It's going to be another wild one!

It's going to be another wild one!

As you can see from Dave Fry's S&P chart, we dropped all the way to 1,820 on the S&P yesterday, before recovering just after 1pm on an report from Bloomberg that indicated:

Federal Reserve Chair Janet Yellen voiced confidence in the durability of the U.S. economic expansion in the face of slowing global growth and turbulent financial markets at a closed-door meeting in Washington last weekend, according to two people familiar with her comments.

That's TWO people who were familiar with her comments from LAST WEEKEND – that's certainly worth 40 points (2%) on the S&P isn't it? The people, who asked not to be named because the meeting was private, said Yellen told the Group of 30 that the economy looked to be on track to achieve growth of around 3 percent going forward. She also saw inflation eventually rising back up to the Fed’s 2 percent target as unemployment falls further, according to the people.

Well, as long as the people say so, that's good enough for us, right? It seemed good enough that we began to cash out out short positions in our aggressively bearish Short-Term Portfolio but this morning it seems we may have gotten a bit ahead of ourselves as the Futures are right back to yesterday's lows, dragged down by another massive sell-off in Europe.

Well, as long as the people say so, that's good enough for us, right? It seemed good enough that we began to cash out out short positions in our aggressively bearish Short-Term Portfolio but this morning it seems we may have gotten a bit ahead of ourselves as the Futures are right back to yesterday's lows, dragged down by another massive sell-off in Europe.

As we caught a great bounce from 1,040 on /TF (Russell Futures) back to 1,070 (+$3,000 per contract) on yesterday's rally we've been going back to that well at 1,050 this morning but, so far, only picking up $200-400 as /TF bounces between 1,050 and 1,054. Still, as long as that line holds – I like it for bounces and, if that fails, we tightly stop out and go back to 1,040 BUT, if that fails – RUN AWAY!!!

There are no bonus points for bravery in the stock market. If you are losing money in your portfolio and you are not sure how to adjust – GET OUT!!! There's nothing wrong with being in cash – especially in a declining market. In yesterday's portfolio reviews, we didn't find a lot of things we wanted to buy but we haven't gotten to our aggressive Long-Term Portfolio or the Buy List (though we did review it in Tuesday's Live Webinar) yet.

There are no bonus points for bravery in the stock market. If you are losing money in your portfolio and you are not sure how to adjust – GET OUT!!! There's nothing wrong with being in cash – especially in a declining market. In yesterday's portfolio reviews, we didn't find a lot of things we wanted to buy but we haven't gotten to our aggressive Long-Term Portfolio or the Buy List (though we did review it in Tuesday's Live Webinar) yet.

While there SEEM to be a lot of buying opportunities – as I warned yesterday, this is a CORRECTION – which means the prices you are starting to see are CORRECT, not low… There's a huge difference there and there should be a huge difference in your attitude towards the trades.

We are rolling our long-term positions lower and longer and lowering our expectations for making profits over the long-term. Our combined long and short-term gains have dropped down to just over 20% for the year and, if we don't get a handle on this turn, we'll probably cash out as 20% is good for a year, so there's no reason to blow that. As I mentioned, we took a risk and flipped bullish yesterday – expecting a bounce but, so far, the Global Markets are not cooperating.

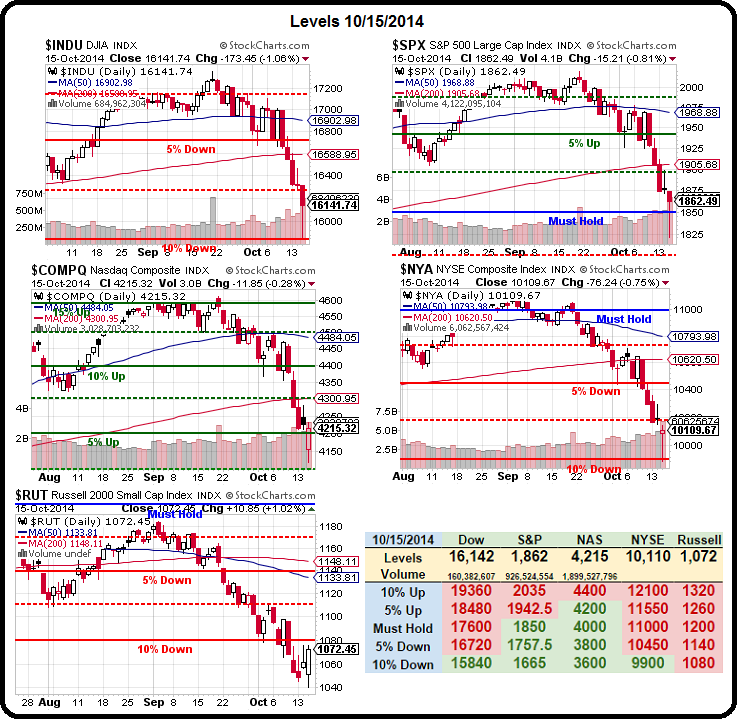

Meanwhile, we're still watching our bounce levels but we came very close to failing 15,824 on the Dow yesterday and that would have been – BAD!

- Dow – 15,480 should hold. Weak bounce 15,824, strong bounce 16,168.

- S&P – 1,800 should hold. 1,840 (weak) and 1,880 (strong).

- Nasdaq – 4,140 should hold. 4,232 (weak) and 4,324 (strong).

- NYSE – 9,900 should hold. 10,120 (weak) and 10,340 (strong)

- Russell – 1,050 MUST HOLD. 1,080 (weak) and 1,110 (strong)

As you can see from the Big Chart – so far, all we really have is a bounce off almost perfect tests of the lows we predicted for the week on Tuesday morning, which were just the already predicted lows using our 5% Rule™ and the lines we established almost 2 years ago. Not bad for long-term predictions.

On that basis, we've been playing for a bounce off our 10% lines but, if we don't get over those weak bounce lines by tomorrow. Losing the weak bounce lines on EITHER the Dow or the S&P would be BAD! – so let's watch that this morning as the S&P already looks like it will open below it.

With the Dow still the relative outperformer, DXD still makes a nice hedge and we highlighted that spread in yesterday's post, which hit $1.25 on yesterday's bottoming action – up 50% from the morning post and up 100% since we called it on Monday. We'll also have a big winner on our NFLX spread, where we took a $2,250 credit to short it in our Live Member Chat Room on the 9th. NFLX fell over $100 on poor earnings last night (as expected) and we should make a lot more than $2,125 on that trade!

NFLX earnings are 10/15 (pre 17th expiration) and we can sell 5 of the Nov $475 calls for $17.50 ($8,750) and buy 5 of the March $470/500 bull call spreads for $13 ($6,500) to cover in the STP. That's a net $2,250 credit and we have $30 of upside coverage on our short calls. Hopefully, NFLX stays below $475 and the short calls expire worthless and we get whatever is left on the long spread as a bonus. As long as they stay below $490, we should have a nice winner.

It's earnings season and we'll have lots of opportunities to make quick trades like these around earnings – it's one of the fun things we can do when we are in CASH!!! NFLX is going to be a drag on the Nasdaq and we'll see if 4,140 does indeed hold today or if, perhaps, we should start adding more SQQQ hedges.