![[image]](http://si.wsj.net/public/resources/images/BN-HY048_pageon_OR_20150417003349.jpg) Oh no.

Oh no.

They are pulling out all the guns this morning and firing blanks. As you can see from the front page of the WSJ, our friendbuddypal Jon Hilsenrath (aka "The Fed Whisperer") has poked his head out like a groundhog and, scared of the economic shadows he sees – has proclaimed 6 more weeks of FREE MONEY for all!

That gave us a nice little pop early this morning BUT, over in Europe, they are FLEEING into bonds, sending Germany's 10-year notes down to 0.07% – a new all-time low. This is coming on the heels of Greece's Finance Minister accusing Europe's creditor powers of trying to force his country to its knees by "liquidity asphyxiation".

"Toying with Grexit, or amputating Greece, is profoundly anti-European. Anybody who says they know what will happen if Greece is pushed out of the euro is deluded," he said. The warnings were echoed by Eric Rosengren, head of the Boston Federal Reserve, who said Europe risks sitting off uncontrollable contagion if it mishandles the Greek crisis, even though Greece may look too small to matter.

"I would say to some European analysts who assume that a Greek exit would not be a problem, people thought that Lehman wouldn't be a problem. If you measured the size of Lehman relative to the size of the US economy it was quite small," he told a group at Chatham House.

Greek bonds, of course, went flying higher. Up to about 13% this morning. Watch that 15% line, which is where Europe begin to melt down back in 2011. The 4-year bonds already jumped 4.5% this morning and are now hovering around 27% and the 2:1 inverted yield curve indicates investors are once again seeing a very high possibility of default.

Greek bonds, of course, went flying higher. Up to about 13% this morning. Watch that 15% line, which is where Europe begin to melt down back in 2011. The 4-year bonds already jumped 4.5% this morning and are now hovering around 27% and the 2:1 inverted yield curve indicates investors are once again seeing a very high possibility of default.

Even worse, the last time Greek yields were flying there were two rounds of bailouts to help stem the tide. This time, the ECB and the IMF are demanding PAYMENT instead of offering a hand. Greece simply cannot afford to pay out money and be forced to borrow more short-term money at 27% – even an economoron understands that much, don't they?

“Overall the probability of a Greek exit [from the euro] remains higher now than it ever was,” economists at Barclays wrote in a note. Others warned that a default or an exit from the euro could spark a wave of volatility across other Southern European countries, such as Spain, Italy and Portugal, that were hit hardest during the height of the eurozone crisis.

“If I were an investor, I think I’d even be tempted to ditch some Portuguese and Spanish bonds in this risk environment,” said Neil Mellor, a strategist at Bank of New York Mellon. “It could be a case of the market not understanding how bad the situation is until it is too late,” he added.

Have I mentioned how much I love CASH!!! lately?

Have I mentioned how much I love CASH!!! lately?

Speaking of cash – Global Slant asks this morning: "If QE is so great, why stop printing now?" which does a nice job of pointing out how ridiculously thin this economic house of cards the Fed is building really is. As noted by Dassault, the people have obeyed the Fed and bought stocks and bonds and houses and cars and leveraged themselves up to their eyeballs with more debt so – WHERE IS THE RECOVERY?

Europe is beginning to ask the same question and Draghi came off looking clueless the other day proclaiming QEurope a smashing success after just 6 weeks. If people lose faith in their Central Banksters they may begin to lose faith in their Local Bankers and, even worse, they may take the time to look at all that money (Federal Reserve Notes – read the top!) they have and realize that it's only actual value depends on how much you trust in God.

Paper money is worth nothing. You can exchange it for nothing. If you go to the government with $100 and say, "what do I get for this", they will will give you four twenties and two tens at best. Once upon a time, you were able to exchange a $100 reserve note for $100 in gold or silver on demand. That's why people used to care about Fort Knox – that was "our" gold in there. The fact that there was never really enough gold to cover all the money the Government issued was generally ignored at the time and the Gold Standard kept things fairly honest.

Alan Greenspan wrote that the bank failures of the 1930s were sparked by Great Britain dropping the gold standard in 1931. This act "tore asunder" any remaining confidence in the banking system. Financial historian Niall Ferguson, before joining One Direction, wrote that what made the Great Depression truly 'great' was the European banking crisis of 1931.

Alan Greenspan wrote that the bank failures of the 1930s were sparked by Great Britain dropping the gold standard in 1931. This act "tore asunder" any remaining confidence in the banking system. Financial historian Niall Ferguson, before joining One Direction, wrote that what made the Great Depression truly 'great' was the European banking crisis of 1931.

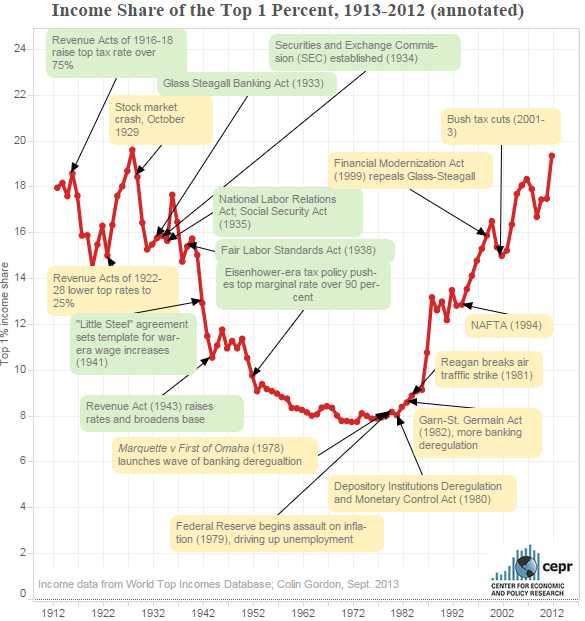

According to Fed Chairman Marriner Eccles, the root cause was the concentration of wealth resulting in a stagnating or decreasing standard of living for the poor and middle class (like what we have now!). These classes went into debt, producing the credit explosion of the 1920s (like what we have now!). Eventually the debt load grew too heavy, resulting in the massive defaults and financial panics of the 1930s.

Why am I bringing this up now? Because aside from the obvious economic parallels we're experiencing at the moment – Congress is about to pass the TPA, which will be 10x bigger than NAFTA was in 1994 and will do 10x more damage to the poor and middle class. Nonetheless, the deal was slapped into the voting schedule this week, despite strenuous objections by most Democrats:

“Today we’re meeting in a hearing that was noticed 12 hours before it began on a bill we haven’t seen with witnesses, I assume, who know more than we do, and frankly, will never tell us,” said Sen. Sherrod Brown (D-Ohio), who noted that previous trade deals have gotten extensive airings in Congress before lawmakers had to vote on them. “We can’t fast track fast-track, that’s a complete abdication of our responsibilities,” Brown said.

“This process is not good,” said Sen. Chuck Schumer (D-N.Y.), the heir-apparent to Senate Minority Leader Harry Reid (Nev.). “We are supposed to vote on TPA, tie our hands and not vote on amendments, before we’ve seen what the [Trans-Pacific Partnership] is. I’ve never seen anything like it.”

Meanwhile, do you remember way back about 4 weeks ago when the MSM Talking Point was that low oil and gas prices ($45 at the time) would spark consumer demand and retail sales? Well, it didn't (as we can clearly see from earnings reports) and now oil is up 30% to just under $60 and they are telling you it won't have a negative effect on the economy. Who are these people kidding?

While we are mainly in cash, we are still having a great month with our Member Portfolios (see yesterday's review), with our paired Long-Term and Short-Term Portfolios up 5.8% in April already. As I said to our Members yesterday, that is ridiculous and that's why we keep hedging with the Futures – though we got beaten this week on Oil and the S&P – we just want to lock in our ill-gotten gains on our long positions.

While we are mainly in cash, we are still having a great month with our Member Portfolios (see yesterday's review), with our paired Long-Term and Short-Term Portfolios up 5.8% in April already. As I said to our Members yesterday, that is ridiculous and that's why we keep hedging with the Futures – though we got beaten this week on Oil and the S&P – we just want to lock in our ill-gotten gains on our long positions.

That's the conundrum with this BS rally. As much as we want to stay away, there's no other game in town, so we play anyway – but we always have one hand firmly on the exit – just in case…

Have a great weekend,

– Phil