Factset: Pity the Multi-nats

Courtesy of Joshua M Brown

Earnings revision trends are not going a positive direction for S&P 500 companies that get the bulk of their sales and earnings from overseas markets. The strong dollar and weaker foreign economies are combining to chop these companies’ estimates like a hatchet…

Here’s Factset Research:

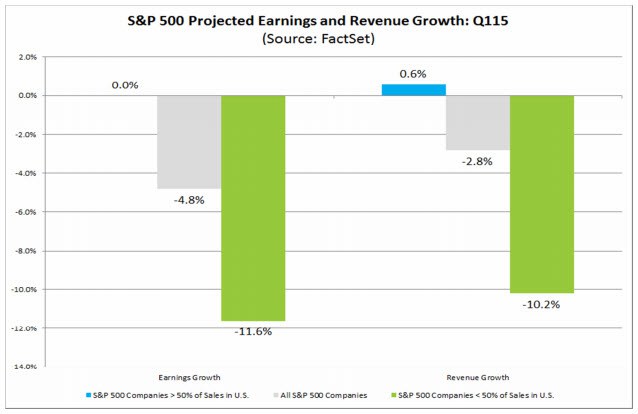

The estimated earnings decline for the S&P 500 is -4.8%. For companies that generate more than 50% of sales inside the U.S., the estimated earnings growth rate is 0.0%. For companies that generate less than 50% of sales inside the U.S., the estimated earnings decline is -11.6%.

The estimated sales decline for the S&P 500 is -2.8%. For companies that generate more than 50% of sales inside the U.S., the estimated sales growth rate is 0.6%. For companies that generate less than 50% of sales inside the U.S., the estimated sales decline is -10.2%.

It’s been noted (here and elsewhere) that small caps and US growth companies are contributing all of the market’s performance YTD and that a lot of the biggest Dow Jones stocks are plumbing the depths of the 52 week low list. Now you know why. Smaller companies have little overseas exposure and very little currency issues as the dollar rallies by 20% against the euro. Dow companies are global and, by definition, highly exposed to the world economy and the related forex issue.

Source:

S&P 500 Companies With Higher Global Exposure to See Lower Growth in Q1? (Factset)