The charts are getting ugly!

The charts are getting ugly!

Yesterday the Russell 2000 fell 1.2%, below the 50 day moving average and below the 200 day moving average which are about to form a "Death Cross", where the 50 dma moves below the 200 dma and is generally considered to be a bearish sign.

Of course, we've been telling you for weeks now that the markets were toppy but at least now it's getting obvious. The Fed may still pull a rabbit out of its ass and goose the markets once again but I very much doubt anything is going to stop the eventual correction now. Delay, maybe – stop, no.

Fortunately, we're well-positioned for this and our bearish, Short-Term Portfolio was up 50% on yesterday's dip while our bullish, Long-Term Portfolio held on to 21.2% of its gains for the year, giving us our best combined total for the year, even as the markets are pulling back. I'll be reviewing all of our Member Portfolios live this afternoon (1pm) in our Weekly Webinar (Members Only, but you can join right here). Our Members get trade ideas like this one (from our 9/2 Morning Alert):

Fortunately, we're well-positioned for this and our bearish, Short-Term Portfolio was up 50% on yesterday's dip while our bullish, Long-Term Portfolio held on to 21.2% of its gains for the year, giving us our best combined total for the year, even as the markets are pulling back. I'll be reviewing all of our Member Portfolios live this afternoon (1pm) in our Weekly Webinar (Members Only, but you can join right here). Our Members get trade ideas like this one (from our 9/2 Morning Alert):

If, however, you buy just $2,500 worth of the of the TZA Oct $13/16 bull call spread at $1 (25 contracts), they will pay you back $7,500 if TZA goes up about 15% (just a 5% move up in the RUT) AND they don't lose all their money until TZA is down 10% (a 3% move up in the RUT).

This is how we teach our Members how to hedge. As you can see, TZA crossed $15 yesterday and that spread is on it's way to a 200% gain already – a very nice offset against a relatively small drop in the Russell. This is how we can lean our portfolios just a little bearish and actually make more money as the market sells off than we did on the way up.

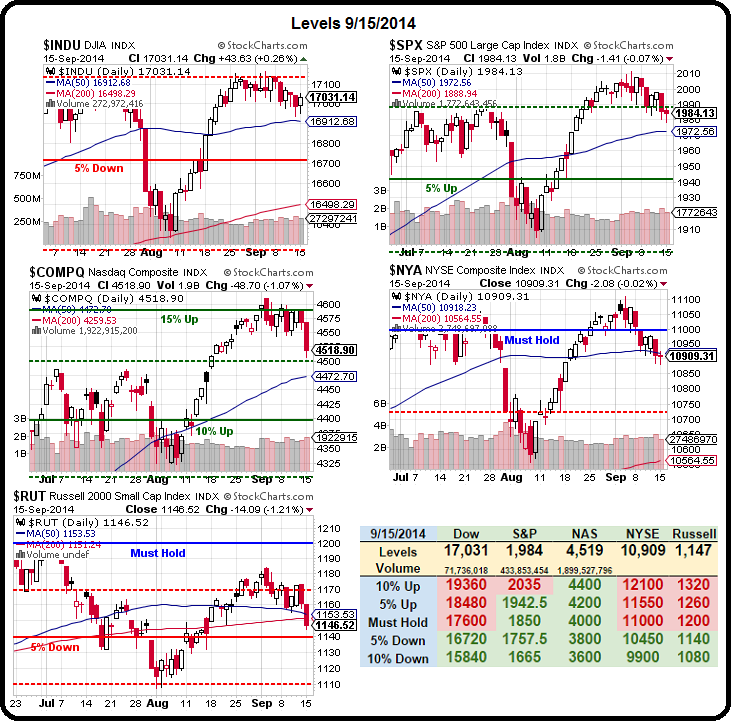

In the next day's post (9/3), we set our Futures shorts at 17,120 on the Dow (/YM), 2,005 on the S&P (/ES), 4,093 on the Nasdaq (/NQ), 1,179.50 on the Russell (/ES) and 15,800 on the Nikkei (/NKD). As of this morning, we have:

In the next day's post (9/3), we set our Futures shorts at 17,120 on the Dow (/YM), 2,005 on the S&P (/ES), 4,093 on the Nasdaq (/NQ), 1,179.50 on the Russell (/ES) and 15,800 on the Nikkei (/NKD). As of this morning, we have:

- Dow (/YM) Futures at 16,900 – up $1,040 per contract

- S&P (/ES) Futures at 1,973 – up $1,600 per contract

- Nasdaq (/NQ) Futures at 4,015 – up $1,560 per contract

- Russell (/TF) Futures at 1,137.50 – up $4,200 per contract

- Nikkei (/NKD) Futures at 15,840 – down $200 per contract

Hey, they can't all be winners but 4 out of 5 for net $8,200 in just two weeks is pretty good, right? All of those picks were also discussed in that Tuesday's Live Trading Webcast as well – the perks of being a Member! In that same morning's post I asked "What kind of idiot is paying $286 a share for TSLA?" We shorted the stock the next day with a target of $250, using the October $250 puts at $3. Yesterday we were able to cash them out for $11.50, up 283% in just two weeks with each $300 contract returning $1,150 – nice work if you can get it. As I said that Thursday:

So many suckers, in fact, that I can post trades like the ones above, which anyone can follow by simply reading our morning post – and they still make money. Usually (and we still usually do), you have to guard trades like that for fear of people taking advantage of your known position but, in this case, the market is being so blatantly manipulated and so many Trillions of Dollars are at stake for the manipulators – that our trading can't alter their plans, even when it costs them a lot of money. Still, if they're offering – we'll take it, right?

Just for good measure, we added an oil short to that post at $95 (/CL Futures) and oil bottomed out at $91 yesterday for a $4,000 per contract gain on that trade. This stuff isn't hard to follow folks – all I said in the morning post was:

Oil is probably too expensive at $95 (/CL Futures) and we can short them below that line into the 11am inventory report. Anything but a 2Mb net draw is going to be a disappointment and we had a lovely collapse on Tuesday to below $93, which would be $2,000 per contract if it's repeated. Set a stop at $95.15 and your risk $150 to make much, much more – a good risk/reward ratio!

We shorted oil again, at $93, in this morning's Live Member Chat and we already got a nice dip to $92.50 (up $500 per contract), which pays for our Egg McMuffins – so we're pleased with that and now we'll let it bounce and look for another short entry. Ahead of the Fed, we're not going to be too brave with our futures trading but we're still on the bear side – lonely though it may be over here.

Yesterday, in the morning post (did I mention you can SUBSCRIBE HERE), we talked about shorting China (FXI) and India (EPI) and the Shanghai dove off a cliff into the close this morning, falling almost 2% after being propped up all morning. Foreign Direct Investment fell 14% from last year, a 4-year low for China and Bloomberg ran an article titled: "Bad Loans Could Bust China," something we've been warning our Members about all year, but it is nice to see the MSM catching up to our premise.

Yesterday, in the morning post (did I mention you can SUBSCRIBE HERE), we talked about shorting China (FXI) and India (EPI) and the Shanghai dove off a cliff into the close this morning, falling almost 2% after being propped up all morning. Foreign Direct Investment fell 14% from last year, a 4-year low for China and Bloomberg ran an article titled: "Bad Loans Could Bust China," something we've been warning our Members about all year, but it is nice to see the MSM catching up to our premise.

Another thing the MSM is finally catching on to is how much of this market is nothing more than companies buying back their own shares. While we've been complaining about it through our own observation, the figures compiled by the WSJ this morning are kind of shocking.

Another thing the MSM is finally catching on to is how much of this market is nothing more than companies buying back their own shares. While we've been complaining about it through our own observation, the figures compiled by the WSJ this morning are kind of shocking.

- Corporations bought back $338.3 billion of stock in the first half of the year, the most for any six-month period since 2007, according to research firm Birinyi Associates. Through August, 740 firms have authorized repurchase programs, the most since 2008.

- In mid-August, about 25% of nonelectronic trades executed at Goldman Sachs Group Inc., excluding the small, automated, rapid-fire trades that have come to dominate the market, involved companies buying back shares. That is more than twice the long-run trend, according to a person familiar with the matter.

- According to Barclays, companies in the second quarter spent 31% of their cash flow on buybacks, the most since 2008.

- IBM accounted for one in eight open-market purchases of its stock in the first quarter of 2014, spending $8.2 billion repurchasing 45.2 million shares.

I've been warning for quite some time that we've seen all this before – in 2008. Unfortunately, it's all been forgotten already by complacent investors even though we're in the same month that crash began at the same levels that crash began with the same BS from the MSM we had when that crash began with the same signs of weakening foreign markets we had when that crash began…

Never forget indeed!