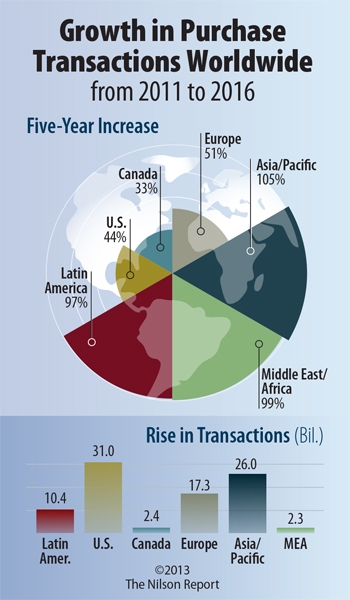

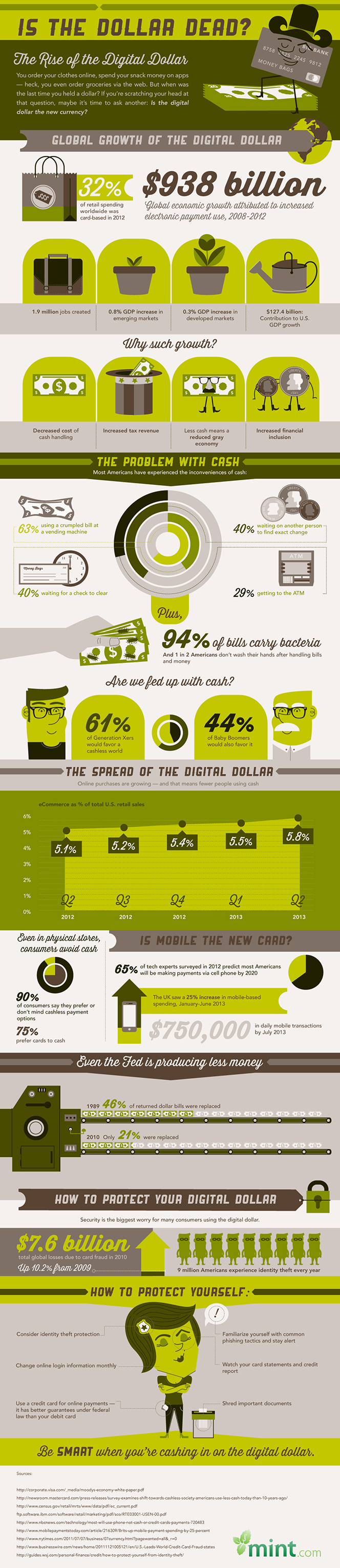

While it could be argued that a lot of good news is priced in, I think NFC/Mobile Payments is being completely missed along with the impact it will have on the company's revenues. Already there are talks of deals being in place with V, MC and AXP so it's not a question of WILL iPhones become a new way of making payments but how much payment volume they will generate.

The Big 3 credit card firms account for roughly $8Tn a year in transactions and AAPLs customers skew to the top 20% who spend 80% of that money so $6.4Tn paid by credit card and let's say, that iPhone users decide to use their phones for just 5% of those transactions and let's say AAPL gets just a 1% transaction fee for the process – that's still $3.2Bn dropping to their bottom line (+10%) – not bad at all!

The Big 3 credit card firms account for roughly $8Tn a year in transactions and AAPLs customers skew to the top 20% who spend 80% of that money so $6.4Tn paid by credit card and let's say, that iPhone users decide to use their phones for just 5% of those transactions and let's say AAPL gets just a 1% transaction fee for the process – that's still $3.2Bn dropping to their bottom line (+10%) – not bad at all!

But I gave them a +20% because I was at the mall last week and I gave my teenage girls $20 each and neither one of them had pockets and I was worried they would lose their money but I certainly wasn't worried they would lose their phones. I would have been much more comfortable transferring $20 to each of their phones to spend instead.

Now consider money transfers that can then be made by parents and grandparents around the world. Now what about employers to employees and now consider the Billions of people in the World with limited access to banks – but they have phones!

This is no small thing, this is likely to be World-changing. In theory, phone transactions will be more secure than credit card transactions, especially with biometric IDs added in. NFC systems are already at most of the places you shop as well as vending machines and now, any street vendor with a phone can accept money from your phone. You won't need money, or your wallet for that matter – just your phone — or your iWatch.

Ah ha – get it? See how AAPL is taking over the Universe? I know it sounds strange to think of not needing cash or credit cards (and there's no reason your IDs and insurance info can't be on your phone too, all safely cloned at home or the cloud in case you lose it) but remember when we needed to have our checkbooks with us? Some of you may even remeber needing billfolds or coin purses too!

In case you missed our earlier entries this year, we still love AAPL as a long-term play and you can still sell the 2016 $80 puts for $5 for a net $75 entry and that can be paired with the 2016 $100/120 bull call spread at $5.70 for net 0.70 on the $20 spread so you get almost all of the upside on a move over $100 (with a max profit of 2,757% on cash) and your worst case is you end up owning AAPL at net $80.70, which is 18% off the current price.

If AAPL is somehow disappointing today and the stock falls lower (and we're still expecting a broad market correction to give us better prices anyway), you should be able to get much better prices on this spread so I'd go light on the first round and, HOPEFULLY, we get a chance at a cheaper entry down the road.