Sterling takes a tumble on disappointing GDP data (FT)

Ouch.

Sterling has fallen sharply after the first estimate of first quarter UK GDP significantly undershot economists' expectations.

The British pound has lost 50 pips against the US dollar to 1.5182.

U.K. Growth Weakens in Blow to Cameron in Tight Election Battle (Bloomberg)

U.K. Growth Weakens in Blow to Cameron in Tight Election Battle (Bloomberg)

U.K. economic growth slowed more than economists forecast in the first quarter, dealing a potential blow to Prime Minister David Cameron’s claim that his Conservative Party is best placed to manage the economy’s recovery.

The 0.3 percent pace was just half the rate of the previous three months and marked the weakest reading since the fourth quarter of 2012. Economists had forecast growth of 0.5 percent, according to a Bloomberg News survey. The pound weakened after the data.

U.K. Economy Slows Ahead of Election (WSJ)

LONDON—The U.K. economy slowed during the first quarter of 2015, official figures showed Tuesday, casting a shadow over the British government’s economic track record less than two weeks before a closely fought national election.

Fed Seen Delaying Liftoff to September to Push Down Unemployment (Bloomberg)

Fed Seen Delaying Liftoff to September to Push Down Unemployment (Bloomberg)

The Federal Reserve’s long-awaited liftoff on its benchmark interest rate won’t happen until September, according to economists surveyed by Bloomberg News, as officials try to spur inflation and hiring after the economy stumbled in the first quarter.

Policy makers meeting on Tuesday and Wednesday in Washington will assess the impact of a harsh winter and a stronger dollar, which may have helped reduce the pace of economic growth to the lowest in a year, economists said. A hiring slowdown last month is adding to caution inside the Federal Open Market Committee, said Thomas Costerg at Standard Chartered Bank in New York.

Drought Frames Economic Divide of Californians (NYTimes)

Drought Frames Economic Divide of Californians (NYTimes)

COMPTON, Calif. — Alysia Thomas, a stay-at-home mother in this working-class city, tells her children to skip a bath on days when they do not play outside; that holds down the water bill. Lillian Barrera, a housekeeper who travels 25 miles to clean homes in Beverly Hills, serves dinner to her family on paper plates for much the same reason. In the fourth year of a severe drought, conservation is a fine thing, but in this Southern California community, saving water means saving money.

Deutsche Bank ‘Baby Steps’ Overhaul Disappoints Investors (Bloomberg)

After six months of review and three statements in four days, Deutsche Bank AG laid out a new strategy Monday that underwhelmed investors.

Maryland Governor Calls in National Guard to Control Baltimore Riots (Bloomberg)

Maryland Governor Calls in National Guard to Control Baltimore Riots (Bloomberg)

Riots erupted in Baltimore after the funeral of a black man who died of injuries suffered while he was in police custody, prompting officials to declare a state of emergency, impose a curfew and close schools.

Cars and several buildings burned on Monday as police were attacked with rocks and bricks. Police teamed with firefighters to protect them against attacks and National Guard troops moved into the city overnight after being summoned by Maryland Governor Larry Hogan.

Five Technologies That Will Increase Your Cash Flow This Year (Forbes)

Five Technologies That Will Increase Your Cash Flow This Year (Forbes)

Want to get a business owner’s attention? Tell us how we can increase our cash flow. Yes, we have passion, commitment, love and belief in what we do. But in the end we’re doing what we do for cash. And anything that helps us increase our cash flow is something we want to know about. So here are five technologies you should know about if that’s what you’re interested in doing this year.

India’s Nifty Futures Roll Over Below Average as Foreigners Sell (Bloomberg)

Indian traders extended fewer April CNX Nifty Index futures than the average rate over the past six months, signaling caution before the securities expire on Thursday after three days of selling by foreign investors.

Standard Chartered Misses Estimates in Last Results Under Sands (Bloomberg)

Standard Chartered Misses Estimates in Last Results Under Sands (Bloomberg)

Standard Chartered Plc reported first-quarter profit that missed analysts’ estimates, with all but one division reporting lower earnings in Peter Sands’s final results as chief executive officer.

Pretax profit fell 22 percent to $1.5 billion from the year-earlier period, the London-based lender said in a statement on Tuesday. That missed the $1.6 billion average estimate of four analysts in a Bloomberg survey.

Russia Plans to Meet With OPEC Before Group Next Gathers in June (Bloomberg)

Russia, the world’s biggest energy exporter, will meet with OPEC before the group next gathers in June to discuss whether to adjust production limits, amid prices that are almost half their level of 10 months ago.

Natural Gas Settles at 3-year Low (EconMatters)

Crude oil has been the center of energy-related headlines since 2H14 when it started its dramatic 'normalizatin' process while everybody (us included) seems to have forgotten about natural gas. So we thought we should give an update on natural gas as well.

Market Watch reported that May natural gas NGK15 settled at $2.49 per million British thermal units (MMBtu) on Monday, ahead of the May contract expiration on Tuesday. Prices, based on the front-active contracts, haven’t settled at levels this low since June 15, 2012.

ECB’s Repo Plan May Make Negative Bund Yields a Matter of Time (Bloomberg)

The European Central Bank’s efforts to keep the region’s debt markets from drying up may be acting as a magnet for lower yields on government bonds.

Tsipras Says Greek People May Have to Rule on Final Deal (Bloomberg)

Prime Minister Alexis Tsipras said Greek voters could be asked to decide on whether to approve an agreement with creditors that may not be in line with his campaign pledge to end austerity.

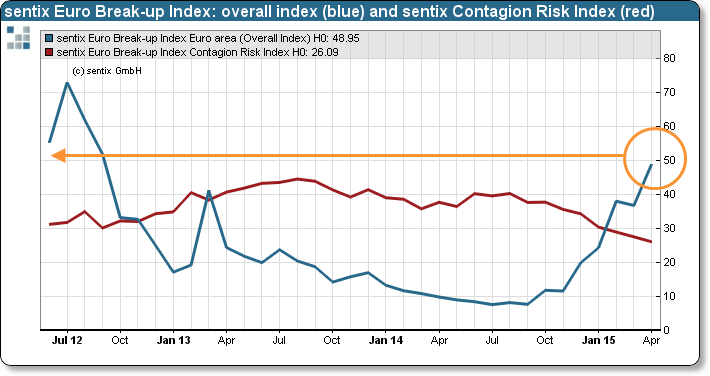

Draghi put to the test: one out of two investors expects a “Grexit” (Sentix)

In April, the sentix Euro Break-up Index jumps to 49.0% from a previous 36.8%. Thus, European politicians’ promises to pursue the scenario of Greece keeping the euro are not taken at face value by about the half of all investors. In 2012 Mario Draghi calmed down investors with his ultimate commitment to the euro. But is his pledge still valid for Greece today?

The Euro Break-up Index (EBI) has currently reached about the same level as during the high times of the euro crisis in the year 2012 (see graph). And again it is Greece which pushes up the index. The Greek EBI climbs from 35.5% to 48.3%. Apart from that, it is only Cyprus that sticks out among the country indices. Its EBI increases slightly to just below 11.

Central Banks Run in Place as Inflation Slide Outpaces Rate Cuts (Bloomberg)

Emerging market central banks can’t cut interest rates fast enough.

Real rates — benchmarks minus inflation — are higher now than they were at the start of the year in South Korea, Poland and Israel despite easier monetary policy, according to Bloomberg data.

Oops! Anti-Obamacare Lawsuit Would Invalidate Reagan Tax Law If It Succeeds (ThinkProgress)

Oops! Anti-Obamacare Lawsuit Would Invalidate Reagan Tax Law If It Succeeds (ThinkProgress)

A lawsuit attacking the Affordable Care Act relies on such a sweeping legal theory that it would invalidate countless laws if it were successful — including a prong of President Ronald Reagan’s tax policy.

Toyota Plans $4.2 Billion Share Sale for Fuel-Cell Car R&D (Bloomberg)

Toyota Plans $4.2 Billion Share Sale for Fuel-Cell Car R&D (Bloomberg)

Toyota Motor Corp. plans to replace as much as 500 billion yen ($4.2 billion) of common equity with unlisted shares that have transfer restrictions, locking in longer-term funding as the carmaker develops new technology.

The automaker will sell as many as 150 million “Model AA” shares, named after its first passenger car, it said Tuesday in a filing to Japan’s Finance Ministry and on its website. The shares will be sold for at least a 20 percent premium over common stock, and the funds will be used for research and development, including work on fuel-cell cars, Toyota said.

The 23 Count Indictment of the TPP (NakedCapitalism)

To really appreciate what a travesty the TPP is, and the scandal of the failure of our Congress to reject it, and the “Fast Track Authority“ sought for it, out of hand, I’m going to list 23 negative consequences that would likely follow from it. Any one of these, would, by itself be sufficient for any representative of the people, Senator or Congressperson, to vote to kill it. I’ll offer this list in the form of stanzas appropriate for a chant, except for the starting point in the list.

The 10 most conservative (and liberal) cities in America (Salon)

The 10 most conservative (and liberal) cities in America (Salon)

Americans have countless stereotypes about people from different regions of the country. There’s the polite Midwesterner, the abrasive New Yorker, the Berkeley hippy, the gun-toting Texan. There is red America and there is blue, and never the twain shall meet. But a study of conservative cities published in American Political Science Review suggests that the United States has a much more complicated political patchwork than we might expect.

Why I've taken some money out of the market: El-Erian (CNBC)

Why I've taken some money out of the market: El-Erian (CNBC)

Asset prices have been pushed higher thanks to the Federal Reserve's monetary policy, but because there's uncertainty over whether the central bank will be able to deliver better economic fundamentals, Allianz chief economic advisor Mohamed El-Erian said he's taken some money out of the market.

BP Profit Beats Estimates as Refining Offsets Oil’s Plunge (Bloomberg)

BP Plc reported first-quarter profit that was more than double analysts’ estimates as earnings from refining and trading offset lower crude prices.

On Monday, Fox News’ “Outnumbered” featured an exchange of such mind-boggling stupidity that it failed to meet the show’s already very low standards.

Co-host Andrea Tantaros read from comments allegedly made by George W. Bush in which the former president said, “just remember the guy who slit Danny Pearl’s throat is in Gitmo, and now they’re doing it on TV.”

Singapore Family Cuts Dollar Bets Citing Volatile Policies (Bloomberg)

Woodside Holdings Investment Management, a Singapore-based family office, trimmed bets the U.S. dollar will strengthen amid uncertainty as to when the Federal Reserve will start raising interest rates.

VW’s MAN Truck Unit Profit Drops as ‘No Sign’ of Brazil Recovery (Bloomberg)

VW’s MAN Truck Unit Profit Drops as ‘No Sign’ of Brazil Recovery (Bloomberg)

MAN SE, Europe’s third-largest truck manufacturer, said first-quarter earnings fell 50 percent as the market in Brazil continues to decline.

Operating profit fell to 34 million euros ($37 million), from 68 million euros a year earlier, the Munich-based unit of Volkswagen AG said Tuesday in a statement. Sales fell 2 percent to 3.09 billion euros.

China’s Slowdown Puts Asian Central Banks in a Bind as Fed Looms (Bloomberg)

China’s slowing economy is putting pressure on central banks across Asia to lower interest rates further.

For policy makers, that poses a dilemma. The lower rates go, the sharper the U-turn required if the U.S. Federal Reserve delivers as expected this year its first rate increase since 2006, which could lure funds away from emerging markets.

Be Very Afraid: “We the People” of the United States and it’s United Kingdom lapdog (GlobalResearch)

Be Very Afraid: “We the People” of the United States and it’s United Kingdom lapdog (GlobalResearch)

The ultimate objective is to subdue the citizens, totally depoliticize social life in America, prevent people from thinking and conceptualizing, from analyzing facts and challenging the legitimacy of the inquisitorial social order which rules America.

The Big Lie becomes the Truth. Realities are turned upside down.

War becomes peace, a worthwhile “humanitarian undertaking”,

Peaceful dissent becomes heresy.

Ignore Greece ‘Noise,’ BlackRock’s Kapito Tells Investors (Bloomberg)

Ignore Greece ‘Noise,’ BlackRock’s Kapito Tells Investors (Bloomberg)

Investors planning for retirement should ignore day-to-day “noise” over events from the Federal Reserve’s interest rate strategy to a standoff over Greece’s bailout, BlackRock Inc. President Robert Kapito said.

Greece “gets so much noise from everyone, that it’s so fascinating that it causes the typical mom and pop that are saving not to want to invest because they’re afraid,” Kapito said in an interview in Miami. “It’s really just noise because if it’s not going to be Greece today, it’s going to be someone else in the paper.”

Religion’s smart-people problem: The shaky intellectual foundations of absolute faith (Salon)

Religion’s smart-people problem: The shaky intellectual foundations of absolute faith (Salon)

Should you believe in a God? Not according to most academic philosophers. A comprehensive survey revealed that only about 14 percent of English speaking professional philosophers are theists. As for what little religious belief remains among their colleagues, most professional philosophers regard it as a strange aberration among otherwise intelligent people. Among scientists the situation is much the same. Surveys of the members of the National Academy of Sciences, composed of the most prestigious scientists in the world, show that religious belief among them is practically nonexistent, about 7 percent.

Why the Cost of Hedging European Banks Stocks Has Soared (Bloomberg)

Anyone wondering why it costs so much to protect against losses in European bank stocks in the options market saw the reason on Monday.

What each state has more of than any other [map] (Holykaw)

What each state has more of than any other [map] (Holykaw)

Does your state love holiday music? Have a need for mental health facilities? Sell a lot of cigarettes to kids?

Find out with this map from Estately, and plan your next move carefully.

Who would have thought Georgia was the panda bear capital of the nation?

Fanuc Pushes Japan’s Nikkei 225 to First Advance in Three Days (Bloomberg)

Fanuc Pushes Japan’s Nikkei 225 to First Advance in Three Days (Bloomberg)

Japanese stocks rose, with the Nikkei 225 Stock Average advancing for the first time in three days, as Fanuc Corp. jumped after the robot maker said it will boost shareholder returns.

Fanuc, in which activist investor Daniel Loeb took a stake this year, rose 3.3 percent after saying it will double its dividend. The stock is the second-biggest member on the Nikkei 225, accounting for 5.3 percent of the gauge. Osaka Gas Co. added 3.2 percent after reporting profit that beat its forecast. Tokyo Electron Ltd. tumbled the most since 1982 after the chipmaking equipment supplier said it will cancel its merger with U.S.-based Applied Materials Inc. Komatsu Ltd. slumped 3.1 percent after net income declined.

The central delusion of the Christian right: Americans aren’t really churchgoers after all (Salon)

The central delusion of the Christian right: Americans aren’t really churchgoers after all (Salon)

The 2016 presidential campaign has really and truly started now, and already the religious pandering is getting silly. Despite wanting voters to think of him as a “libertarian” Rand Paul was recently bleating about how this country needs a religious revival, specifically “another Great Awakening.” Ted Cruz made a big fancy speech at Liberty University where he highlighted his defense of state promotion of religion, which he erroneously called “religious freedom,” even though having the state push faith on you is the opposite of that. Mike Huckabee claimed that Christians in the military are being persecuted. Marco Rubio is so desperate to be seen as a religious right savior that he spread himself out, claiming formally to be Catholic but attending a Bible-thumping holy roller church that believes in young earth creationism and demons. He’s also done his time as a Mormon, to cover all bases.

Asian Stocks Outside Japan Decline as Investors Weigh Earnings (Bloomberg)

Asian shares outside Japan fell, with a gauge of regional equities retreating from a seven-year high, as energy shares led losses and companies slid on earnings concerns. Fanuc Corp. surged in Tokyo.

Charting American Oligarchy: How The 0.01% Contributes 42% Of All Campaign Cash (ZeroHedge)

Charting American Oligarchy: How The 0.01% Contributes 42% Of All Campaign Cash (ZeroHedge)

This is an economic fight, but this is also a political fight. The biggest financial institutions aren’t just big – they wield enormous political power. Last December, Citibank lobbyists wrote an amendment to Dodd-Frank and persuaded their friends in Washington to attach it to a bill that had to pass or the government would have been shut down. And when there was pushback over the amendment, the CEO of JPMorgan, Jamie Dimon, personally got on the phone with Members of Congress to secure their votes. How many individuals who are looking for a mortgage or a credit card could make that call? How many small banks could have their lobbyists write an amendment and threaten to shut down the US government if they didn’t get it? None. Keep in mind that the big banks aren’t trying to make the market more competitive; they just want rules that create more advantages for themselves. The system is rigged and those who rigged it want to keep it that way.

Treasuries Divide Backs Bullard Warning Fed May Get Behind Curve (Bloomberg)

Treasuries Divide Backs Bullard Warning Fed May Get Behind Curve (Bloomberg)

Short-term Treasuries are no longer the losers of the bond market, backing James Bullard’s warning the Federal Reserve may fall behind in its efforts to cap inflation.

The president of the Fed Bank of St. Louis said in March the central bank risks being “behind the curve” on inflation if it doesn’t raise its benchmark interest rate from near zero soon. Under the Fed’s rotation system, Bullard is scheduled to vote on monetary policy next year.

China Stocks Fall Most in Week on Earnings Concern, CSRC Warning (Bloomberg)

China’s stocks fell the most in a week, led by commodity and technology companies, amid disappointing corporate earnings and a warning from the nation’s securities regulator about the risk of investment losses.

Bill Maher, American hero: Laughing at religion is exactly what the world needs (Salon)

Bill Maher, American hero: Laughing at religion is exactly what the world needs (Salon)

Bill Maher, the host of HBO’s “Real Time,” is a shining beacon of the New American Enlightenment, radiant with goodness and hope.

But first, a bit of background.

Three Reasons Morgan Stanley Is Still Bullish on U.S. Stocks (Bloomberg)

Three Reasons Morgan Stanley Is Still Bullish on U.S. Stocks (Bloomberg)

Stocks in the U.S. are once again around record highs. Although there are well-known risks in the market, from geopolitics to disappointing U.S. economic data to stretched valuations, Morgan Stanley equity strategist Adam Parker remains bullish.

New York Times columnist Paul Krugman attacked his fellow pundits — especially those on the right — who refuse to acknowledge that the dire predictions they made about Obamacare and its effect on the American economy never came to pass.

He labeled them “Obamacare truthers,” and noted that instead of being intellectually honest and admitting that they were wrong about the Affordable Care Act’s economic impact, they are attempting to revise history by claiming, for example, that they always said that more people would be insured, and that the real issue has always been the quality of their new coverage.

Worst G-10 Central Banks Show Swedish Guidance Model No Help (Bloomberg)

The world’s most transparent central bank is emerging as one of the worst in guiding markets.

Sweden’s Riksbank, which in 2007 started signaling where it sees its interest rate, is now one of the most inscrutable central banks. Only U.S. and Australian policy makers have bewildered analysts more over the past eight years. That’s according to a Bloomberg study of analyst estimates ahead of meetings at which central banks of 8 of the world’s 10 most traded currencies changed rates.

The 54-year-old author and talk show host Dr. Mehmet Oz’s career has been on the rocks ever since last December when a British Medical Journal study revealed that only 46 percent of his televised recommendations could be backed by scientific evidence. Earlier this month, a group of doctors — 10 physicians, surgeons and professors in total — sent a letter to the dean of medicine at Columbia University asking the university to reconsider Dr. Oz’s faculty appointment. “Dr. Oz has repeatedly shown disdain for science and for evidence-based medicine,” that letter noted.

Nobody Said That (NYTimes)

Imagine yourself as a regular commentator on public affairs — maybe a paid pundit, maybe a supposed expert in some area, maybe just an opinionated billionaire. You weigh in on a major policy initiative that’s about to happen, making strong predictions of disaster. The Obama stimulus, you declare, will cause soaring interest rates; the Fed’s bond purchases will “debase the dollar” and cause high inflation; the Affordable Care Act will collapse in a vicious circle of declining enrollment and surging costs.

Facebook Adds Video Calls to Messenger App (Bloomberg)

Facebook Adds Video Calls to Messenger App (Bloomberg)

Facebook Inc. is releasing a video-call feature for its messenger application.

The company said Monday in a blog post that the feature will work for iOS and Android phones, competing with Apple Inc.’s Facetime, which is tailored to Apple devices, and Google Inc.’s Hangouts. Skype, from Microsoft Corp., and WeChat from Tencent Holdings Ltd., also provide video-messaging services.

Japan Hits The Easy Money Wall. We May Be Next (DollarCollapse)

Japan’s retail sales fell in March the most since 1998, cutting against central bank chief Haruhiko Kuroda’s view that cheaper energy will give a boost to the world’s third-biggest economy.

Sales dropped 9.7 percent from a year earlier, when there was a run-up in purchases ahead of an April sales-tax increase, according to trade ministry data released Tuesday. Sales sank 1.9 percent from the previous month, compared with a gain of 0.6 percent forecast by economists in a Bloomberg survey.

Apple Adds Yet Another Title: Largest Dividend Payer in S&P 500 (Bloomberg)

The world’s biggest company just became the biggest source of dividends in the Standard & Poor’s 500 Index.

Apple Inc. raised its dividend by 10.6 percent to $2.08, putting it on the hook for about $12.1 billion in annual payments, according to data compiled by Bloomberg and S&P. That eclipses the $11.6 billion sent out in dividends each year by Exxon Mobil Corp., the previous title holder.

For once, Donald Trump is asking that President Obama go “a little longer.” Following Saturday’s White House Correspondents’ Dinner, which spawned the hilarious “Key and Peele Anger Translator” viral video, among other things, Fox & Friends invited Donald Trump to the program to give a firsthand rehashing of the evening’s events. Trump was the subject of one of the most loudly applauded jokes of the evening (“And Donald Trump is here … still”). The billionaire curmudgeon said that, despite what many new outlets will inevitably report, he very much enjoyed himself that evening — even Obama’s joke abut him — but was totally unimpressed with “Saturday Night Live’s” Cecily Strong. Also, the “sleazy” press.

Draghi QE Boosts Emerging Europe’s Tolerance for Currency Gains (Bloomberg)

Draghi QE Boosts Emerging Europe’s Tolerance for Currency Gains (Bloomberg)

Policy makers across eastern Europe seem unbothered by the rallies in their currencies versus the euro.

Adopting a passive stance that has surprised some observers, they’ve for the most part opted against trying to reverse the gains of late.