What a crazy-assed market!

What a crazy-assed market!

With virtually NO volume at all, the S&P (along with the other indexes) gapped up 10 points at the open (0.5%) but then proceeded to sell off all day as the Fund Managers that manipulate the Futures trading sold their stocks to all the suckers who ran in to buy into the "rally" that the Media Puppets were applauding all morning.

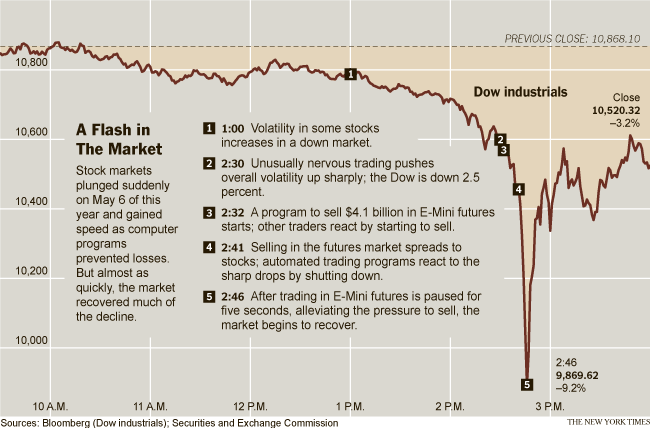

I know it sounds like a conspiracy theory when I tell you the markets are manipulated but, just yesterday, they accused a 36 year-old guy (31 at the time) with a very small trading firm ($5M) of crashing the Global Markets in the "Flash Crash" (May 6th, 2010).

Aside from the sad fact that it took them 5 years to find the culprit, it should scare the crap out of people that a single person, with no special equipment and a fairly ordinary margin broker account could knock $1Tn in value off of global equities in less than an hour. If that's how easy it is to manipulate the entire market – how can you NOT believe that there are people manipulating individual stocks every day?

“Things like this don’t build a lot of confidence,” said Timothy Ghriskey, the chief investment officer at Solaris Asset Management LLC in New York.

“It’s ridiculous, it’s the government at its best — inept,” Rick Fier, director of equity trading at Conifer Securities LLC in New York, said in a phone interview. “It really is just another one of many things to deal with, it’s extremely frustrating. We’ve seen flash crashes and we’ll see them again and it’s definitely disconcerting.”

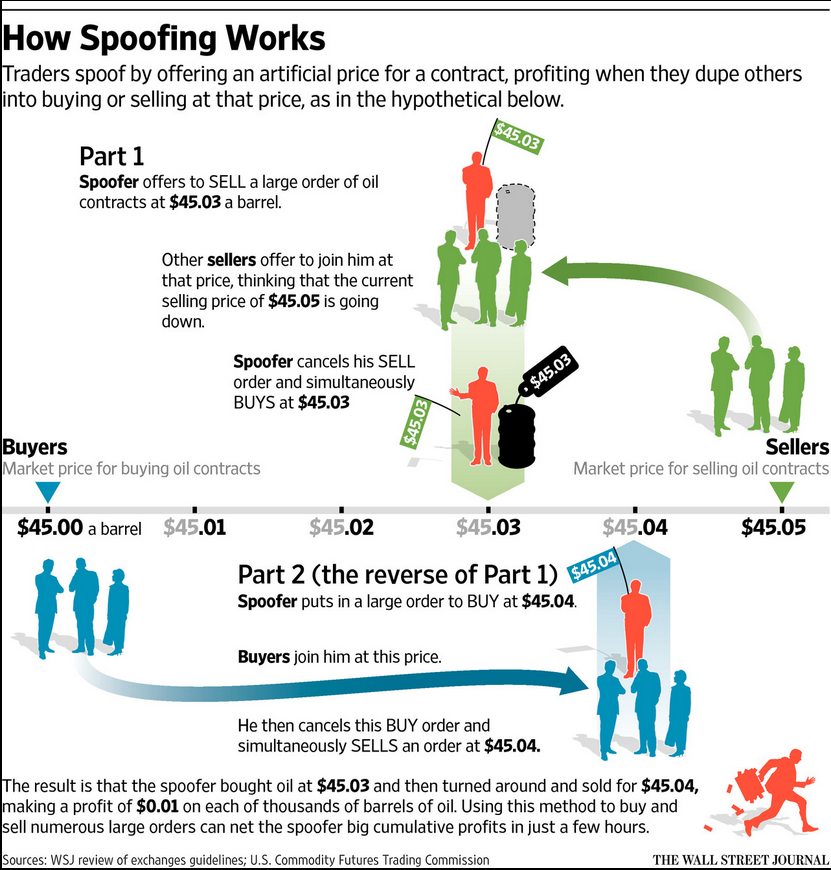

According to the government, Sarao had trading software altered to let him send and modify orders to sell stock futures thousands of times a day with virtually no risk they’d be filled. That was his goal: to make it seem like orders for futures were piling up so they’d fall and he could buy them on the cheap, the complaints say. Oddly enough – I just pointed out that same activity going on in the Oil Futures during yesterday's Live Webinar.

According to the government, Sarao had trading software altered to let him send and modify orders to sell stock futures thousands of times a day with virtually no risk they’d be filled. That was his goal: to make it seem like orders for futures were piling up so they’d fall and he could buy them on the cheap, the complaints say. Oddly enough – I just pointed out that same activity going on in the Oil Futures during yesterday's Live Webinar.

The allegation is that he was sending what are known as spoof orders to sell futures contracts in the US stock market. He would drive the price of the stock down – then withdraw the sell orders, but the price would already have fallen. He would then buy the orders back and guarantee a profit for himself. According the charge sheet, he did this thousands and thousands of times over many years.

Sarao’s tactics, known as spoofing and dynamic layering, were “particularly intense” in the hours before the flash crash plunge that knocked the Dow Jones Industrial Average down about 1,000 points, the complaints alleged. Just before stocks went over the edge, his sell orders were nearly equivalent to all the buy orders in S&P 500 e-mini contracts, it said. The activity created “persistent downward pressure” on the price of the contracts during a period when they fell more than 3.6%.

Sarao’s tactics, known as spoofing and dynamic layering, were “particularly intense” in the hours before the flash crash plunge that knocked the Dow Jones Industrial Average down about 1,000 points, the complaints alleged. Just before stocks went over the edge, his sell orders were nearly equivalent to all the buy orders in S&P 500 e-mini contracts, it said. The activity created “persistent downward pressure” on the price of the contracts during a period when they fell more than 3.6%.

Today, with no constraints placed on this kind of trading (also enabled by the CFMA we discussed yesterday), we don't think it's strange at all for the markets to go up 0.5% or even 1% in the Futures or to sell off and reverse suddenly during the day, also in 0.5% to 1% moves that, when you think about it, are changes of $500Bn in market value up or down in the average day.

Here's a look at how the Russell, for example, has traded over the past two weeks. Every 12-point move is 1% – I see 14 of them in 13 trading sessions – a roller coaster with this many dips and twists would snap your neck!

As I was saying to our Members in yesterday's Live Webinar, we have plenty of fun taking advantage of these little twists and turns because we know HOW the game is played and we know how to play along with the manipulators. During the seminar, we were able to make a quick $500 just trading oil contracts into the close because we know exactly how those work.

Still, the best way to make money in these crazy markets is the Warren Buffett way, which is also my way – keep your cash ready and buy good companies when they get cheap, don't be greedy and sell risk premium to others. It's not complicated – it just takes a bit of discipline.

You never know when the next flash crash will be but you do know that IBM will be in the computer business in 2030 so, if they come back to $155, they become a buy that we put in our Long-Term Portfolio (along with our hedges that give us a 15-20% discount, of course). We do know LL is probably way too cheap at $33.36 and RIG is a bargain at $17 and LQMT is looking attractive again at 0.13.

You never know when the next flash crash will be but you do know that IBM will be in the computer business in 2030 so, if they come back to $155, they become a buy that we put in our Long-Term Portfolio (along with our hedges that give us a 15-20% discount, of course). We do know LL is probably way too cheap at $33.36 and RIG is a bargain at $17 and LQMT is looking attractive again at 0.13.

When we took our winners off the table in late March, I put out a Top Trade Alert that highlighted our remaining LTP positions saying:

Obviously, one thing they all have in common is they are low in their channels. That's how we built the LTP in the first place – we bought stocks from our Buy List whenever they were low in their channels. We also have a bit of diversity with ABX and CLF representing materials, UCO, USO, RIG and BHI representing the energy sector HOV and CIM are housing, MAT, LULU and LL are consumer (but we're short LULU) and GTAT represents penny stocks.

I think pretty much all of these are on Jabob's FU list, so we're in excellent shape going forward.

As I said to the HNW investors in Canada on Monday night, it's silly to try to guess which oil company will survive over time when we can simply pick up the UCO July $5/9 bull call spread at $1.70 and sell the $5 puts for 0.50 for net $1.20 on the $4 spread that's $2 in the money. If oil is up in July, you make up to $2.80, which is 233% return on cash and, if you lose on the UCO play (break-even is $6.20, more than 10% below the current price and sub-$40 oil), then I'm very sure whatever oil or gas stocks you are thinking of buying now will be much, much cheaper!

Those HNW Investors, as well as our Top Trade Alert Members and, of course, our Live Member Chat participants should all be pleased with that UCO trade. It may not look like a big move on the chart but we bought when other people were selling and the July $5/9 spread is now net $2.80 and the short July $5 puts are 0.14 for net $2.66 – up 121% in a month, which is actually only "on track" for our goal of 231%.

We didn't try to make 121% in a month. We took a good, conservative position based on sound fundamentals and we happened to have good timing following our core strategies. Try it some time – it's a good way to trade!