I told you so.

I told you so.

I told you so yesterday and, much more profitably, I told you so on the morning of May 11th, when FXI opened at $50.75 on news of more Chinese stimulus and we called for a short using the FXI June $50 puts, which were $1.20 at the time and are now $1.60 – up 33% in 12 days. We're already done with those and have moved on to new FXI short positions.

Yesterday we talked about the sudden and still unexplained failures of Hanergy and Goldin and now, this morning, Ordos' (the ghost city) Huyan Investment Group is unable to pay the piper on $194M round of bonds as they have $1.1Bn in debt and just $3.5M in cash remaining.

Huyan is just a drop in the Ordos bucket, where $3-5BBn worth of bonds are likely to default every year for the next 12 years – so the hits just keep on coming in China. Ordos city bonds have climbed to 9.63% as the city's rating has been cut to A on negative watch. In the rating statement, Pengyuan described the Ordos property market as “extremely not optimistic” because of the slowing economy and pressure the coal industry is facing. Several other firms have also been downgraded and will be having trouble rolling their debt in the next round.

Meanwhile, Zhuhai Zhongfu Enterprise (a bottling company) is short $72M of the next $106M they owe on May 28th and they have just $10M left in the bank. This company employs 4,000 people and bottles for both KO and PEP in China. Meanwhile, shares of ZZ are up 126% this year but have been suspended since April 29th with a $10Bn market cap. This is the state of Chinese companies, folks – there are many more examples and here's even more. .

The above chart illustrates the game that is being played in China to keep things LOOKING good, even while they are falling apart. Then we have to take into account that 90% of the public companies in China are some form of quasi-state controlled entities. While a lot of "investors" take solace in that, believing the Government will back up these companies if they begin to stumble – the consultant in me has to consider the internal bleeding of all these companies adding up to possibly Trillions of Dollars (certain Trillions of Yuan) in bailouts. How long can the PBOC really keep this up?

Since the answer is probably not "forever", we can expect, at some point, a bit of a correction. It's not likely the US, Europe and certainly not the rest of Asia will be able to avoid the fallout of a Chinese correction so we're going to be watching China very carefully this summer and reading between the lines of their policy announcements – especially when the Premier talks about "letting the markets work," which is code for no longer bailing out failing businesses.

It might not be too bad because most of the profits in China are paper profits anyway. People bought $1,000 worth of stock last year and now they think they have $10,000 but really it's $500. Of course, multiply that by half a Billion Chinese speculators and it does add up. Global Markets, led by China, just hit $75Tn – a new record. This is really amazing since Global GDP is still lower than it was in 2007 so that means that the ratio of stock valuations is now at an all-time high – isn't that special?

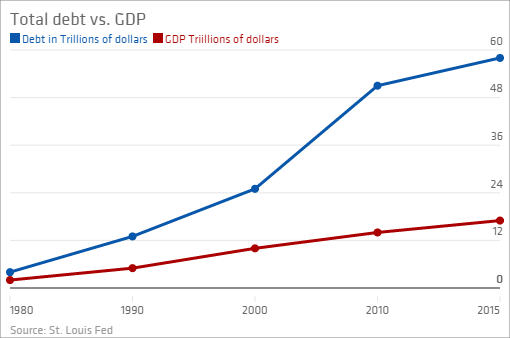

Our own GDP is up about $2Tn since 2007, so we're doing our share – especially when you consider we've borrowed $12Tn to boost it to that level. Of course, Obama borrowed far less than Bush, who came in with a $9Tn GDP and $24Tn in Total Debt (Government, Business and Consumer) but, no matter who you want to blame, the fact of the matter is that, 15 years later, our GDP is $16Tn and now we're $58Tn in debt.

Our own GDP is up about $2Tn since 2007, so we're doing our share – especially when you consider we've borrowed $12Tn to boost it to that level. Of course, Obama borrowed far less than Bush, who came in with a $9Tn GDP and $24Tn in Total Debt (Government, Business and Consumer) but, no matter who you want to blame, the fact of the matter is that, 15 years later, our GDP is $16Tn and now we're $58Tn in debt.

This is going on all over the World as the bottom 90% are forced to go deeper and deeper into debt to finance their lifestyles (or just to feed their children) which maintains the ILLUSION of prosperity and keeps the profits flowing up to the top 1%, who collect them all and then refuse to pay taxes and vote down reform or anything that might actually fix the economy and the bottom 90% sink deeper and deeper into debt while the top 1% accumulate more and more of the wealth.

It used to be that the Corporations (who are also "people" in the top 1%) used to spend some of their money on infrastructure projects – building new factories, buying machines that men would work with, etc. That part of the chain is also broken and this year our Corporate Masters will spend $500Bn of the profits sent to them by the Bottom 90% to BUY BACK THEIR OWN STOCK. This benefits no one except the members of the investing class.

Even worse, a lot of the machines that our Corporate Masters are now buying are ROBOTS, which are meant to eliminate the need for us entirely. Yes, ENTIRELY – no one is selling a robot and talking about how many jobs it keeps, are they? As the robots get more and more sophisticated, they will need less and less human intervention. Obviously, that would be the improvement of each new model – needing less and less human labor. Even the goal of AI is to eliminate the need for programmers – though they seem too stupid to see that…

Even worse, a lot of the machines that our Corporate Masters are now buying are ROBOTS, which are meant to eliminate the need for us entirely. Yes, ENTIRELY – no one is selling a robot and talking about how many jobs it keeps, are they? As the robots get more and more sophisticated, they will need less and less human intervention. Obviously, that would be the improvement of each new model – needing less and less human labor. Even the goal of AI is to eliminate the need for programmers – though they seem too stupid to see that…

So ignore the warning signs while you can, enjoy the grand illusion while it lasts but we'll be heading into this long weekend "Cashy and Cautious" – just in case it falls apart faster than we think it will.

Don't be fooled by the radio

The TV or the magazines

They'll show you photographs of how your life should be

But they're just someone else's fantasies

So if you think your life is complete confusion

'Cause you never win the game

Just remember that it's a grand illusion

And deep inside we're all the same – Styx

The film "La Grande Illusion," by Renior, is an all-time classic about class relationships among French officers who were prisoners of war under the Germans in WWI. The illusion is keeping up appearances while the World crumbles around them. Keep that in mind while you're firing up the barbcue this weekend.

Have a great holiday weekend,

– Phil