The Forces at Work as Developed World Currencies Diverge

|

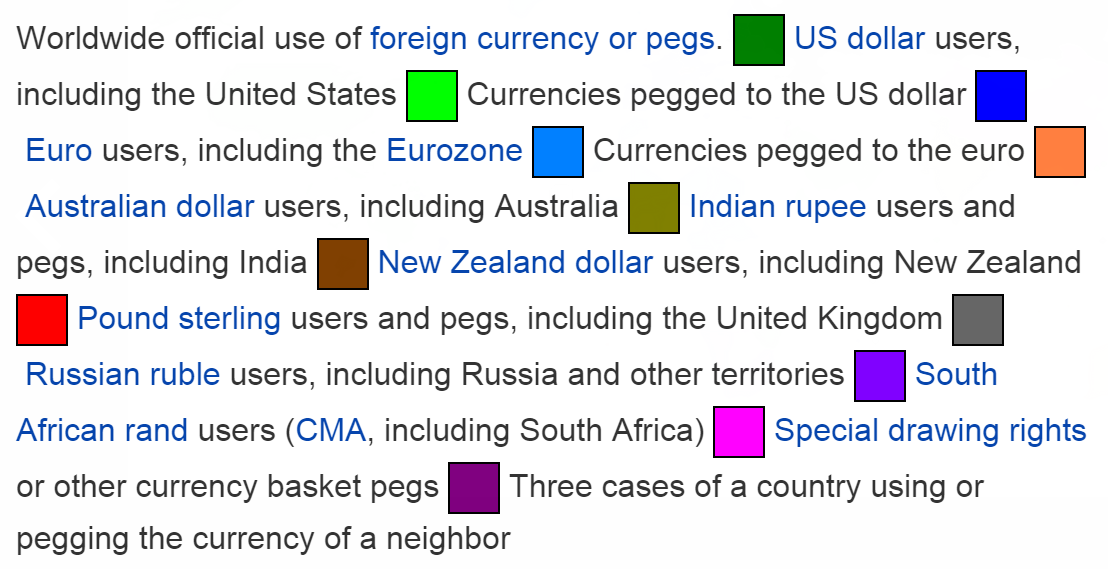

| Source: Currency Substitution / Wikipedia |

Of all major base currencies, the euro and US dollar have displayed the largest divergence in recent months as the US economy strengthens and the EU continues QE.

|

| Source: @RoutersJamie |

The SNB’s action earlier this month is an interesting case study on countries pegged to a depreciating base currency. The SNB’s move was unexpected largely because the relative weakness of the Swiss franc looks positive for Switzerland at first glance. As an exporting nation, Switzerland benefits greatly from a weaker currency and greater trade competitiveness.

|

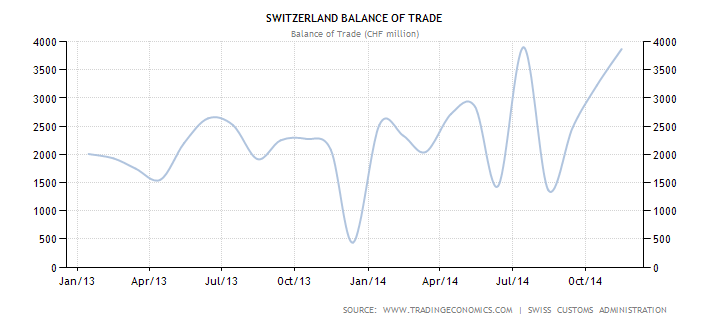

| Source: Trading Economics |

The usual concern about devalued currency is inflation, though this was clearly not an issue for the Swiss.

|

| Source: Trading Economics |

Instead, the SNB was concerned with the mounting foreign exchange reserves necessary to maintain their peg. The EU’s latest expected round of QE, along with CHF’s ongoing use as a safe-haven currency, forced the SNB to reach $500 Billion in foreign reserves.

|

| Source: Trading Economics |

Turning to other Euro-pegged countries, we see a similar trend in foreign exchange reserves.

|

| Source: Trading Economics |

|

| Source: Trading Economics |

|

| Source: Trading Economics |

In contrast, the US dollar has appreciated on recent strong economic news, and USD-pegged countries should be drawing down on foreign currency reserves to strengthen their domestic currency. Though recent evidence is weak, we may see further draw-downs soon:

|

| Source: Trading Economics |

|

| Source: Trading Economics |

Unlike euro-pegged currencies, stress on US dollar pegs will be far more direct: countries will draw down on foreign exchange reserves as the first line of defense. This will generally result in tighter monetary policy at a time these nations struggle with slower global growth. Once they can no longer buy domestic currency in open markets, they may turn to grimmer deflationary measures such as seizing currency through higher taxes. For now, we’ll have to watch out for USD-peg rumblings(GCC) and avoid speculation (Hong Kong).

_________________________________________________________________________

Sign up for Sober Look's daily newsletter called the Daily Shot.